Lumentum (NASDAQ:LITE - Get Free Report) had its price target lifted by investment analysts at Susquehanna from $80.00 to $115.00 in a report released on Friday,Benzinga reports. The brokerage presently has a "positive" rating on the technology company's stock. Susquehanna's price objective indicates a potential upside of 37.15% from the company's previous close.

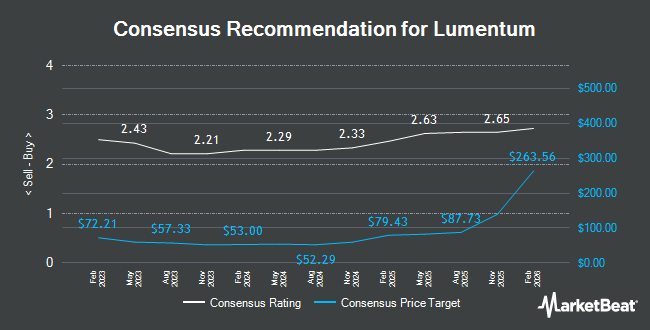

A number of other brokerages have also recently issued reports on LITE. B. Riley upped their target price on Lumentum from $40.00 to $50.00 and gave the stock a "neutral" rating in a report on Thursday, August 15th. Needham & Company LLC raised their price objective on shares of Lumentum from $65.00 to $70.00 and gave the company a "buy" rating in a report on Thursday, August 15th. Northland Securities lifted their target price on shares of Lumentum from $40.00 to $45.00 and gave the stock a "market perform" rating in a research report on Friday, August 16th. Craig Hallum upped their price target on shares of Lumentum from $65.00 to $70.00 and gave the company a "buy" rating in a research report on Thursday, August 15th. Finally, Bank of America raised their price target on shares of Lumentum from $45.00 to $50.00 and gave the company an "underperform" rating in a research note on Thursday, August 15th. Three equities research analysts have rated the stock with a sell rating, three have given a hold rating and eight have assigned a buy rating to the company. According to data from MarketBeat.com, the company has an average rating of "Hold" and a consensus target price of $70.08.

Read Our Latest Analysis on LITE

Lumentum Price Performance

Shares of LITE stock traded up $10.21 during trading hours on Friday, reaching $83.85. The company's stock had a trading volume of 7,365,855 shares, compared to its average volume of 1,458,924. The company has a market capitalization of $5.75 billion, a price-to-earnings ratio of -10.36, a PEG ratio of 5.48 and a beta of 0.88. The company has a quick ratio of 4.43, a current ratio of 5.90 and a debt-to-equity ratio of 2.61. Lumentum has a fifty-two week low of $38.28 and a fifty-two week high of $88.00. The firm's 50 day simple moving average is $62.73 and its 200-day simple moving average is $53.61.

Lumentum (NASDAQ:LITE - Get Free Report) last released its quarterly earnings data on Wednesday, August 14th. The technology company reported $0.06 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.03 by $0.03. The business had revenue of $308.30 million during the quarter, compared to analysts' expectations of $301.36 million. Lumentum had a negative net margin of 40.21% and a negative return on equity of 4.79%. The firm's quarterly revenue was down 16.9% compared to the same quarter last year. During the same period in the prior year, the company earned $0.12 EPS. Sell-side analysts forecast that Lumentum will post 0.2 earnings per share for the current year.

Institutional Inflows and Outflows

A number of institutional investors have recently modified their holdings of LITE. Vanguard Group Inc. boosted its position in shares of Lumentum by 0.3% during the 1st quarter. Vanguard Group Inc. now owns 7,218,293 shares of the technology company's stock worth $341,786,000 after purchasing an additional 22,088 shares in the last quarter. Dimensional Fund Advisors LP raised its position in shares of Lumentum by 8.3% during the second quarter. Dimensional Fund Advisors LP now owns 1,703,969 shares of the technology company's stock worth $86,760,000 after purchasing an additional 130,838 shares during the period. Earnest Partners LLC lifted its holdings in shares of Lumentum by 6.0% in the 1st quarter. Earnest Partners LLC now owns 1,690,117 shares of the technology company's stock worth $80,027,000 after purchasing an additional 95,428 shares in the last quarter. Swedbank AB acquired a new stake in Lumentum in the 1st quarter valued at $71,025,000. Finally, Van Lanschot Kempen Investment Management N.V. increased its stake in Lumentum by 17.8% during the 2nd quarter. Van Lanschot Kempen Investment Management N.V. now owns 1,154,805 shares of the technology company's stock valued at $58,803,000 after purchasing an additional 174,828 shares in the last quarter. Institutional investors and hedge funds own 94.05% of the company's stock.

Lumentum Company Profile

(

Get Free Report)

Lumentum Holdings Inc manufactures and sells optical and photonic products in the Americas, the Asia-Pacific, Europe, the Middle East, and Africa. The company operates through two segments: Optical Communications (OpComms) and Commercial Lasers (Lasers). The OpComms segment offers components, modules, and subsystems that enable the transmission and transport of video, audio, and data over high-capacity fiber optic cables.

Featured Articles

Before you consider Lumentum, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lumentum wasn't on the list.

While Lumentum currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.