Mizuho Securities USA LLC cut its holdings in Digital Realty Trust, Inc. (NYSE:DLR - Free Report) by 20.2% in the third quarter, according to the company in its most recent disclosure with the SEC. The fund owned 19,957 shares of the real estate investment trust's stock after selling 5,059 shares during the quarter. Mizuho Securities USA LLC's holdings in Digital Realty Trust were worth $3,230,000 at the end of the most recent reporting period.

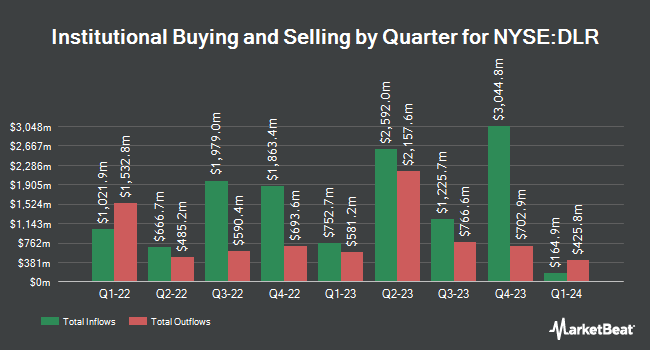

Other hedge funds and other institutional investors also recently added to or reduced their stakes in the company. Pathway Financial Advisers LLC raised its stake in shares of Digital Realty Trust by 15,301.1% in the third quarter. Pathway Financial Advisers LLC now owns 1,850,292 shares of the real estate investment trust's stock worth $299,433,000 after purchasing an additional 1,838,278 shares during the last quarter. Massachusetts Financial Services Co. MA raised its stake in shares of Digital Realty Trust by 543.6% in the second quarter. Massachusetts Financial Services Co. MA now owns 1,447,340 shares of the real estate investment trust's stock worth $220,068,000 after purchasing an additional 1,773,591 shares during the last quarter. Wulff Hansen & CO. raised its stake in shares of Digital Realty Trust by 15,105.0% in the second quarter. Wulff Hansen & CO. now owns 795,830 shares of the real estate investment trust's stock worth $121,006,000 after purchasing an additional 790,596 shares during the last quarter. Electron Capital Partners LLC grew its holdings in Digital Realty Trust by 220.7% during the second quarter. Electron Capital Partners LLC now owns 1,041,594 shares of the real estate investment trust's stock worth $158,374,000 after acquiring an additional 716,816 shares during the period. Finally, Daiwa Securities Group Inc. grew its holdings in Digital Realty Trust by 16.8% during the second quarter. Daiwa Securities Group Inc. now owns 4,725,971 shares of the real estate investment trust's stock worth $718,584,000 after acquiring an additional 678,165 shares during the period. 99.71% of the stock is currently owned by hedge funds and other institutional investors.

Digital Realty Trust Trading Up 1.3 %

Digital Realty Trust stock traded up $2.47 during trading on Friday, reaching $189.84. 2,526,522 shares of the company were exchanged, compared to its average volume of 2,415,356. Digital Realty Trust, Inc. has a 52-week low of $130.00 and a 52-week high of $193.88. The company has a market capitalization of $62.97 billion, a P/E ratio of 159.55, a PEG ratio of 4.97 and a beta of 0.59. The company has a debt-to-equity ratio of 0.81, a current ratio of 1.61 and a quick ratio of 1.61. The stock's 50 day simple moving average is $169.56 and its two-hundred day simple moving average is $156.35.

Digital Realty Trust (NYSE:DLR - Get Free Report) last announced its quarterly earnings data on Thursday, October 24th. The real estate investment trust reported $0.09 EPS for the quarter, missing analysts' consensus estimates of $1.67 by ($1.58). Digital Realty Trust had a return on equity of 2.24% and a net margin of 8.04%. The company had revenue of $1.43 billion for the quarter, compared to analysts' expectations of $1.43 billion. During the same quarter in the previous year, the business posted $1.62 EPS. The business's quarterly revenue was up 2.1% compared to the same quarter last year. On average, equities research analysts expect that Digital Realty Trust, Inc. will post 6.71 earnings per share for the current fiscal year.

Digital Realty Trust Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Friday, January 17th. Shareholders of record on Friday, December 13th will be given a $1.22 dividend. The ex-dividend date is Friday, December 13th. This represents a $4.88 dividend on an annualized basis and a yield of 2.57%. Digital Realty Trust's dividend payout ratio is currently 410.08%.

Analyst Ratings Changes

Several analysts recently commented on DLR shares. Jefferies Financial Group raised their target price on Digital Realty Trust from $190.00 to $205.00 and gave the stock a "buy" rating in a report on Friday, October 25th. Royal Bank of Canada raised their target price on Digital Realty Trust from $177.00 to $207.00 and gave the stock an "outperform" rating in a report on Monday, October 28th. Wells Fargo & Company raised their target price on Digital Realty Trust from $175.00 to $185.00 and gave the stock an "overweight" rating in a report on Friday, October 25th. TD Cowen raised their target price on Digital Realty Trust from $120.00 to $128.00 and gave the stock a "hold" rating in a report on Friday, October 25th. Finally, Evercore ISI raised their target price on Digital Realty Trust from $160.00 to $175.00 and gave the stock an "outperform" rating in a report on Wednesday, October 23rd. Two research analysts have rated the stock with a sell rating, nine have issued a hold rating, eleven have assigned a buy rating and one has assigned a strong buy rating to the company's stock. Based on data from MarketBeat, the stock currently has a consensus rating of "Hold" and an average price target of $170.37.

Check Out Our Latest Stock Report on Digital Realty Trust

Digital Realty Trust Profile

(

Free Report)

Digital Realty brings companies and data together by delivering the full spectrum of data center, colocation, and interconnection solutions. PlatformDIGITAL, the company's global data center platform, provides customers with a secure data meeting place and a proven Pervasive Datacenter Architecture (PDx) solution methodology for powering innovation and efficiently managing Data Gravity challenges.

Recommended Stories

Before you consider Digital Realty Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Digital Realty Trust wasn't on the list.

While Digital Realty Trust currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.