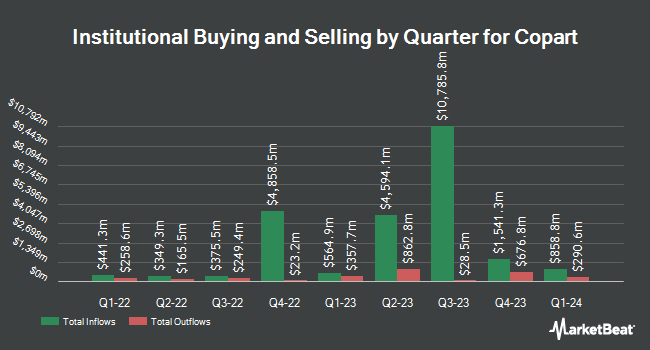

MAI Capital Management grew its position in Copart, Inc. (NASDAQ:CPRT - Free Report) by 53.4% in the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 70,803 shares of the business services provider's stock after acquiring an additional 24,654 shares during the quarter. MAI Capital Management's holdings in Copart were worth $3,710,000 as of its most recent filing with the Securities and Exchange Commission.

A number of other institutional investors have also made changes to their positions in the company. Cadence Bank grew its stake in Copart by 0.6% during the 1st quarter. Cadence Bank now owns 31,371 shares of the business services provider's stock worth $1,817,000 after buying an additional 187 shares during the last quarter. WASHINGTON TRUST Co boosted its position in Copart by 0.3% during the 2nd quarter. WASHINGTON TRUST Co now owns 61,852 shares of the business services provider's stock worth $3,350,000 after acquiring an additional 200 shares during the period. Spinnaker Trust boosted its position in Copart by 4.0% during the 2nd quarter. Spinnaker Trust now owns 5,222 shares of the business services provider's stock worth $283,000 after acquiring an additional 200 shares during the period. Values First Advisors Inc. boosted its position in Copart by 2.9% during the 2nd quarter. Values First Advisors Inc. now owns 7,098 shares of the business services provider's stock worth $384,000 after acquiring an additional 201 shares during the period. Finally, Duncan Williams Asset Management LLC lifted its holdings in shares of Copart by 1.3% in the third quarter. Duncan Williams Asset Management LLC now owns 15,437 shares of the business services provider's stock valued at $809,000 after buying an additional 203 shares during the period. 85.78% of the stock is currently owned by institutional investors.

Copart Stock Performance

Shares of CPRT traded down $1.10 during trading hours on Wednesday, hitting $55.42. 8,154,317 shares of the company were exchanged, compared to its average volume of 4,408,926. The company has a market cap of $53.39 billion, a PE ratio of 40.66 and a beta of 1.27. The firm's 50 day moving average is $53.27 and its 200-day moving average is $53.12. Copart, Inc. has a 52 week low of $46.21 and a 52 week high of $58.58.

Copart (NASDAQ:CPRT - Get Free Report) last announced its earnings results on Wednesday, September 4th. The business services provider reported $0.33 earnings per share for the quarter, missing the consensus estimate of $0.36 by ($0.03). Copart had a net margin of 32.17% and a return on equity of 19.55%. The business had revenue of $1.07 billion for the quarter, compared to the consensus estimate of $1.07 billion. During the same quarter in the previous year, the company earned $0.34 EPS. Copart's revenue for the quarter was up 7.2% compared to the same quarter last year. As a group, equities analysts forecast that Copart, Inc. will post 1.54 earnings per share for the current fiscal year.

Wall Street Analyst Weigh In

CPRT has been the topic of a number of recent analyst reports. Robert W. Baird cut their target price on Copart from $58.00 to $56.00 and set an "outperform" rating on the stock in a research report on Thursday, September 5th. JPMorgan Chase & Co. boosted their target price on Copart from $55.00 to $60.00 and gave the stock a "neutral" rating in a research report on Tuesday.

Read Our Latest Analysis on CPRT

About Copart

(

Free Report)

Copart, Inc provides online auctions and vehicle remarketing services. It offers a range of services for processing and selling vehicles over the Internet through its Virtual Bidding Third Generation Internet auction-style sales technology on behalf of vehicle sellers, insurance companies, banks and finance companies, charities, and fleet operators and dealers, as well as individual owners.

Featured Articles

Before you consider Copart, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Copart wasn't on the list.

While Copart currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.