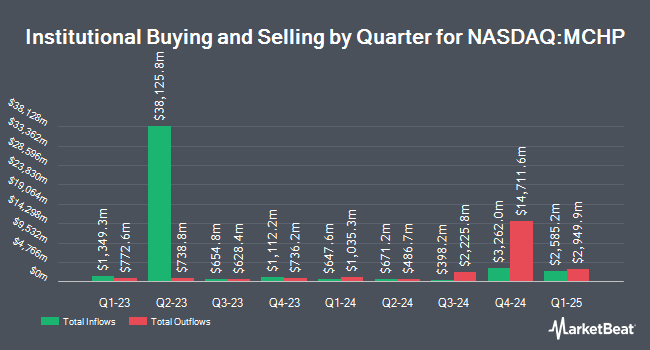

Empowered Funds LLC raised its stake in Microchip Technology Incorporated (NASDAQ:MCHP - Free Report) by 25.7% in the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 96,163 shares of the semiconductor company's stock after purchasing an additional 19,663 shares during the period. Empowered Funds LLC's holdings in Microchip Technology were worth $7,721,000 as of its most recent SEC filing.

Other institutional investors have also recently made changes to their positions in the company. Empirical Finance LLC increased its holdings in shares of Microchip Technology by 2.1% during the third quarter. Empirical Finance LLC now owns 18,650 shares of the semiconductor company's stock valued at $1,497,000 after acquiring an additional 384 shares in the last quarter. CIBC Asset Management Inc grew its position in Microchip Technology by 63.7% in the 3rd quarter. CIBC Asset Management Inc now owns 260,683 shares of the semiconductor company's stock valued at $20,930,000 after purchasing an additional 101,453 shares during the period. OneDigital Investment Advisors LLC increased its stake in Microchip Technology by 6.7% during the 3rd quarter. OneDigital Investment Advisors LLC now owns 4,458 shares of the semiconductor company's stock valued at $358,000 after purchasing an additional 280 shares in the last quarter. Lifeworks Advisors LLC raised its holdings in Microchip Technology by 35.0% during the third quarter. Lifeworks Advisors LLC now owns 20,638 shares of the semiconductor company's stock worth $1,657,000 after buying an additional 5,350 shares during the last quarter. Finally, Tokio Marine Asset Management Co. Ltd. raised its holdings in Microchip Technology by 3.3% during the third quarter. Tokio Marine Asset Management Co. Ltd. now owns 14,192 shares of the semiconductor company's stock worth $1,139,000 after buying an additional 460 shares during the last quarter. Institutional investors and hedge funds own 91.51% of the company's stock.

Microchip Technology Stock Performance

NASDAQ MCHP traded down $2.74 on Friday, hitting $62.86. 9,280,916 shares of the stock traded hands, compared to its average volume of 6,049,709. The company has a debt-to-equity ratio of 0.71, a quick ratio of 0.48 and a current ratio of 0.88. The business's fifty day moving average is $75.65 and its two-hundred day moving average is $84.03. Microchip Technology Incorporated has a 12 month low of $62.63 and a 12 month high of $100.57. The firm has a market capitalization of $33.76 billion, a price-to-earnings ratio of 43.96 and a beta of 1.53.

Microchip Technology (NASDAQ:MCHP - Get Free Report) last posted its quarterly earnings results on Tuesday, November 5th. The semiconductor company reported $0.46 earnings per share for the quarter, topping the consensus estimate of $0.43 by $0.03. Microchip Technology had a return on equity of 19.47% and a net margin of 14.22%. The company had revenue of $1.16 billion during the quarter, compared to the consensus estimate of $1.15 billion. During the same quarter in the prior year, the company earned $1.54 EPS. The firm's quarterly revenue was down 48.4% compared to the same quarter last year. As a group, equities analysts anticipate that Microchip Technology Incorporated will post 1.38 EPS for the current fiscal year.

Microchip Technology Increases Dividend

The firm also recently declared a quarterly dividend, which will be paid on Friday, December 6th. Investors of record on Friday, November 22nd will be paid a dividend of $0.455 per share. This is a boost from Microchip Technology's previous quarterly dividend of $0.45. This represents a $1.82 dividend on an annualized basis and a dividend yield of 2.90%. The ex-dividend date is Friday, November 22nd. Microchip Technology's dividend payout ratio is presently 127.27%.

Analyst Ratings Changes

A number of brokerages have recently issued reports on MCHP. Mizuho set a $95.00 price objective on shares of Microchip Technology in a report on Friday, October 18th. Truist Financial downgraded Microchip Technology from a "buy" rating to a "hold" rating and cut their price target for the company from $89.00 to $80.00 in a research note on Monday, September 23rd. JPMorgan Chase & Co. lowered their price objective on Microchip Technology from $110.00 to $100.00 and set an "overweight" rating for the company in a research note on Friday, August 2nd. Rosenblatt Securities reaffirmed a "buy" rating and set a $90.00 target price on shares of Microchip Technology in a research report on Wednesday, November 6th. Finally, Bank of America downgraded Microchip Technology from a "buy" rating to a "neutral" rating and decreased their price target for the stock from $110.00 to $90.00 in a report on Friday, August 2nd. One research analyst has rated the stock with a sell rating, five have issued a hold rating and fourteen have assigned a buy rating to the company. According to data from MarketBeat, the stock presently has an average rating of "Moderate Buy" and a consensus price target of $92.00.

Check Out Our Latest Report on Microchip Technology

Insider Buying and Selling

In related news, CFO James Eric Bjornholt sold 2,154 shares of the business's stock in a transaction on Friday, August 23rd. The stock was sold at an average price of $81.50, for a total transaction of $175,551.00. Following the sale, the chief financial officer now directly owns 33,257 shares in the company, valued at approximately $2,710,445.50. The trade was a 6.08 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. 2.10% of the stock is owned by insiders.

Microchip Technology Company Profile

(

Free Report)

Microchip Technology Incorporated engages in the development, manufacture, and sale of smart, connected, and secure embedded control solutions in the Americas, Europe, and Asia. The company offers general purpose 8-bit, 16-bit, and 32-bit mixed-signal microcontrollers; 32-bit embedded mixed-signal microprocessors; and specialized microcontrollers for automotive, industrial, computing, communications, lighting, power supplies, motor control, human machine interface, security, wired connectivity, and wireless connectivity applications.

Featured Stories

Before you consider Microchip Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Microchip Technology wasn't on the list.

While Microchip Technology currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.