International Assets Investment Management LLC purchased a new position in shares of CRISPR Therapeutics AG (NASDAQ:CRSP - Free Report) during the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund purchased 38,852 shares of the company's stock, valued at approximately $1,825,000.

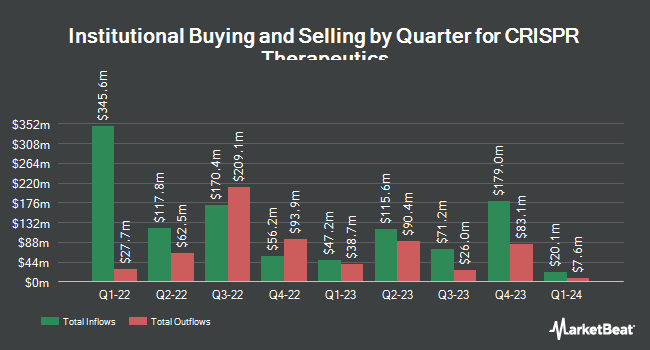

A number of other institutional investors also recently made changes to their positions in the stock. Nordea Investment Management AB raised its position in CRISPR Therapeutics by 40.8% in the first quarter. Nordea Investment Management AB now owns 148,700 shares of the company's stock worth $10,305,000 after acquiring an additional 43,100 shares in the last quarter. Cetera Investment Advisers boosted its holdings in CRISPR Therapeutics by 451.3% during the first quarter. Cetera Investment Advisers now owns 34,100 shares of the company's stock worth $2,324,000 after buying an additional 27,915 shares in the last quarter. CWM LLC grew its position in CRISPR Therapeutics by 11,871.1% in the second quarter. CWM LLC now owns 22,386 shares of the company's stock worth $1,209,000 after buying an additional 22,199 shares during the last quarter. Granite Bay Wealth Management LLC acquired a new stake in shares of CRISPR Therapeutics during the 2nd quarter valued at $2,375,000. Finally, Vanguard Group Inc. boosted its stake in shares of CRISPR Therapeutics by 3.4% during the 4th quarter. Vanguard Group Inc. now owns 1,590,651 shares of the company's stock worth $99,575,000 after acquiring an additional 51,926 shares in the last quarter. 69.20% of the stock is owned by institutional investors and hedge funds.

CRISPR Therapeutics Stock Down 0.3 %

Shares of NASDAQ:CRSP traded down $0.17 on Monday, reaching $50.59. The company had a trading volume of 1,596,371 shares, compared to its average volume of 1,448,576. The stock has a market capitalization of $4.30 billion, a P/E ratio of -15.50 and a beta of 1.67. The stock has a 50-day moving average price of $47.15 and a 200 day moving average price of $52.32. CRISPR Therapeutics AG has a twelve month low of $43.42 and a twelve month high of $91.10.

CRISPR Therapeutics (NASDAQ:CRSP - Get Free Report) last announced its earnings results on Monday, August 5th. The company reported ($1.49) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($1.43) by ($0.06). The business had revenue of $0.52 million during the quarter, compared to analysts' expectations of $12.31 million. During the same period in the prior year, the firm earned ($0.98) earnings per share. The firm's revenue for the quarter was down 99.3% on a year-over-year basis. On average, sell-side analysts predict that CRISPR Therapeutics AG will post -5.57 earnings per share for the current fiscal year.

Analyst Ratings Changes

A number of equities analysts recently weighed in on the company. Rodman & Renshaw began coverage on CRISPR Therapeutics in a research report on Friday, August 2nd. They issued a "buy" rating and a $90.00 price target for the company. Truist Financial reduced their price target on shares of CRISPR Therapeutics from $120.00 to $100.00 and set a "buy" rating for the company in a research report on Monday, August 12th. Barclays lowered their price objective on shares of CRISPR Therapeutics from $67.00 to $59.00 and set an "equal weight" rating on the stock in a research report on Tuesday, August 6th. Royal Bank of Canada cut their target price on shares of CRISPR Therapeutics from $60.00 to $53.00 and set a "sector perform" rating on the stock in a research note on Friday, October 4th. Finally, Chardan Capital decreased their target price on CRISPR Therapeutics from $112.00 to $94.00 and set a "buy" rating for the company in a research report on Tuesday, August 6th. Three analysts have rated the stock with a sell rating, eight have issued a hold rating and nine have issued a buy rating to the company's stock. Based on data from MarketBeat.com, the company has a consensus rating of "Hold" and an average target price of $75.19.

Read Our Latest Report on CRSP

Insider Transactions at CRISPR Therapeutics

In related news, General Counsel James R. Kasinger sold 1,089 shares of the firm's stock in a transaction on Monday, October 14th. The shares were sold at an average price of $46.28, for a total value of $50,398.92. Following the transaction, the general counsel now directly owns 62,597 shares in the company, valued at approximately $2,896,989.16. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is available through this link. In other news, CEO Samarth Kulkarni sold 4,293 shares of the firm's stock in a transaction on Monday, October 14th. The shares were sold at an average price of $46.28, for a total value of $198,680.04. Following the sale, the chief executive officer now owns 226,540 shares in the company, valued at approximately $10,484,271.20. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is accessible through this hyperlink. Also, General Counsel James R. Kasinger sold 1,089 shares of the business's stock in a transaction on Monday, October 14th. The stock was sold at an average price of $46.28, for a total transaction of $50,398.92. Following the transaction, the general counsel now directly owns 62,597 shares in the company, valued at $2,896,989.16. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. 4.10% of the stock is owned by corporate insiders.

CRISPR Therapeutics Profile

(

Free Report)

CRISPR Therapeutics is a gene-editing company focused on developing transformative gene-based medicines for serious diseases using its proprietary CRISPR/Cas9 platform. CRISPR/Cas9 is a revolutionary gene-editing technology that allows for precise, directed changes to genomic DNA. CRISPR Therapeutics has established a portfolio of therapeutic programs across a broad range of disease areas including hemoglobinopathies, oncology, regenerative medicine and rare diseases.

Featured Articles

Before you consider CRISPR Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CRISPR Therapeutics wasn't on the list.

While CRISPR Therapeutics currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.