Marriott Vacations Worldwide (NYSE:VAC - Free Report) had its price objective upped by Mizuho from $110.00 to $117.00 in a research note issued to investors on Tuesday,Benzinga reports. Mizuho currently has an outperform rating on the stock.

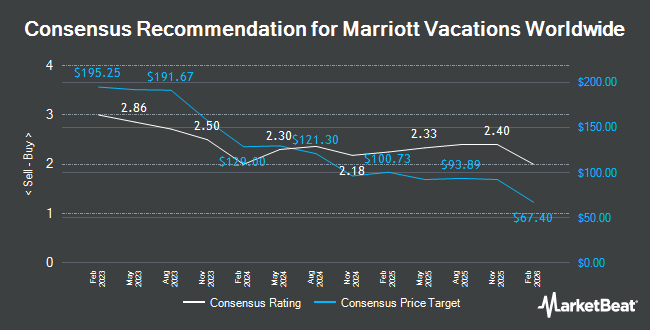

VAC has been the topic of several other research reports. Stifel Nicolaus dropped their target price on shares of Marriott Vacations Worldwide from $108.00 to $96.50 and set a "buy" rating on the stock in a research report on Friday, September 13th. StockNews.com raised shares of Marriott Vacations Worldwide from a "sell" rating to a "hold" rating in a research report on Friday. Truist Financial reduced their target price on shares of Marriott Vacations Worldwide from $161.00 to $159.00 and set a "buy" rating for the company in a research note on Friday, July 19th. Barclays boosted their price objective on shares of Marriott Vacations Worldwide from $74.00 to $97.00 and gave the company an "equal weight" rating in a research note on Friday. Finally, The Goldman Sachs Group assumed coverage on shares of Marriott Vacations Worldwide in a research note on Wednesday, September 18th. They issued a "sell" rating and a $62.00 target price on the stock. Two equities research analysts have rated the stock with a sell rating, four have assigned a hold rating and five have issued a buy rating to the company's stock. According to MarketBeat.com, Marriott Vacations Worldwide has a consensus rating of "Hold" and a consensus target price of $98.05.

View Our Latest Analysis on VAC

Marriott Vacations Worldwide Stock Down 0.3 %

Shares of NYSE VAC traded down $0.28 during midday trading on Tuesday, hitting $93.86. 382,660 shares of the stock traded hands, compared to its average volume of 465,444. The company has a market cap of $3.29 billion, a PE ratio of 17.82, a P/E/G ratio of 0.87 and a beta of 1.79. The business has a 50 day moving average price of $76.48 and a two-hundred day moving average price of $82.41. The company has a debt-to-equity ratio of 1.26, a quick ratio of 2.72 and a current ratio of 3.28. Marriott Vacations Worldwide has a one year low of $67.28 and a one year high of $108.57.

Marriott Vacations Worldwide Announces Dividend

The business also recently announced a quarterly dividend, which was paid on Thursday, October 3rd. Shareholders of record on Thursday, September 19th were issued a dividend of $0.76 per share. The ex-dividend date of this dividend was Thursday, September 19th. This represents a $3.04 dividend on an annualized basis and a yield of 3.24%. Marriott Vacations Worldwide's dividend payout ratio is currently 57.90%.

Insider Buying and Selling

In other news, insider Jason P. Marino acquired 700 shares of Marriott Vacations Worldwide stock in a transaction that occurred on Wednesday, September 11th. The stock was purchased at an average price of $69.00 per share, for a total transaction of $48,300.00. Following the purchase, the insider now directly owns 15,851 shares in the company, valued at $1,093,719. The trade was a 0.00 % increase in their position. The purchase was disclosed in a document filed with the SEC, which can be accessed through this link. 1.70% of the stock is currently owned by company insiders.

Institutional Inflows and Outflows

A number of institutional investors and hedge funds have recently added to or reduced their stakes in VAC. Impactive Capital LP purchased a new stake in Marriott Vacations Worldwide during the first quarter worth $123,613,000. AQR Capital Management LLC grew its holdings in Marriott Vacations Worldwide by 178.2% in the second quarter. AQR Capital Management LLC now owns 355,089 shares of the company's stock valued at $29,771,000 after purchasing an additional 227,465 shares during the period. Dimensional Fund Advisors LP increased its position in shares of Marriott Vacations Worldwide by 14.9% in the second quarter. Dimensional Fund Advisors LP now owns 1,599,789 shares of the company's stock valued at $139,687,000 after buying an additional 207,938 shares in the last quarter. International Assets Investment Management LLC acquired a new position in shares of Marriott Vacations Worldwide during the 3rd quarter worth approximately $14,983,000. Finally, Vanguard Group Inc. lifted its holdings in Marriott Vacations Worldwide by 4.6% during the first quarter. Vanguard Group Inc. now owns 3,266,238 shares of the company's stock valued at $351,872,000 after purchasing an additional 143,074 shares in the last quarter. 89.52% of the stock is currently owned by institutional investors and hedge funds.

Marriott Vacations Worldwide Company Profile

(

Get Free Report)

Marriott Vacations Worldwide Corporation, a vacation company, develops, markets, sells, and manages vacation ownership and related businesses, products, and services in the United States and internationally. It operates through two segments, Vacation Ownership and Exchange & Third-Party Management.

Read More

Before you consider Marriott Vacations Worldwide, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Marriott Vacations Worldwide wasn't on the list.

While Marriott Vacations Worldwide currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.