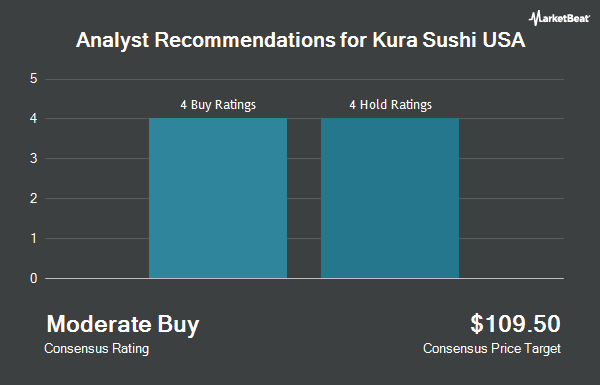

Shares of Kura Sushi USA, Inc. (NASDAQ:KRUS - Get Free Report) have earned an average recommendation of "Moderate Buy" from the nine research firms that are covering the firm, Marketbeat reports. Four analysts have rated the stock with a hold rating and five have assigned a buy rating to the company. The average 12-month price target among brokers that have updated their coverage on the stock in the last year is $73.63.

Several analysts have recently issued reports on the stock. Lake Street Capital reduced their price target on shares of Kura Sushi USA from $72.00 to $64.00 and set a "hold" rating on the stock in a research report on Wednesday, July 10th. Roth Mkm restated a "buy" rating and set a $70.00 target price (down from $90.00) on shares of Kura Sushi USA in a research note on Wednesday, July 10th. Northcoast Research started coverage on shares of Kura Sushi USA in a research note on Tuesday, September 10th. They set a "buy" rating and a $79.00 target price on the stock. Craig Hallum cut their target price on shares of Kura Sushi USA from $120.00 to $85.00 and set a "buy" rating on the stock in a research note on Wednesday, July 10th. Finally, Benchmark restated a "buy" rating and set a $90.00 target price on shares of Kura Sushi USA in a research note on Wednesday, July 10th.

Check Out Our Latest Stock Analysis on Kura Sushi USA

Kura Sushi USA Stock Down 0.0 %

Shares of KRUS traded down $0.01 during mid-day trading on Friday, hitting $99.81. 174,644 shares of the company's stock were exchanged, compared to its average volume of 159,319. Kura Sushi USA has a fifty-two week low of $48.66 and a fifty-two week high of $122.81. The stock's 50-day moving average is $79.86 and its 200-day moving average is $80.90.

Hedge Funds Weigh In On Kura Sushi USA

Several hedge funds have recently added to or reduced their stakes in the stock. Comerica Bank grew its position in shares of Kura Sushi USA by 58.6% during the first quarter. Comerica Bank now owns 268 shares of the company's stock worth $31,000 after acquiring an additional 99 shares during the last quarter. Headlands Technologies LLC purchased a new position in shares of Kura Sushi USA during the first quarter worth approximately $46,000. RiverPark Advisors LLC grew its position in shares of Kura Sushi USA by 293.5% during the first quarter. RiverPark Advisors LLC now owns 1,452 shares of the company's stock worth $167,000 after acquiring an additional 1,083 shares during the last quarter. Virtu Financial LLC purchased a new position in shares of Kura Sushi USA during the first quarter worth approximately $370,000. Finally, Price T Rowe Associates Inc. MD grew its position in shares of Kura Sushi USA by 7.6% during the first quarter. Price T Rowe Associates Inc. MD now owns 3,278 shares of the company's stock worth $378,000 after acquiring an additional 232 shares during the last quarter. 65.49% of the stock is currently owned by hedge funds and other institutional investors.

About Kura Sushi USA

(

Get Free ReportFeatured Articles

Before you consider Kura Sushi USA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kura Sushi USA wasn't on the list.

While Kura Sushi USA currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.