M&G PLC lowered its stake in Thermo Fisher Scientific Inc. (NYSE:TMO - Free Report) by 8.1% during the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The firm owned 124,927 shares of the medical research company's stock after selling 10,947 shares during the period. M&G PLC's holdings in Thermo Fisher Scientific were worth $77,330,000 at the end of the most recent reporting period.

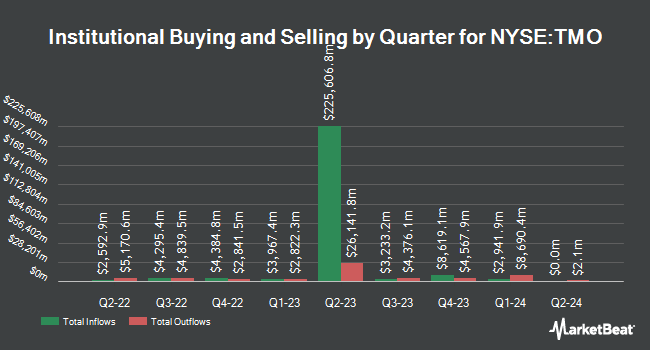

Several other large investors have also recently added to or reduced their stakes in the company. Concurrent Investment Advisors LLC boosted its position in shares of Thermo Fisher Scientific by 5.3% during the 3rd quarter. Concurrent Investment Advisors LLC now owns 3,587 shares of the medical research company's stock worth $2,219,000 after purchasing an additional 179 shares in the last quarter. Umpqua Bank grew its position in Thermo Fisher Scientific by 4.6% during the third quarter. Umpqua Bank now owns 4,645 shares of the medical research company's stock worth $2,873,000 after buying an additional 204 shares during the period. Ballast Advisors LLC lifted its position in shares of Thermo Fisher Scientific by 1.5% during the 3rd quarter. Ballast Advisors LLC now owns 1,741 shares of the medical research company's stock valued at $1,077,000 after acquiring an additional 25 shares during the period. Foster & Motley Inc. boosted its stake in shares of Thermo Fisher Scientific by 2.4% during the 3rd quarter. Foster & Motley Inc. now owns 5,971 shares of the medical research company's stock worth $3,693,000 after acquiring an additional 141 shares in the last quarter. Finally, Harvest Portfolios Group Inc. increased its stake in Thermo Fisher Scientific by 0.6% in the 3rd quarter. Harvest Portfolios Group Inc. now owns 91,540 shares of the medical research company's stock valued at $56,624,000 after purchasing an additional 583 shares in the last quarter. 89.23% of the stock is owned by hedge funds and other institutional investors.

Thermo Fisher Scientific Trading Down 0.7 %

NYSE TMO traded down $3.79 during mid-day trading on Thursday, hitting $555.89. The company's stock had a trading volume of 1,236,130 shares, compared to its average volume of 1,460,032. Thermo Fisher Scientific Inc. has a 52-week low of $437.26 and a 52-week high of $627.88. The stock's fifty day simple moving average is $596.33 and its two-hundred day simple moving average is $583.80. The firm has a market capitalization of $212.63 billion, a P/E ratio of 34.92, a price-to-earnings-growth ratio of 3.67 and a beta of 0.79. The company has a debt-to-equity ratio of 0.64, a current ratio of 1.63 and a quick ratio of 1.26.

Thermo Fisher Scientific (NYSE:TMO - Get Free Report) last released its quarterly earnings data on Wednesday, October 23rd. The medical research company reported $5.28 EPS for the quarter, beating the consensus estimate of $5.25 by $0.03. The company had revenue of $10.60 billion for the quarter, compared to analyst estimates of $10.63 billion. Thermo Fisher Scientific had a return on equity of 17.49% and a net margin of 14.48%. The firm's revenue was up .2% compared to the same quarter last year. During the same period last year, the company posted $5.69 earnings per share. Research analysts expect that Thermo Fisher Scientific Inc. will post 21.68 EPS for the current year.

Analysts Set New Price Targets

Several analysts have weighed in on the company. Raymond James upped their target price on Thermo Fisher Scientific from $650.00 to $660.00 and gave the company an "outperform" rating in a report on Thursday, July 25th. Bernstein Bank raised their target price on shares of Thermo Fisher Scientific from $565.00 to $625.00 and gave the company a "market perform" rating in a report on Tuesday, October 22nd. Robert W. Baird dropped their price objective on shares of Thermo Fisher Scientific from $632.00 to $622.00 and set an "outperform" rating for the company in a research note on Thursday, October 24th. Stifel Nicolaus lowered their target price on Thermo Fisher Scientific from $680.00 to $665.00 and set a "buy" rating on the stock in a report on Thursday, October 24th. Finally, Stephens began coverage on Thermo Fisher Scientific in a report on Tuesday, October 1st. They issued an "overweight" rating and a $680.00 price target for the company. Four research analysts have rated the stock with a hold rating, seventeen have issued a buy rating and one has issued a strong buy rating to the stock. Based on data from MarketBeat, the stock has an average rating of "Moderate Buy" and a consensus target price of $649.33.

Get Our Latest Stock Analysis on Thermo Fisher Scientific

Insider Activity

In related news, CEO Marc N. Casper sold 10,000 shares of Thermo Fisher Scientific stock in a transaction on Monday, October 28th. The shares were sold at an average price of $554.29, for a total transaction of $5,542,900.00. Following the sale, the chief executive officer now owns 121,192 shares of the company's stock, valued at $67,175,513.68. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is accessible through the SEC website. In related news, SVP Michael A. Boxer sold 2,000 shares of the company's stock in a transaction on Friday, October 25th. The shares were sold at an average price of $560.16, for a total value of $1,120,320.00. Following the sale, the senior vice president now directly owns 12,736 shares of the company's stock, valued at $7,134,197.76. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link. Also, CEO Marc N. Casper sold 10,000 shares of the firm's stock in a transaction on Monday, October 28th. The stock was sold at an average price of $554.29, for a total transaction of $5,542,900.00. Following the transaction, the chief executive officer now directly owns 121,192 shares of the company's stock, valued at approximately $67,175,513.68. This represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 18,150 shares of company stock worth $10,094,925 over the last 90 days. Company insiders own 0.34% of the company's stock.

Thermo Fisher Scientific Profile

(

Free Report)

Thermo Fisher Scientific Inc provides life sciences solutions, analytical instruments, specialty diagnostics, and laboratory products and biopharma services in the North America, Europe, Asia-Pacific, and internationally. The company's Life Sciences Solutions segment offers reagents, instruments, and consumables for biological and medical research, discovery, and production of drugs and vaccines, as well as diagnosis of infections and diseases; and solutions include biosciences, genetic sciences, and bio production to pharmaceutical, biotechnology, agricultural, clinical, healthcare, academic, and government markets.

Further Reading

Before you consider Thermo Fisher Scientific, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Thermo Fisher Scientific wasn't on the list.

While Thermo Fisher Scientific currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report