Robeco Institutional Asset Management B.V. cut its stake in shares of Amdocs Limited (NASDAQ:DOX - Free Report) by 20.0% in the third quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 529,324 shares of the technology company's stock after selling 132,357 shares during the period. Robeco Institutional Asset Management B.V. owned approximately 0.45% of Amdocs worth $46,305,000 as of its most recent SEC filing.

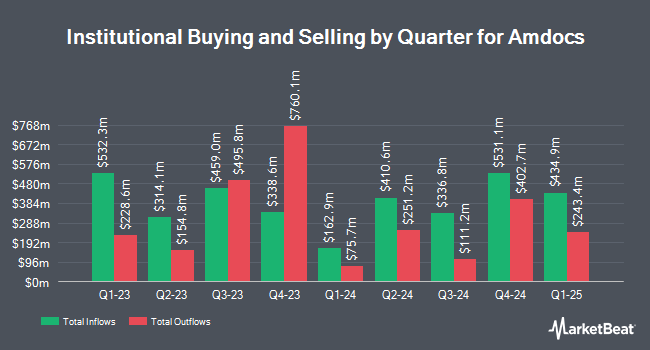

Other large investors have also made changes to their positions in the company. Pzena Investment Management LLC grew its position in Amdocs by 33.2% in the second quarter. Pzena Investment Management LLC now owns 5,667,603 shares of the technology company's stock valued at $447,287,000 after purchasing an additional 1,412,826 shares in the last quarter. Allspring Global Investments Holdings LLC increased its position in shares of Amdocs by 36.6% during the 3rd quarter. Allspring Global Investments Holdings LLC now owns 3,175,790 shares of the technology company's stock worth $277,818,000 after purchasing an additional 851,022 shares during the last quarter. Vanguard Group Inc. raised its stake in shares of Amdocs by 39.5% during the 1st quarter. Vanguard Group Inc. now owns 2,033,536 shares of the technology company's stock worth $183,771,000 after purchasing an additional 576,168 shares in the last quarter. Brandes Investment Partners LP boosted its holdings in shares of Amdocs by 31.1% in the 2nd quarter. Brandes Investment Partners LP now owns 2,260,811 shares of the technology company's stock valued at $178,335,000 after buying an additional 536,359 shares during the last quarter. Finally, Pacer Advisors Inc. lifted its stake in Amdocs by 36.2% in the second quarter. Pacer Advisors Inc. now owns 1,675,784 shares of the technology company's stock valued at $132,253,000 after acquiring an additional 444,966 shares during the last quarter. Institutional investors own 92.02% of the company's stock.

Amdocs Price Performance

DOX traded up $0.67 on Tuesday, hitting $89.15. 227,044 shares of the stock were exchanged, compared to its average volume of 668,070. The company has a debt-to-equity ratio of 0.21, a current ratio of 1.24 and a quick ratio of 1.24. Amdocs Limited has a 12 month low of $74.41 and a 12 month high of $94.04. The firm has a market capitalization of $10.48 billion, a price-to-earnings ratio of 20.39, a PEG ratio of 1.42 and a beta of 0.74. The business has a 50-day moving average of $87.48 and a two-hundred day moving average of $83.68.

Amdocs (NASDAQ:DOX - Get Free Report) last posted its quarterly earnings results on Wednesday, August 7th. The technology company reported $1.62 earnings per share for the quarter, beating analysts' consensus estimates of $1.60 by $0.02. The company had revenue of $1.25 billion for the quarter, compared to the consensus estimate of $1.25 billion. Amdocs had a net margin of 10.21% and a return on equity of 17.89%. The firm's quarterly revenue was up 1.1% compared to the same quarter last year. During the same period last year, the company posted $1.41 EPS. Sell-side analysts forecast that Amdocs Limited will post 5.67 EPS for the current fiscal year.

Amdocs Dividend Announcement

The business also recently announced a quarterly dividend, which was paid on Friday, October 25th. Shareholders of record on Monday, September 30th were issued a dividend of $0.479 per share. This represents a $1.92 annualized dividend and a yield of 2.15%. The ex-dividend date was Monday, September 30th. Amdocs's payout ratio is presently 44.24%.

Wall Street Analysts Forecast Growth

Several equities research analysts recently issued reports on the stock. Stifel Nicolaus started coverage on shares of Amdocs in a research note on Wednesday, October 2nd. They issued a "buy" rating and a $100.00 target price for the company. StockNews.com upgraded shares of Amdocs from a "buy" rating to a "strong-buy" rating in a research note on Friday, October 25th. One investment analyst has rated the stock with a hold rating, four have assigned a buy rating and one has given a strong buy rating to the company. According to MarketBeat.com, the stock currently has an average rating of "Buy" and an average target price of $102.00.

View Our Latest Report on Amdocs

Amdocs Profile

(

Free Report)

Amdocs Limited, through its subsidiaries, provides software and services worldwide. It designs, develops, operates, implements, supports, and markets open and modular cloud portfolio. The company provides CES23, a 5G and cloud-native microservices-based market-leading customer experience suite, that enables service providers to build, deliver, and monetize advanced services; Amdocs Subscription Marketplace, a software-as-a-service-based platform that includes an expansive network of pre-integrated digital services, such as media, gaming, eLearning, sports, and retail to security and business services; the monetization suite for charging, billing, policy, and revenue management; Intelligent networking suite with a set of modular, flexible, and open service lifecycle management capabilities for network automation journeys; amAIz, a telco GenAI framework; Amdocs Digital Brands Suite, a pre-integrated digital business suite; and Amdocs eSIM Cloud for service providers.

Featured Articles

Before you consider Amdocs, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amdocs wasn't on the list.

While Amdocs currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.