Harmony Biosciences (NASDAQ:HRMY - Free Report) had its price target lifted by Cantor Fitzgerald from $51.00 to $58.00 in a research note released on Wednesday, Benzinga reports. They currently have an overweight rating on the stock.

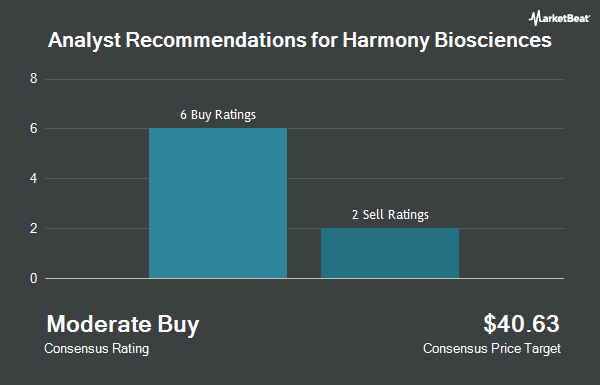

Several other research analysts have also commented on HRMY. Oppenheimer reaffirmed an "outperform" rating and set a $59.00 price objective (up from $56.00) on shares of Harmony Biosciences in a research note on Wednesday. Raymond James restated an "outperform" rating and issued a $40.00 target price on shares of Harmony Biosciences in a report on Thursday, October 10th. UBS Group began coverage on shares of Harmony Biosciences in a report on Tuesday, September 10th. They set a "buy" rating and a $56.00 price target on the stock. Mizuho raised their price objective on shares of Harmony Biosciences from $42.00 to $52.00 and gave the stock an "outperform" rating in a research note on Thursday, October 10th. Finally, Needham & Company LLC reaffirmed a "buy" rating and set a $52.00 target price on shares of Harmony Biosciences in a research note on Tuesday. Two research analysts have rated the stock with a sell rating and seven have assigned a buy rating to the company. According to MarketBeat, Harmony Biosciences currently has a consensus rating of "Moderate Buy" and a consensus price target of $47.00.

Get Our Latest Stock Report on Harmony Biosciences

Harmony Biosciences Price Performance

Shares of NASDAQ:HRMY traded down $7.69 on Wednesday, reaching $33.80. The company's stock had a trading volume of 2,887,437 shares, compared to its average volume of 422,945. The company has a 50-day simple moving average of $36.50 and a 200 day simple moving average of $33.10. The company has a debt-to-equity ratio of 0.32, a quick ratio of 3.09 and a current ratio of 3.13. The company has a market cap of $1.92 billion, a P/E ratio of 17.97, a PEG ratio of 0.69 and a beta of 0.73. Harmony Biosciences has a 52-week low of $22.00 and a 52-week high of $41.61.

Harmony Biosciences (NASDAQ:HRMY - Get Free Report) last issued its quarterly earnings data on Tuesday, October 29th. The company reported $0.79 earnings per share for the quarter, topping the consensus estimate of $0.64 by $0.15. The company had revenue of $186.00 million for the quarter, compared to analysts' expectations of $184.07 million. Harmony Biosciences had a return on equity of 22.97% and a net margin of 17.53%. The firm's revenue for the quarter was up 16.0% on a year-over-year basis. During the same period in the previous year, the firm posted $0.63 earnings per share. As a group, equities research analysts anticipate that Harmony Biosciences will post 2.23 EPS for the current fiscal year.

Institutional Trading of Harmony Biosciences

Several institutional investors and hedge funds have recently made changes to their positions in the company. Pacer Advisors Inc. increased its position in Harmony Biosciences by 0.6% during the 2nd quarter. Pacer Advisors Inc. now owns 2,509,609 shares of the company's stock valued at $75,715,000 after purchasing an additional 14,695 shares during the period. Dimensional Fund Advisors LP boosted its stake in shares of Harmony Biosciences by 13.3% during the second quarter. Dimensional Fund Advisors LP now owns 956,785 shares of the company's stock valued at $28,871,000 after purchasing an additional 112,197 shares in the last quarter. American Century Companies Inc. increased its holdings in Harmony Biosciences by 53.7% during the second quarter. American Century Companies Inc. now owns 681,536 shares of the company's stock valued at $20,562,000 after buying an additional 238,140 shares during the period. Renaissance Technologies LLC raised its stake in Harmony Biosciences by 56.7% in the second quarter. Renaissance Technologies LLC now owns 595,800 shares of the company's stock worth $17,975,000 after buying an additional 215,700 shares in the last quarter. Finally, LSV Asset Management lifted its holdings in Harmony Biosciences by 72.5% during the second quarter. LSV Asset Management now owns 578,246 shares of the company's stock worth $17,446,000 after buying an additional 243,100 shares during the period. 86.23% of the stock is currently owned by institutional investors.

Harmony Biosciences Company Profile

(

Get Free Report)

Harmony Biosciences Holdings, Inc, a commercial-stage pharmaceutical company, focuses on developing and commercializing therapies for patients with rare and other neurological diseases in the United States. The company offers WAKIX (pitolisant), a molecule with a novel mechanism of action for the treatment of excessive daytime sleepiness in adult patients with narcolepsy.

Recommended Stories

Before you consider Harmony Biosciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Harmony Biosciences wasn't on the list.

While Harmony Biosciences currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.