PNC Financial Services Group Inc. reduced its position in shares of McKesson Co. (NYSE:MCK - Free Report) by 3.1% in the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 80,647 shares of the company's stock after selling 2,592 shares during the period. PNC Financial Services Group Inc. owned approximately 0.06% of McKesson worth $39,873,000 at the end of the most recent quarter.

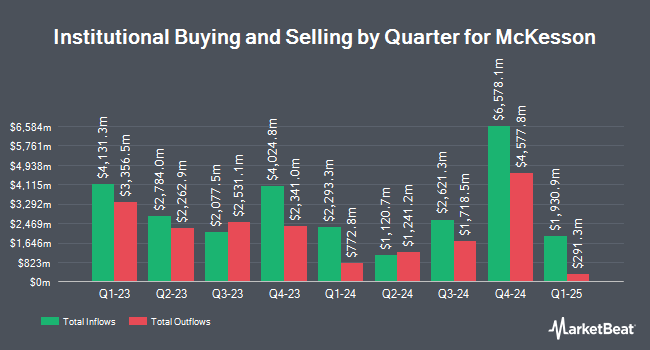

Several other institutional investors also recently modified their holdings of the stock. Healthcare of Ontario Pension Plan Trust Fund purchased a new position in McKesson in the 1st quarter worth approximately $81,000. Advisors Asset Management Inc. grew its stake in shares of McKesson by 6.2% in the first quarter. Advisors Asset Management Inc. now owns 10,234 shares of the company's stock worth $5,494,000 after acquiring an additional 601 shares during the last quarter. Capital International Investors raised its holdings in McKesson by 51.3% in the 1st quarter. Capital International Investors now owns 332,187 shares of the company's stock worth $178,335,000 after acquiring an additional 112,655 shares during the last quarter. Canada Pension Plan Investment Board raised its stake in McKesson by 29.3% during the 1st quarter. Canada Pension Plan Investment Board now owns 248,912 shares of the company's stock valued at $133,628,000 after buying an additional 56,342 shares during the last quarter. Finally, 1832 Asset Management L.P. purchased a new position in McKesson during the first quarter valued at $102,000. 85.07% of the stock is currently owned by institutional investors.

Insider Transactions at McKesson

In related news, CEO Brian S. Tyler sold 3,753 shares of McKesson stock in a transaction dated Thursday, September 5th. The stock was sold at an average price of $561.10, for a total transaction of $2,105,808.30. Following the sale, the chief executive officer now directly owns 78,586 shares of the company's stock, valued at $44,094,604.60. This trade represents a 4.56 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. 0.11% of the stock is currently owned by company insiders.

Wall Street Analyst Weigh In

Several research firms recently weighed in on MCK. Leerink Partners cut their target price on shares of McKesson from $665.00 to $630.00 and set an "outperform" rating for the company in a research note on Monday, October 7th. Mizuho lifted their target price on McKesson from $540.00 to $570.00 and gave the stock a "neutral" rating in a report on Thursday, August 8th. Deutsche Bank Aktiengesellschaft cut their price target on McKesson from $623.00 to $579.00 and set a "buy" rating for the company in a report on Wednesday, September 25th. Barclays increased their price target on McKesson from $596.00 to $616.00 and gave the company an "overweight" rating in a report on Thursday, August 8th. Finally, Evercore ISI boosted their price target on McKesson from $560.00 to $680.00 and gave the stock an "outperform" rating in a research report on Thursday, November 7th. Two analysts have rated the stock with a hold rating, fourteen have assigned a buy rating and one has issued a strong buy rating to the stock. Based on data from MarketBeat, the company has a consensus rating of "Moderate Buy" and an average price target of $631.57.

Check Out Our Latest Analysis on MCK

McKesson Trading Up 1.1 %

Shares of McKesson stock traded up $7.00 during trading hours on Thursday, reaching $628.15. The stock had a trading volume of 338,172 shares, compared to its average volume of 819,943. McKesson Co. has a 1 year low of $431.35 and a 1 year high of $637.51. The firm has a 50 day simple moving average of $526.55 and a two-hundred day simple moving average of $556.24. The firm has a market capitalization of $79.74 billion, a price-to-earnings ratio of 32.17, a P/E/G ratio of 1.33 and a beta of 0.44.

McKesson (NYSE:MCK - Get Free Report) last announced its quarterly earnings data on Wednesday, November 6th. The company reported $7.07 earnings per share for the quarter, beating the consensus estimate of $6.88 by $0.19. The firm had revenue of $93.65 billion during the quarter, compared to analyst estimates of $89.33 billion. McKesson had a negative return on equity of 207.50% and a net margin of 0.77%. McKesson's quarterly revenue was up 21.3% on a year-over-year basis. During the same period in the previous year, the company earned $6.23 earnings per share. Sell-side analysts forecast that McKesson Co. will post 32.81 EPS for the current year.

McKesson Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Thursday, January 2nd. Investors of record on Monday, December 2nd will be given a dividend of $0.71 per share. This represents a $2.84 annualized dividend and a yield of 0.45%. The ex-dividend date is Monday, December 2nd. McKesson's payout ratio is 14.71%.

McKesson Profile

(

Free Report)

McKesson Corporation provides healthcare services in the United States and internationally. It operates through four segments: U.S. Pharmaceutical, Prescription Technology Solutions (RxTS), Medical-Surgical Solutions, and International. The U.S. Pharmaceutical segment distributes branded, generic, specialty, biosimilar and over-the-counter pharmaceutical drugs, and other healthcare-related products.

Featured Stories

Before you consider McKesson, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and McKesson wasn't on the list.

While McKesson currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.