Stephens Investment Management Group LLC grew its holdings in shares of Ambarella, Inc. (NASDAQ:AMBA - Free Report) by 20.1% during the third quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 501,036 shares of the semiconductor company's stock after buying an additional 83,752 shares during the period. Stephens Investment Management Group LLC owned 1.22% of Ambarella worth $28,261,000 as of its most recent filing with the Securities and Exchange Commission.

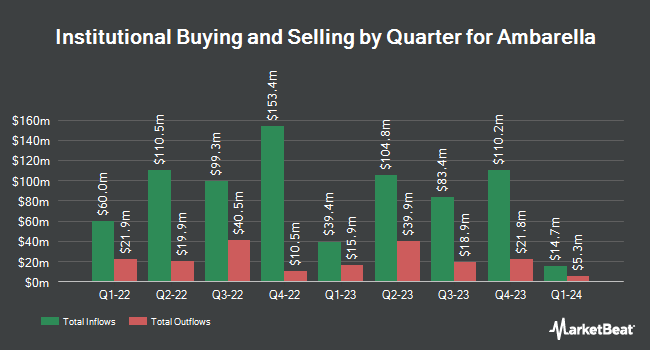

Several other hedge funds and other institutional investors have also made changes to their positions in the business. Vanguard Group Inc. increased its stake in Ambarella by 6.1% during the 1st quarter. Vanguard Group Inc. now owns 4,340,831 shares of the semiconductor company's stock valued at $220,384,000 after buying an additional 248,297 shares during the period. Millennium Management LLC boosted its holdings in shares of Ambarella by 7.0% in the second quarter. Millennium Management LLC now owns 1,447,466 shares of the semiconductor company's stock valued at $78,091,000 after acquiring an additional 94,257 shares in the last quarter. The Manufacturers Life Insurance Company increased its stake in shares of Ambarella by 36.2% during the second quarter. The Manufacturers Life Insurance Company now owns 1,291,900 shares of the semiconductor company's stock valued at $69,698,000 after acquiring an additional 343,385 shares during the period. Dimensional Fund Advisors LP lifted its position in Ambarella by 0.4% in the second quarter. Dimensional Fund Advisors LP now owns 683,119 shares of the semiconductor company's stock worth $36,854,000 after purchasing an additional 2,994 shares during the period. Finally, Marshall Wace LLP lifted its position in Ambarella by 69.2% in the second quarter. Marshall Wace LLP now owns 613,346 shares of the semiconductor company's stock worth $33,090,000 after purchasing an additional 250,778 shares during the period. 82.09% of the stock is currently owned by institutional investors and hedge funds.

Ambarella Trading Up 3.0 %

NASDAQ AMBA traded up $1.68 during trading on Friday, reaching $57.87. 284,176 shares of the company's stock were exchanged, compared to its average volume of 583,922. Ambarella, Inc. has a fifty-two week low of $39.69 and a fifty-two week high of $65.88. The company's fifty day simple moving average is $56.03 and its 200-day simple moving average is $52.78.

Ambarella (NASDAQ:AMBA - Get Free Report) last posted its quarterly earnings results on Tuesday, August 27th. The semiconductor company reported ($0.13) EPS for the quarter, topping the consensus estimate of ($0.19) by $0.06. The business had revenue of $63.70 million during the quarter, compared to analysts' expectations of $62.10 million. Ambarella had a negative net margin of 79.46% and a negative return on equity of 26.01%. The firm's quarterly revenue was up 2.6% compared to the same quarter last year. During the same period last year, the company posted ($0.76) earnings per share. As a group, analysts predict that Ambarella, Inc. will post -3 earnings per share for the current fiscal year.

Insider Buying and Selling

In other Ambarella news, VP Christopher Day sold 483 shares of the business's stock in a transaction dated Tuesday, September 17th. The stock was sold at an average price of $53.54, for a total value of $25,859.82. Following the transaction, the vice president now owns 21,370 shares in the company, valued at $1,144,149.80. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available through the SEC website. In other news, VP Christopher Day sold 483 shares of the stock in a transaction on Tuesday, September 17th. The shares were sold at an average price of $53.54, for a total transaction of $25,859.82. Following the transaction, the vice president now owns 21,370 shares in the company, valued at $1,144,149.80. This represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, COO Chan W. Lee sold 1,490 shares of Ambarella stock in a transaction on Tuesday, September 17th. The shares were sold at an average price of $53.54, for a total transaction of $79,774.60. Following the completion of the sale, the chief operating officer now directly owns 121,406 shares of the company's stock, valued at approximately $6,500,077.24. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 24,423 shares of company stock worth $1,356,402. Corporate insiders own 5.70% of the company's stock.

Wall Street Analysts Forecast Growth

AMBA has been the topic of a number of research reports. Susquehanna dropped their price objective on Ambarella from $80.00 to $70.00 and set a "positive" rating on the stock in a research note on Monday, October 21st. Westpark Capital reissued a "buy" rating and issued a $85.00 price target on shares of Ambarella in a report on Monday, August 26th. TD Cowen raised their price objective on shares of Ambarella from $65.00 to $75.00 and gave the company a "hold" rating in a research report on Wednesday, August 28th. Craig Hallum boosted their target price on shares of Ambarella from $80.00 to $85.00 and gave the stock a "buy" rating in a report on Wednesday, August 28th. Finally, Bank of America raised their target price on shares of Ambarella from $50.00 to $57.00 and gave the stock an "underperform" rating in a report on Wednesday, August 28th. Two research analysts have rated the stock with a sell rating, three have given a hold rating and seven have given a buy rating to the stock. Based on data from MarketBeat.com, Ambarella currently has an average rating of "Hold" and an average target price of $74.09.

View Our Latest Stock Report on Ambarella

Ambarella Company Profile

(

Free Report)

Ambarella, Inc develops semiconductor solutions that enable high-definition (HD) and ultra HD compression, image signal processing, and artificial intelligence processing worldwide. The company's system-on-a-chip designs integrated HD video processing, image processing, artificial intelligence computer vision algorithms, audio processing, and system functions onto a single chip for delivering video and image quality, differentiated functionality, and low power consumption.

Recommended Stories

Before you consider Ambarella, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ambarella wasn't on the list.

While Ambarella currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.