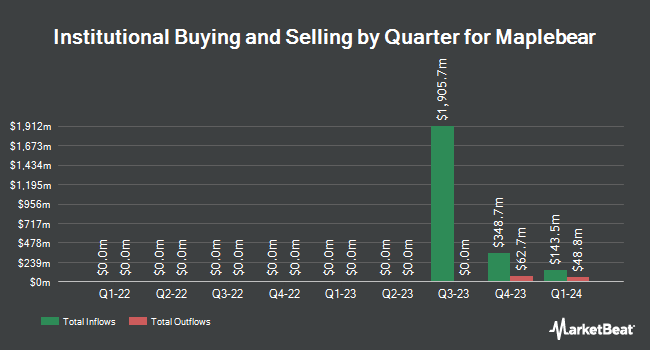

ING Groep NV grew its stake in Maplebear Inc. (NASDAQ:CART - Free Report) by 119.7% in the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 158,600 shares of the company's stock after buying an additional 86,400 shares during the period. ING Groep NV owned approximately 0.06% of Maplebear worth $6,461,000 at the end of the most recent reporting period.

A number of other institutional investors have also recently made changes to their positions in the stock. Sculptor Capital LP bought a new position in shares of Maplebear during the 2nd quarter valued at $77,361,000. Federated Hermes Inc. lifted its stake in shares of Maplebear by 102.2% in the 2nd quarter. Federated Hermes Inc. now owns 1,734,264 shares of the company's stock valued at $55,739,000 after acquiring an additional 876,439 shares during the last quarter. Industry Ventures L.L.C. grew its position in Maplebear by 3.3% during the 2nd quarter. Industry Ventures L.L.C. now owns 980,458 shares of the company's stock worth $31,512,000 after acquiring an additional 31,175 shares during the last quarter. Marshall Wace LLP increased its stake in Maplebear by 34.1% in the 2nd quarter. Marshall Wace LLP now owns 726,582 shares of the company's stock worth $23,352,000 after purchasing an additional 184,569 shares during the period. Finally, Renaissance Technologies LLC bought a new stake in Maplebear in the second quarter valued at approximately $22,816,000. Institutional investors own 63.09% of the company's stock.

Maplebear Stock Performance

Shares of CART stock traded down $0.93 during trading hours on Friday, reaching $42.00. The company had a trading volume of 6,629,671 shares, compared to its average volume of 3,988,891. The business has a fifty day moving average price of $42.17 and a 200-day moving average price of $36.61. Maplebear Inc. has a one year low of $22.13 and a one year high of $50.01. The firm has a market cap of $10.95 billion, a PE ratio of 28.19, a price-to-earnings-growth ratio of 1.30 and a beta of 1.12.

Maplebear (NASDAQ:CART - Get Free Report) last posted its quarterly earnings data on Tuesday, November 12th. The company reported $0.42 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.22 by $0.20. The company had revenue of $852.00 million for the quarter, compared to the consensus estimate of $844.03 million. Maplebear had a net margin of 13.37% and a return on equity of 13.32%. The firm's revenue was up 11.5% compared to the same quarter last year. During the same quarter last year, the firm posted ($20.86) earnings per share. Equities research analysts forecast that Maplebear Inc. will post 1.2 EPS for the current year.

Wall Street Analysts Forecast Growth

Several brokerages have recently issued reports on CART. BMO Capital Markets raised their target price on shares of Maplebear from $39.00 to $48.00 and gave the stock a "market perform" rating in a report on Wednesday. Piper Sandler boosted their price objective on shares of Maplebear from $50.00 to $58.00 and gave the company an "overweight" rating in a research report on Wednesday. Robert W. Baird increased their target price on shares of Maplebear from $44.00 to $51.00 and gave the stock an "outperform" rating in a report on Wednesday. Barclays upped their price target on Maplebear from $48.00 to $56.00 and gave the company an "overweight" rating in a research report on Wednesday. Finally, Benchmark reissued a "hold" rating on shares of Maplebear in a research report on Wednesday, August 7th. Twelve analysts have rated the stock with a hold rating and thirteen have given a buy rating to the stock. Based on data from MarketBeat, the company has an average rating of "Moderate Buy" and a consensus price target of $47.29.

Read Our Latest Analysis on CART

Insider Buying and Selling

In other Maplebear news, CEO Fidji Simo sold 33,000 shares of the stock in a transaction that occurred on Wednesday, August 28th. The shares were sold at an average price of $35.27, for a total transaction of $1,163,910.00. Following the completion of the sale, the chief executive officer now directly owns 1,844,778 shares of the company's stock, valued at $65,065,320.06. This trade represents a 1.76 % decrease in their position. The sale was disclosed in a filing with the SEC, which is available through the SEC website. Also, General Counsel Morgan Fong sold 8,345 shares of the business's stock in a transaction on Wednesday, September 18th. The stock was sold at an average price of $40.00, for a total transaction of $333,800.00. Following the completion of the transaction, the general counsel now directly owns 330,886 shares in the company, valued at $13,235,440. This trade represents a 2.46 % decrease in their position. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 118,710 shares of company stock valued at $4,978,164. 36.00% of the stock is owned by insiders.

Maplebear Company Profile

(

Free Report)

Maplebear Inc, doing business as Instacart, engages in the provision of online grocery shopping services to households in North America. It sells and delivers grocery products, as well as pickup services through a mobile application and website. It also operates virtual convenience stores; and provides software-as-a-service solutions to retailers.

Featured Stories

Before you consider Maplebear, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Maplebear wasn't on the list.

While Maplebear currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.