International Assets Investment Management LLC lifted its stake in shares of Avis Budget Group, Inc. (NASDAQ:CAR - Free Report) by 19,203.5% during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 481,044 shares of the business services provider's stock after acquiring an additional 478,552 shares during the quarter. International Assets Investment Management LLC owned about 1.35% of Avis Budget Group worth $421,350,000 at the end of the most recent reporting period.

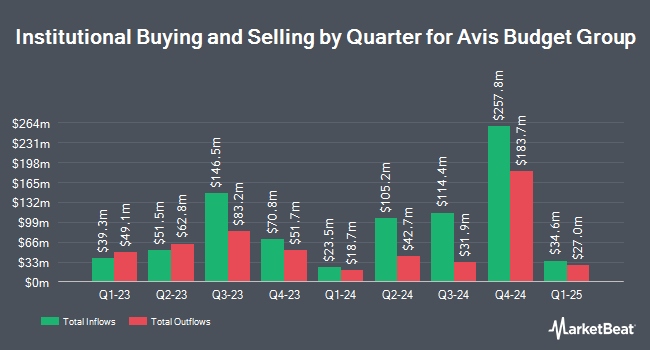

Several other hedge funds and other institutional investors have also recently added to or reduced their stakes in CAR. State of Michigan Retirement System grew its position in Avis Budget Group by 2.2% in the first quarter. State of Michigan Retirement System now owns 4,573 shares of the business services provider's stock worth $560,000 after buying an additional 100 shares during the last quarter. Denali Advisors LLC increased its stake in Avis Budget Group by 94.1% in the 1st quarter. Denali Advisors LLC now owns 231 shares of the business services provider's stock worth $28,000 after purchasing an additional 112 shares in the last quarter. EntryPoint Capital LLC raised its holdings in Avis Budget Group by 119.2% during the 1st quarter. EntryPoint Capital LLC now owns 228 shares of the business services provider's stock worth $28,000 after buying an additional 124 shares during the period. SummerHaven Investment Management LLC lifted its stake in Avis Budget Group by 4.5% during the second quarter. SummerHaven Investment Management LLC now owns 3,223 shares of the business services provider's stock valued at $337,000 after buying an additional 138 shares in the last quarter. Finally, US Bancorp DE lifted its stake in Avis Budget Group by 5.2% during the first quarter. US Bancorp DE now owns 3,123 shares of the business services provider's stock valued at $382,000 after buying an additional 155 shares in the last quarter. Institutional investors own 96.35% of the company's stock.

Avis Budget Group Trading Down 1.4 %

CAR traded down $1.21 during midday trading on Friday, reaching $82.36. The company's stock had a trading volume of 664,716 shares, compared to its average volume of 711,172. Avis Budget Group, Inc. has a twelve month low of $65.73 and a twelve month high of $204.77. The stock has a market cap of $2.94 billion, a P/E ratio of 2.64 and a beta of 2.13. The company has a fifty day simple moving average of $82.25 and a 200 day simple moving average of $98.13.

Avis Budget Group (NASDAQ:CAR - Get Free Report) last posted its quarterly earnings results on Monday, August 5th. The business services provider reported $0.41 earnings per share (EPS) for the quarter, missing the consensus estimate of $2.60 by ($2.19). The company had revenue of $3.05 billion during the quarter, compared to analyst estimates of $3.13 billion. Avis Budget Group had a negative return on equity of 230.71% and a net margin of 6.58%. The business's revenue for the quarter was down 2.4% on a year-over-year basis. During the same quarter in the prior year, the business earned $11.01 earnings per share. Sell-side analysts expect that Avis Budget Group, Inc. will post 7.68 earnings per share for the current year.

Analyst Upgrades and Downgrades

A number of analysts have recently issued reports on the company. Susquehanna reduced their target price on Avis Budget Group from $120.00 to $95.00 and set a "neutral" rating for the company in a report on Friday, August 9th. JPMorgan Chase & Co. reduced their price objective on Avis Budget Group from $205.00 to $175.00 and set an "overweight" rating for the company in a research note on Wednesday, August 7th. Deutsche Bank Aktiengesellschaft dropped their target price on Avis Budget Group from $155.00 to $146.00 and set a "buy" rating on the stock in a report on Friday, August 30th. StockNews.com lowered shares of Avis Budget Group from a "hold" rating to a "sell" rating in a research report on Wednesday, August 14th. Finally, Barclays started coverage on shares of Avis Budget Group in a research report on Thursday, September 19th. They set an "equal weight" rating and a $105.00 price objective on the stock. One analyst has rated the stock with a sell rating, three have given a hold rating and five have issued a buy rating to the company's stock. According to MarketBeat, Avis Budget Group currently has a consensus rating of "Hold" and an average target price of $136.63.

Read Our Latest Research Report on Avis Budget Group

Avis Budget Group Profile

(

Free Report)

Avis Budget Group, Inc, together with its subsidiaries, provides car and truck rentals, car sharing, and ancillary products and services to businesses and consumers in the Americas, Europe, the Middle East and Africa, Asia, and Australasia. It operates the Avis brand, that offers vehicle rental and other mobility solutions to the premium commercial and leisure segments of the travel industry; and the Zipcar brand, a car sharing network, as well as the Budget brand, a supplier of vehicle rental and other mobility solutions focused primarily on more value-conscious customers comprising Budget car rental, and Budget Truck, a local, and one-way truck and cargo van rental businesses with a fleet of approximately 19,000 vehicles, which are rented through a network of dealer-operated and company-operated locations that serve the light commercial and consumer sectors in the continental United States.

Featured Articles

Before you consider Avis Budget Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Avis Budget Group wasn't on the list.

While Avis Budget Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.