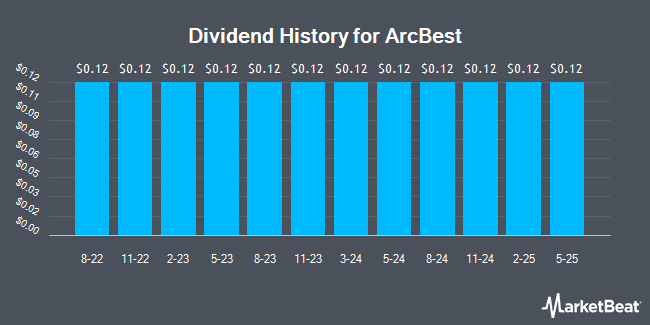

ArcBest Co. (NASDAQ:ARCB - Get Free Report) announced a quarterly dividend on Wednesday, October 30th, Zacks reports. Stockholders of record on Wednesday, November 13th will be given a dividend of 0.12 per share by the transportation company on Wednesday, November 27th. This represents a $0.48 annualized dividend and a dividend yield of 0.48%. The ex-dividend date is Wednesday, November 13th.

ArcBest has increased its dividend by an average of 14.5% per year over the last three years. ArcBest has a payout ratio of 5.1% meaning its dividend is sufficiently covered by earnings. Research analysts expect ArcBest to earn $9.45 per share next year, which means the company should continue to be able to cover its $0.48 annual dividend with an expected future payout ratio of 5.1%.

ArcBest Price Performance

Shares of ArcBest stock traded down $4.16 during mid-day trading on Friday, reaching $100.02. 572,708 shares of the stock were exchanged, compared to its average volume of 285,194. The firm has a 50-day simple moving average of $104.90 and a 200 day simple moving average of $110.77. The company has a current ratio of 1.19, a quick ratio of 1.19 and a debt-to-equity ratio of 0.12. The company has a market cap of $2.37 billion, a price-to-earnings ratio of 19.34, a price-to-earnings-growth ratio of 1.40 and a beta of 1.46. ArcBest has a fifty-two week low of $94.76 and a fifty-two week high of $153.60.

ArcBest (NASDAQ:ARCB - Get Free Report) last posted its quarterly earnings results on Friday, August 2nd. The transportation company reported $1.98 earnings per share (EPS) for the quarter, missing the consensus estimate of $2.03 by ($0.05). The company had revenue of $1.08 billion during the quarter, compared to the consensus estimate of $1.06 billion. ArcBest had a return on equity of 15.98% and a net margin of 2.96%. The firm's revenue for the quarter was down 2.4% on a year-over-year basis. During the same quarter in the prior year, the business earned $1.54 earnings per share. On average, sell-side analysts predict that ArcBest will post 6.89 EPS for the current fiscal year.

Wall Street Analysts Forecast Growth

Several brokerages have recently issued reports on ARCB. Citigroup began coverage on shares of ArcBest in a report on Wednesday, October 9th. They issued a "neutral" rating and a $111.00 price target for the company. Stifel Nicolaus lowered their price target on shares of ArcBest from $131.00 to $119.00 and set a "buy" rating on the stock in a research note on Monday, October 21st. StockNews.com upgraded ArcBest from a "hold" rating to a "buy" rating in a report on Thursday, October 3rd. The Goldman Sachs Group dropped their target price on ArcBest from $133.00 to $125.00 and set a "neutral" rating on the stock in a report on Wednesday, October 9th. Finally, TD Cowen downgraded ArcBest from a "buy" rating to a "hold" rating and reduced their target price for the stock from $131.00 to $114.00 in a research note on Monday, October 14th. One equities research analyst has rated the stock with a sell rating, seven have issued a hold rating and six have assigned a buy rating to the stock. According to data from MarketBeat, the stock currently has a consensus rating of "Hold" and a consensus price target of $126.92.

Read Our Latest Report on ARCB

Insider Buying and Selling

In other ArcBest news, Director Salvatore A. Abbate bought 1,000 shares of the stock in a transaction on Monday, August 12th. The stock was purchased at an average price of $103.93 per share, with a total value of $103,930.00. Following the completion of the purchase, the director now owns 3,650 shares in the company, valued at $379,344.50. The trade was a 0.00 % increase in their ownership of the stock. The purchase was disclosed in a filing with the SEC, which is available through the SEC website. 1.65% of the stock is owned by corporate insiders.

About ArcBest

(

Get Free Report)

ArcBest Corporation, an integrated logistics company, engages in the provision of ground, air, and ocean transportation solutions. It operates through two segments: Asset-Based and Asset-Light. The Asset-Based segment provides less-than-truckload (LTL) services, that transports general commodities, such as food, textiles, apparel, furniture, appliances, chemicals, non-bulk petroleum products, rubber, plastics, metal and metal products, wood, glass, automotive parts, machinery, and miscellaneous manufactured products.

Recommended Stories

Before you consider ArcBest, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ArcBest wasn't on the list.

While ArcBest currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.