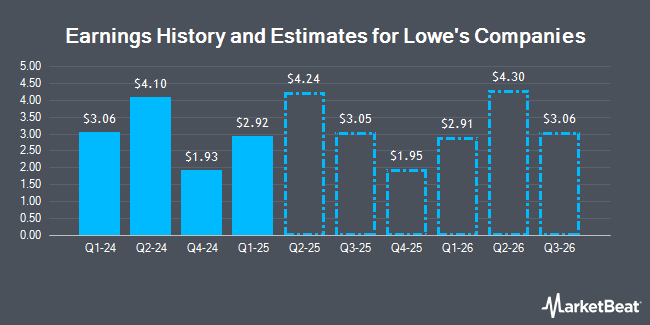

Lowe's Companies (NYSE:LOW - Get Free Report) issued an update on its FY 2024 earnings guidance on Tuesday morning. The company provided earnings per share guidance of 11.800-11.900 for the period, compared to the consensus earnings per share estimate of 11.820. The company issued revenue guidance of $83.0 billion-$83.5 billion, compared to the consensus revenue estimate of $83.0 billion. Lowe's Companies also updated its FY25 guidance to $11.80-11.90 EPS.

Lowe's Companies Stock Down 4.6 %

NYSE:LOW traded down $12.54 on Tuesday, reaching $259.23. The company's stock had a trading volume of 4,207,691 shares, compared to its average volume of 2,448,560. The firm has a market cap of $147.06 billion, a price-to-earnings ratio of 21.50, a price-to-earnings-growth ratio of 2.21 and a beta of 1.10. Lowe's Companies has a 12-month low of $196.23 and a 12-month high of $287.01. The stock has a 50 day moving average price of $267.97 and a 200 day moving average price of $244.23.

Lowe's Companies (NYSE:LOW - Get Free Report) last announced its earnings results on Tuesday, August 20th. The home improvement retailer reported $4.10 earnings per share for the quarter, topping the consensus estimate of $3.96 by $0.14. The company had revenue of $23.59 billion during the quarter, compared to analyst estimates of $23.93 billion. Lowe's Companies had a net margin of 8.25% and a negative return on equity of 47.07%. Lowe's Companies's revenue was down 5.5% compared to the same quarter last year. During the same quarter last year, the firm posted $4.56 earnings per share. Equities research analysts expect that Lowe's Companies will post 11.93 EPS for the current fiscal year.

Lowe's Companies Increases Dividend

The company also recently announced a quarterly dividend, which was paid on Wednesday, November 6th. Investors of record on Wednesday, October 23rd were paid a dividend of $1.15 per share. This is a positive change from Lowe's Companies's previous quarterly dividend of $0.15. The ex-dividend date was Wednesday, October 23rd. This represents a $4.60 annualized dividend and a yield of 1.77%. Lowe's Companies's dividend payout ratio is presently 38.14%.

Analysts Set New Price Targets

LOW has been the topic of several recent research reports. Sanford C. Bernstein initiated coverage on shares of Lowe's Companies in a research note on Tuesday, October 22nd. They set an "outperform" rating and a $323.00 target price on the stock. Wells Fargo & Company lifted their target price on Lowe's Companies from $280.00 to $295.00 and gave the company an "overweight" rating in a report on Wednesday, November 6th. Loop Capital upgraded Lowe's Companies from a "hold" rating to a "buy" rating and upped their price target for the stock from $250.00 to $300.00 in a report on Wednesday, October 9th. Oppenheimer upgraded Lowe's Companies from a "market perform" rating to an "outperform" rating and lifted their price objective for the company from $230.00 to $305.00 in a research note on Tuesday, September 24th. Finally, Telsey Advisory Group restated an "outperform" rating and set a $305.00 target price on shares of Lowe's Companies in a research note on Tuesday. Ten equities research analysts have rated the stock with a hold rating and sixteen have assigned a buy rating to the stock. Based on data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and a consensus price target of $273.84.

View Our Latest Stock Analysis on LOW

Insider Transactions at Lowe's Companies

In other Lowe's Companies news, EVP Margrethe R. Vagell sold 5,730 shares of the company's stock in a transaction on Wednesday, October 2nd. The shares were sold at an average price of $271.45, for a total transaction of $1,555,408.50. Following the completion of the transaction, the executive vice president now owns 13,214 shares in the company, valued at approximately $3,586,940.30. This represents a 30.25 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, CAO Dan Clayton Griggs, Jr. sold 6,769 shares of the firm's stock in a transaction dated Thursday, September 12th. The shares were sold at an average price of $248.82, for a total transaction of $1,684,262.58. Following the completion of the sale, the chief accounting officer now owns 9,383 shares of the company's stock, valued at approximately $2,334,678.06. The trade was a 41.91 % decrease in their position. The disclosure for this sale can be found here. Insiders own 0.26% of the company's stock.

Lowe's Companies Company Profile

(

Get Free Report)

Lowe's Companies, Inc, together with its subsidiaries, operates as a home improvement retailer in the United States. The company offers a line of products for construction, maintenance, repair, remodeling, and decorating. It also provides home improvement products, such as appliances, seasonal and outdoor living, lawn and garden, lumber, kitchens and bath, tools, paint, millwork, hardware, flooring, rough plumbing, building materials, décor, and electrical.

Read More

Before you consider Lowe's Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lowe's Companies wasn't on the list.

While Lowe's Companies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.