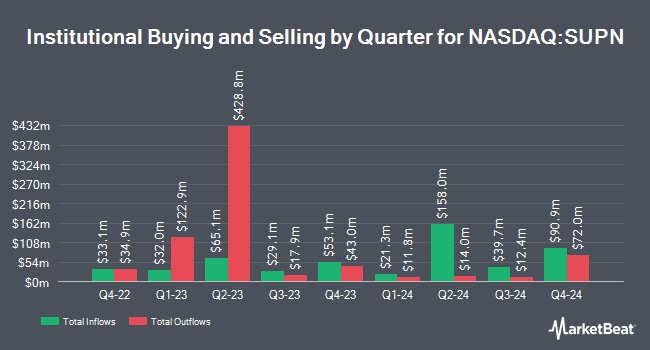

Mutual of America Capital Management LLC lowered its holdings in shares of Supernus Pharmaceuticals, Inc. (NASDAQ:SUPN - Free Report) by 27.2% during the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 202,654 shares of the specialty pharmaceutical company's stock after selling 75,782 shares during the period. Mutual of America Capital Management LLC owned about 0.37% of Supernus Pharmaceuticals worth $6,319,000 as of its most recent SEC filing.

Other institutional investors have also recently bought and sold shares of the company. Commonwealth Equity Services LLC raised its holdings in shares of Supernus Pharmaceuticals by 3.6% in the second quarter. Commonwealth Equity Services LLC now owns 10,195 shares of the specialty pharmaceutical company's stock valued at $273,000 after buying an additional 350 shares during the last quarter. Mirae Asset Global Investments Co. Ltd. raised its stake in shares of Supernus Pharmaceuticals by 21.5% during the 3rd quarter. Mirae Asset Global Investments Co. Ltd. now owns 1,993 shares of the specialty pharmaceutical company's stock worth $61,000 after purchasing an additional 352 shares in the last quarter. Covestor Ltd raised its stake in shares of Supernus Pharmaceuticals by 15.3% during the 1st quarter. Covestor Ltd now owns 2,702 shares of the specialty pharmaceutical company's stock worth $92,000 after purchasing an additional 358 shares in the last quarter. GAMMA Investing LLC raised its stake in Supernus Pharmaceuticals by 97.1% in the 3rd quarter. GAMMA Investing LLC now owns 808 shares of the specialty pharmaceutical company's stock valued at $25,000 after acquiring an additional 398 shares during the period. Finally, Louisiana State Employees Retirement System grew its holdings in Supernus Pharmaceuticals by 2.2% in the 2nd quarter. Louisiana State Employees Retirement System now owns 27,700 shares of the specialty pharmaceutical company's stock valued at $741,000 after buying an additional 600 shares in the last quarter.

Wall Street Analysts Forecast Growth

SUPN has been the topic of a number of recent analyst reports. Cowen reiterated a "buy" rating on shares of Supernus Pharmaceuticals in a research report on Friday, October 18th. StockNews.com upgraded Supernus Pharmaceuticals from a "buy" rating to a "strong-buy" rating in a report on Wednesday, August 7th. Finally, Piper Sandler restated a "neutral" rating on shares of Supernus Pharmaceuticals in a report on Friday, October 18th.

View Our Latest Stock Report on Supernus Pharmaceuticals

Supernus Pharmaceuticals Trading Up 1.4 %

Supernus Pharmaceuticals stock traded up $0.48 during trading on Wednesday, hitting $36.01. 111,510 shares of the company were exchanged, compared to its average volume of 447,346. The company has a market capitalization of $1.99 billion, a P/E ratio of 33.21 and a beta of 0.86. The business's 50 day moving average is $33.42 and its 200 day moving average is $30.99. Supernus Pharmaceuticals, Inc. has a 52 week low of $25.53 and a 52 week high of $39.37.

Supernus Pharmaceuticals (NASDAQ:SUPN - Get Free Report) last announced its quarterly earnings data on Monday, November 4th. The specialty pharmaceutical company reported $0.69 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.44 by $0.25. The firm had revenue of $175.70 million during the quarter, compared to the consensus estimate of $157.35 million. Supernus Pharmaceuticals had a return on equity of 7.79% and a net margin of 9.16%. The business's revenue for the quarter was up 14.2% on a year-over-year basis. During the same quarter in the prior year, the company earned ($0.29) EPS. Equities analysts expect that Supernus Pharmaceuticals, Inc. will post 2.37 EPS for the current year.

Insider Activity

In other news, Director Georges Gemayel sold 14,213 shares of the company's stock in a transaction on Thursday, November 7th. The stock was sold at an average price of $36.62, for a total transaction of $520,480.06. Following the transaction, the director now owns 13,315 shares of the company's stock, valued at $487,595.30. This represents a 51.63 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at the SEC website. Also, CEO Jack A. Khattar sold 125,000 shares of the stock in a transaction dated Thursday, November 7th. The stock was sold at an average price of $36.68, for a total value of $4,585,000.00. Following the sale, the chief executive officer now directly owns 926,172 shares in the company, valued at $33,971,988.96. This trade represents a 11.89 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 154,213 shares of company stock valued at $5,660,180 in the last 90 days. Insiders own 9.30% of the company's stock.

Supernus Pharmaceuticals Company Profile

(

Free Report)

Supernus Pharmaceuticals, Inc, a biopharmaceutical company, focuses on the development and commercialization of products for the treatment of central nervous system (CNS) diseases in the United States. The company's commercial products are Trokendi XR, an extended release topiramate product indicated for the treatment of epilepsy, as well as for the prophylaxis of migraine headache; and Oxtellar XR, an extended release oxcarbazepine for the monotherapy treatment of partial onset seizures in adults and children between 6 to 17 years of age.

Read More

Before you consider Supernus Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Supernus Pharmaceuticals wasn't on the list.

While Supernus Pharmaceuticals currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.