MAI Capital Management cut its position in Nestlé S.A. (OTCMKTS:NSRGY - Free Report) by 36.4% in the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 16,567 shares of the company's stock after selling 9,475 shares during the quarter. MAI Capital Management's holdings in Nestlé were worth $1,669,000 at the end of the most recent reporting period.

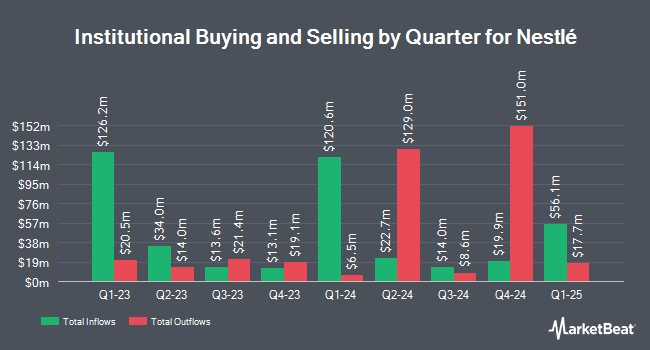

A number of other institutional investors and hedge funds have also recently added to or reduced their stakes in NSRGY. Altrius Capital Management Inc increased its holdings in shares of Nestlé by 2.4% during the third quarter. Altrius Capital Management Inc now owns 69,306 shares of the company's stock worth $6,977,000 after purchasing an additional 1,603 shares during the period. Mengis Capital Management Inc. raised its position in Nestlé by 304.3% in the third quarter. Mengis Capital Management Inc. now owns 22,150 shares of the company's stock valued at $2,230,000 after purchasing an additional 16,671 shares during the last quarter. Chartwell Investment Partners LLC boosted its position in Nestlé by 7.1% during the 3rd quarter. Chartwell Investment Partners LLC now owns 49,222 shares of the company's stock worth $4,958,000 after buying an additional 3,271 shares during the period. Saybrook Capital NC increased its holdings in Nestlé by 11.9% in the third quarter. Saybrook Capital NC now owns 63,401 shares of the company's stock valued at $6,383,000 after purchasing an additional 6,742 shares during the period. Finally, Eagle Bay Advisors LLC bought a new stake in Nestlé in the third quarter valued at approximately $365,000. 0.61% of the stock is owned by institutional investors and hedge funds.

Nestlé Stock Performance

Shares of OTCMKTS NSRGY traded down $1.19 during trading hours on Thursday, reaching $85.68. 1,488,145 shares of the stock traded hands, compared to its average volume of 803,029. The company's 50-day simple moving average is $95.96 and its two-hundred day simple moving average is $101.36. Nestlé S.A. has a 52-week low of $85.56 and a 52-week high of $117.55.

Wall Street Analysts Forecast Growth

NSRGY has been the subject of a number of recent research reports. Barclays reissued an "equal weight" rating on shares of Nestlé in a report on Monday, September 9th. Jefferies Financial Group raised shares of Nestlé from an "underperform" rating to a "hold" rating in a report on Wednesday, July 31st. Morgan Stanley lowered shares of Nestlé from an "equal weight" rating to an "underweight" rating in a research report on Monday, September 16th. Deutsche Bank Aktiengesellschaft lowered shares of Nestlé from a "buy" rating to a "hold" rating in a research note on Friday, July 26th. Finally, Berenberg Bank lowered Nestlé from a "buy" rating to a "hold" rating in a report on Friday, July 26th. Two research analysts have rated the stock with a sell rating, seven have given a hold rating and one has issued a buy rating to the company. According to data from MarketBeat.com, Nestlé has an average rating of "Hold".

Check Out Our Latest Analysis on NSRGY

About Nestlé

(

Free Report)

Nestlé SA, together with its subsidiaries, operates as a food and beverage company. The company operates through Zone North America; Zone Europe; Zone Asia, Oceania, and Africa; Zone Latin America; Zone Greater China; Nespresso; and Nestlé Health Science segments. It offers baby foods under the Cerelac, Gerber, Nido, and NaturNes brands; bottled water under the Nestlé Pure Life, Perrier, Vittel, Buxton, Erikli, and S.Pellegrino brands; cereals under the Fitness, Nesquik, cheerios, and Lion Cereals brands; and chocolate and confectionery products under the KitKat, Smarties, Aero, Nestlé Les Recettes de l'Atelier, Milkybar, Baci Perugina, Quality Street, and Fitness brands.

Further Reading

Before you consider Nestlé, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nestlé wasn't on the list.

While Nestlé currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.