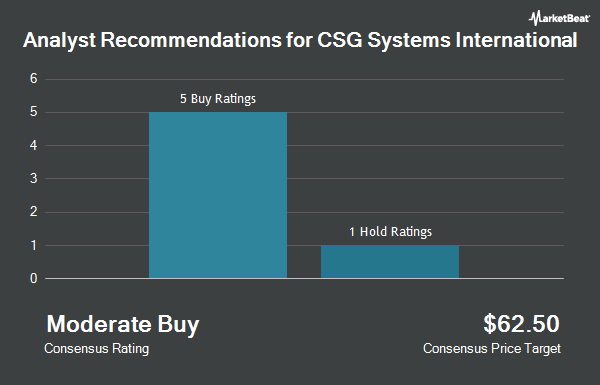

CSG Systems International, Inc. (NASDAQ:CSGS - Get Free Report) has been given a consensus rating of "Moderate Buy" by the five ratings firms that are presently covering the firm, Marketbeat reports. One investment analyst has rated the stock with a hold rating and four have given a buy rating to the company. The average 1 year price objective among analysts that have covered the stock in the last year is $58.80.

CSGS has been the subject of several recent analyst reports. StockNews.com raised CSG Systems International from a "buy" rating to a "strong-buy" rating in a research note on Wednesday, October 23rd. Royal Bank of Canada decreased their target price on CSG Systems International from $61.00 to $52.00 and set an "outperform" rating for the company in a research note on Thursday, August 8th. Benchmark reaffirmed a "buy" rating and set a $75.00 target price on shares of CSG Systems International in a research note on Wednesday, August 7th. Finally, Cantor Fitzgerald raised their target price on CSG Systems International from $62.00 to $64.00 and gave the stock an "overweight" rating in a research note on Thursday, August 8th.

View Our Latest Stock Analysis on CSG Systems International

CSG Systems International Trading Up 0.6 %

Shares of CSGS traded up $0.26 during mid-day trading on Monday, reaching $47.41. 134,215 shares of the company were exchanged, compared to its average volume of 265,893. CSG Systems International has a 52 week low of $39.56 and a 52 week high of $55.64. The company has a debt-to-equity ratio of 1.95, a quick ratio of 1.59 and a current ratio of 1.59. The stock has a market capitalization of $1.41 billion, a PE ratio of 22.02, a PEG ratio of 1.42 and a beta of 0.82. The business has a 50 day simple moving average of $47.66 and a two-hundred day simple moving average of $45.07.

CSG Systems International (NASDAQ:CSGS - Get Free Report) last issued its quarterly earnings data on Wednesday, August 7th. The technology company reported $1.02 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.91 by $0.11. CSG Systems International had a return on equity of 33.18% and a net margin of 5.53%. The company had revenue of $290.30 million during the quarter, compared to the consensus estimate of $269.60 million. During the same period last year, the company earned $0.61 earnings per share. The firm's revenue was up 1.4% compared to the same quarter last year. On average, analysts predict that CSG Systems International will post 3.43 earnings per share for the current fiscal year.

CSG Systems International Dividend Announcement

The company also recently disclosed a quarterly dividend, which was paid on Friday, September 27th. Shareholders of record on Friday, September 13th were paid a $0.30 dividend. The ex-dividend date was Friday, September 13th. This represents a $1.20 dividend on an annualized basis and a yield of 2.53%. CSG Systems International's dividend payout ratio (DPR) is presently 54.79%.

Institutional Investors Weigh In On CSG Systems International

A number of hedge funds have recently added to or reduced their stakes in the company. Central Pacific Bank Trust Division boosted its position in shares of CSG Systems International by 20.3% during the third quarter. Central Pacific Bank Trust Division now owns 3,611 shares of the technology company's stock valued at $176,000 after buying an additional 610 shares during the last quarter. SG Americas Securities LLC boosted its position in shares of CSG Systems International by 88.0% during the first quarter. SG Americas Securities LLC now owns 3,627 shares of the technology company's stock valued at $187,000 after buying an additional 1,698 shares during the last quarter. Sciencast Management LP purchased a new position in shares of CSG Systems International during the first quarter valued at approximately $233,000. EMC Capital Management boosted its position in shares of CSG Systems International by 28.1% during the first quarter. EMC Capital Management now owns 4,808 shares of the technology company's stock valued at $248,000 after buying an additional 1,056 shares during the last quarter. Finally, Stoneridge Investment Partners LLC purchased a new position in shares of CSG Systems International during the second quarter valued at approximately $243,000. Institutional investors and hedge funds own 91.07% of the company's stock.

About CSG Systems International

(

Get Free ReportCSG Systems International, Inc, together with its subsidiaries, provides revenue management and digital monetization, customer experience, and payment solutions primarily to the communications industry in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. It offers Advanced Convergent Platform, a private SaaS platform; and related solutions, including service technician management, analytics, electronic bill presentment, etc.

See Also

Before you consider CSG Systems International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CSG Systems International wasn't on the list.

While CSG Systems International currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.