Leonardo DRS (NASDAQ:DRS - Get Free Report) had its target price raised by investment analysts at JPMorgan Chase & Co. from $29.00 to $32.00 in a research note issued on Monday, Benzinga reports. The brokerage currently has a "neutral" rating on the stock. JPMorgan Chase & Co.'s price objective would suggest a potential upside of 1.56% from the stock's previous close.

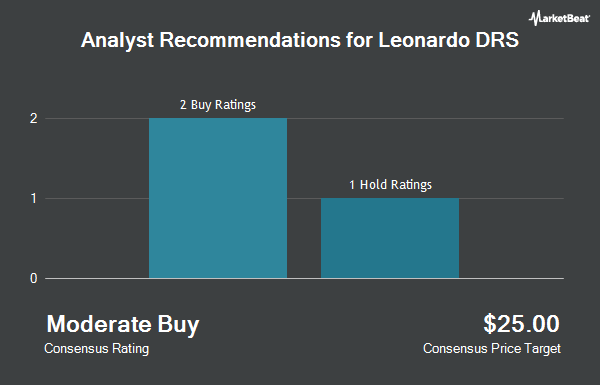

Several other brokerages have also recently weighed in on DRS. BTIG Research boosted their price target on shares of Leonardo DRS from $30.00 to $33.00 and gave the stock a "buy" rating in a research report on Thursday, August 1st. Truist Financial lifted their price objective on shares of Leonardo DRS from $30.00 to $32.00 and gave the stock a "buy" rating in a research note on Wednesday, July 31st. Bank of America lowered shares of Leonardo DRS from a "buy" rating to a "neutral" rating and lifted their price objective for the stock from $26.00 to $30.00 in a research note on Tuesday, September 24th. Finally, Robert W. Baird lifted their price objective on shares of Leonardo DRS from $30.00 to $40.00 and gave the stock an "outperform" rating in a research note on Thursday. Three analysts have rated the stock with a hold rating and three have assigned a buy rating to the company's stock. Based on data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and a consensus price target of $32.17.

Read Our Latest Stock Analysis on Leonardo DRS

Leonardo DRS Price Performance

Shares of Leonardo DRS stock traded up $0.79 on Monday, hitting $31.51. 731,027 shares of the company traded hands, compared to its average volume of 622,453. The stock has a market capitalization of $8.33 billion, a P/E ratio of 42.58, a price-to-earnings-growth ratio of 1.89 and a beta of 0.95. The company has a debt-to-equity ratio of 0.14, a quick ratio of 1.60 and a current ratio of 2.11. Leonardo DRS has a 52 week low of $17.97 and a 52 week high of $33.29. The business has a 50-day simple moving average of $28.55 and a 200 day simple moving average of $26.37.

Leonardo DRS (NASDAQ:DRS - Get Free Report) last released its quarterly earnings data on Wednesday, October 30th. The company reported $0.24 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.20 by $0.04. The firm had revenue of $812.00 million for the quarter, compared to analysts' expectations of $775.44 million. Leonardo DRS had a net margin of 6.23% and a return on equity of 9.71%. The company's revenue for the quarter was up 15.5% compared to the same quarter last year. During the same quarter last year, the business posted $0.20 earnings per share. Research analysts expect that Leonardo DRS will post 0.89 earnings per share for the current fiscal year.

Institutional Inflows and Outflows

Hedge funds and other institutional investors have recently added to or reduced their stakes in the business. Swiss National Bank grew its holdings in Leonardo DRS by 50.5% during the 1st quarter. Swiss National Bank now owns 155,300 shares of the company's stock worth $3,431,000 after acquiring an additional 52,100 shares in the last quarter. California State Teachers Retirement System raised its position in shares of Leonardo DRS by 33.9% in the 1st quarter. California State Teachers Retirement System now owns 77,704 shares of the company's stock valued at $1,716,000 after purchasing an additional 19,673 shares during the last quarter. Price T Rowe Associates Inc. MD raised its position in Leonardo DRS by 15.4% during the 1st quarter. Price T Rowe Associates Inc. MD now owns 2,180,347 shares of the company's stock worth $48,165,000 after buying an additional 290,188 shares during the last quarter. Tidal Investments LLC purchased a new position in Leonardo DRS during the 1st quarter worth approximately $1,265,000. Finally, Russell Investments Group Ltd. raised its position in Leonardo DRS by 32.1% during the 1st quarter. Russell Investments Group Ltd. now owns 188,737 shares of the company's stock worth $4,169,000 after buying an additional 45,821 shares during the last quarter. 18.76% of the stock is currently owned by institutional investors.

Leonardo DRS Company Profile

(

Get Free Report)

Leonardo DRS, Inc, together with its subsidiaries, provides defense electronic products and systems, and military support services. It operates through Advanced Sensing and Computing (ASC) segment, and Integrated Mission Systems (IMS) segments. The ASC segment designs, develops, and manufacture sensing and network computing technology that enables real-time situational awareness required for enhanced operational decision making and execution; and offers sensing capabilities span applications, such as missions requiring advanced detection, precision targeting and surveillance sensing, long range electro-optic/infrared, signals intelligence, and other intelligence systems including electronic warfare, ground vehicle sensing, active electronically scanned array tactical radars, dismounted soldier, and space sensing.

Further Reading

Before you consider Leonardo DRS, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Leonardo DRS wasn't on the list.

While Leonardo DRS currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.