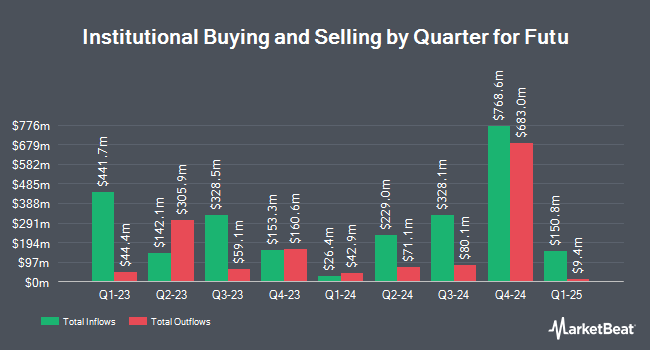

China Universal Asset Management Co. Ltd. decreased its holdings in Futu Holdings Limited (NASDAQ:FUTU - Free Report) by 51.4% in the third quarter, according to its most recent 13F filing with the SEC. The institutional investor owned 7,294 shares of the company's stock after selling 7,706 shares during the period. China Universal Asset Management Co. Ltd.'s holdings in Futu were worth $698,000 as of its most recent SEC filing.

Other institutional investors and hedge funds also recently made changes to their positions in the company. GAMMA Investing LLC lifted its stake in Futu by 181.5% in the third quarter. GAMMA Investing LLC now owns 594 shares of the company's stock worth $57,000 after acquiring an additional 383 shares during the period. CWM LLC lifted its holdings in Futu by 67.7% in the third quarter. CWM LLC now owns 743 shares of the company's stock worth $71,000 after buying an additional 300 shares during the period. Allspring Global Investments Holdings LLC bought a new stake in Futu during the 2nd quarter valued at approximately $50,000. UniSuper Management Pty Ltd boosted its position in Futu by 100.0% during the 1st quarter. UniSuper Management Pty Ltd now owns 800 shares of the company's stock valued at $43,000 after acquiring an additional 400 shares in the last quarter. Finally, SG Americas Securities LLC purchased a new position in shares of Futu during the 2nd quarter worth approximately $123,000.

Wall Street Analysts Forecast Growth

Separately, Bank of America boosted their target price on shares of Futu from $80.20 to $90.00 and gave the company a "buy" rating in a report on Friday, September 27th. One research analyst has rated the stock with a hold rating and six have issued a buy rating to the stock. According to MarketBeat, the company presently has an average rating of "Moderate Buy" and a consensus target price of $72.97.

Read Our Latest Analysis on FUTU

Futu Price Performance

Shares of Futu stock traded down $2.03 during trading hours on Wednesday, reaching $96.14. The company's stock had a trading volume of 1,942,017 shares, compared to its average volume of 2,285,168. Futu Holdings Limited has a one year low of $43.61 and a one year high of $130.50. The firm has a 50 day moving average price of $81.70 and a 200-day moving average price of $72.04. The stock has a market cap of $13.25 billion, a P/E ratio of 24.84, a P/E/G ratio of 0.97 and a beta of 0.74.

Futu (NASDAQ:FUTU - Get Free Report) last announced its earnings results on Tuesday, August 20th. The company reported $1.11 earnings per share for the quarter. Futu had a net margin of 39.27% and a return on equity of 16.77%. The business had revenue of $400.73 million for the quarter. As a group, sell-side analysts forecast that Futu Holdings Limited will post 4.78 EPS for the current fiscal year.

Futu Company Profile

(

Free Report)

Futu Holdings Limited provides digitalized securities brokerage and wealth management product distribution service in Hong Kong and internationally. It offers online financial services, including securities and derivative trades brokerage, margin financing and fund distribution services through its Futubull and Moomoo digital platforms.

See Also

Before you consider Futu, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Futu wasn't on the list.

While Futu currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.