Entropy Technologies LP cut its position in shares of Masco Co. (NYSE:MAS - Free Report) by 55.8% during the 3rd quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 21,608 shares of the construction company's stock after selling 27,249 shares during the quarter. Entropy Technologies LP's holdings in Masco were worth $1,814,000 as of its most recent filing with the Securities & Exchange Commission.

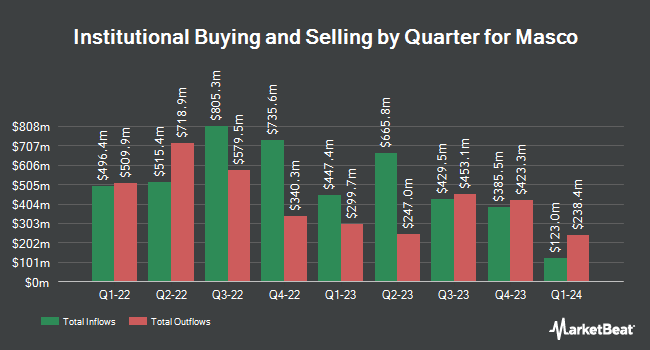

Other hedge funds and other institutional investors also recently added to or reduced their stakes in the company. New Covenant Trust Company N.A. bought a new stake in shares of Masco during the 1st quarter valued at $25,000. Innealta Capital LLC bought a new stake in Masco during the second quarter worth about $25,000. Family Firm Inc. purchased a new stake in Masco in the second quarter worth about $30,000. Massmutual Trust Co. FSB ADV increased its stake in shares of Masco by 46.0% during the second quarter. Massmutual Trust Co. FSB ADV now owns 568 shares of the construction company's stock valued at $38,000 after purchasing an additional 179 shares in the last quarter. Finally, Capital Performance Advisors LLP purchased a new position in shares of Masco during the third quarter valued at approximately $38,000. 93.91% of the stock is owned by hedge funds and other institutional investors.

Insider Activity

In related news, VP Kenneth G. Cole sold 37,814 shares of the business's stock in a transaction that occurred on Tuesday, September 10th. The stock was sold at an average price of $78.32, for a total value of $2,961,592.48. Following the transaction, the vice president now directly owns 36,980 shares of the company's stock, valued at approximately $2,896,273.60. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Company insiders own 1.10% of the company's stock.

Analyst Ratings Changes

Several analysts recently weighed in on the company. Truist Financial upped their price target on Masco from $84.00 to $92.00 and gave the stock a "buy" rating in a research note on Wednesday, October 30th. StockNews.com upgraded Masco from a "hold" rating to a "buy" rating in a report on Thursday, November 7th. UBS Group lifted their price target on Masco from $89.00 to $94.00 and gave the stock a "buy" rating in a research report on Wednesday, October 30th. JPMorgan Chase & Co. increased their price objective on shares of Masco from $80.00 to $83.50 and gave the company a "neutral" rating in a research report on Tuesday, November 5th. Finally, Loop Capital lifted their target price on shares of Masco from $76.00 to $87.00 and gave the stock a "hold" rating in a report on Wednesday, October 30th. Seven research analysts have rated the stock with a hold rating and eight have given a buy rating to the stock. Based on data from MarketBeat, the company has a consensus rating of "Moderate Buy" and an average price target of $85.96.

View Our Latest Research Report on MAS

Masco Stock Performance

Masco stock traded up $0.24 during trading on Wednesday, reaching $79.26. The company had a trading volume of 530,254 shares, compared to its average volume of 1,797,667. The firm's 50-day simple moving average is $81.78 and its 200 day simple moving average is $75.02. Masco Co. has a 52 week low of $57.18 and a 52 week high of $86.70. The company has a current ratio of 1.83, a quick ratio of 1.21 and a debt-to-equity ratio of 20.74. The firm has a market capitalization of $17.10 billion, a price-to-earnings ratio of 21.06, a price-to-earnings-growth ratio of 2.56 and a beta of 1.24.

Masco (NYSE:MAS - Get Free Report) last posted its quarterly earnings data on Tuesday, October 29th. The construction company reported $1.08 earnings per share for the quarter, meeting analysts' consensus estimates of $1.08. Masco had a return on equity of 615.54% and a net margin of 10.54%. The firm had revenue of $1.98 billion for the quarter, compared to analysts' expectations of $2 billion. During the same period in the previous year, the firm earned $1.00 EPS. The business's quarterly revenue was up .2% on a year-over-year basis. Sell-side analysts forecast that Masco Co. will post 4.09 earnings per share for the current fiscal year.

Masco Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Monday, November 25th. Shareholders of record on Friday, November 8th will be issued a dividend of $0.29 per share. The ex-dividend date of this dividend is Friday, November 8th. This represents a $1.16 dividend on an annualized basis and a yield of 1.46%. Masco's dividend payout ratio is presently 30.85%.

Masco Company Profile

(

Free Report)

Masco Corporation designs, manufactures, and distributes home improvement and building products in North America, Europe, and internationally. The company's Plumbing Products segment offers faucets, showerheads, handheld showers, valves, bath hardware and accessories, bathing units, shower bases and enclosures, sinks, toilets, acrylic tubs, shower trays, spas, exercise pools, and fitness systems; brass, copper, and composite plumbing system components; connected water products; thermoplastic solutions, extruded plastic profiles, specialized fabrications, and PEX tubing products; and other non-decorative plumbing products.

Featured Articles

Before you consider Masco, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Masco wasn't on the list.

While Masco currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.