Needham & Company LLC reiterated their buy rating on shares of LivaNova (NASDAQ:LIVN - Free Report) in a report released on Thursday, Benzinga reports. The brokerage currently has a $75.00 target price on the stock.

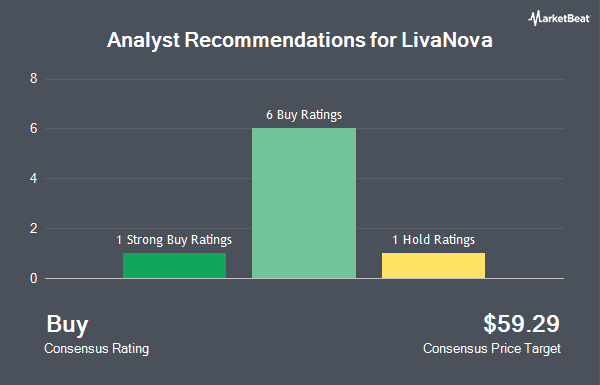

Other equities analysts have also recently issued reports about the company. Robert W. Baird increased their price target on LivaNova from $66.00 to $72.00 and gave the stock an "outperform" rating in a report on Thursday. The Goldman Sachs Group assumed coverage on LivaNova in a report on Friday, October 4th. They set a "buy" rating and a $65.00 target price for the company. Stifel Nicolaus increased their price target on LivaNova from $70.00 to $72.00 and gave the company a "buy" rating in a research report on Thursday, July 25th. Finally, Baird R W raised LivaNova from a "hold" rating to a "strong-buy" rating in a research report on Tuesday, September 17th. One investment analyst has rated the stock with a hold rating, six have given a buy rating and one has given a strong buy rating to the stock. According to data from MarketBeat.com, the company currently has an average rating of "Buy" and an average price target of $69.17.

Read Our Latest Analysis on LivaNova

LivaNova Price Performance

NASDAQ LIVN traded up $0.28 during mid-day trading on Thursday, hitting $51.62. The stock had a trading volume of 522,997 shares, compared to its average volume of 622,489. The firm's 50 day moving average is $51.04 and its 200 day moving average is $53.14. LivaNova has a twelve month low of $42.75 and a twelve month high of $64.47. The company has a debt-to-equity ratio of 0.49, a current ratio of 3.45 and a quick ratio of 2.94. The stock has a market capitalization of $2.80 billion, a price-to-earnings ratio of -86.03 and a beta of 1.00.

LivaNova (NASDAQ:LIVN - Get Free Report) last issued its earnings results on Wednesday, July 31st. The company reported $0.81 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.66 by $0.15. The company had revenue of $318.60 million during the quarter, compared to analysts' expectations of $305.05 million. LivaNova had a positive return on equity of 13.77% and a negative net margin of 1.37%. Equities research analysts forecast that LivaNova will post 2.58 earnings per share for the current fiscal year.

Institutional Trading of LivaNova

Several large investors have recently bought and sold shares of the company. Primecap Management Co. CA grew its holdings in LivaNova by 0.7% in the second quarter. Primecap Management Co. CA now owns 5,981,200 shares of the company's stock valued at $327,889,000 after purchasing an additional 44,049 shares during the last quarter. Vanguard Group Inc. lifted its position in shares of LivaNova by 3.5% in the first quarter. Vanguard Group Inc. now owns 1,832,987 shares of the company's stock valued at $102,537,000 after acquiring an additional 62,480 shares in the last quarter. Point72 Asset Management L.P. lifted its position in shares of LivaNova by 204.3% in the second quarter. Point72 Asset Management L.P. now owns 1,285,636 shares of the company's stock valued at $70,479,000 after acquiring an additional 863,157 shares in the last quarter. Magnetar Financial LLC lifted its position in shares of LivaNova by 8.1% in the second quarter. Magnetar Financial LLC now owns 814,452 shares of the company's stock valued at $44,648,000 after acquiring an additional 61,114 shares in the last quarter. Finally, Allspring Global Investments Holdings LLC lifted its position in shares of LivaNova by 3.3% in the third quarter. Allspring Global Investments Holdings LLC now owns 797,284 shares of the company's stock valued at $41,889,000 after acquiring an additional 25,277 shares in the last quarter. Institutional investors and hedge funds own 97.64% of the company's stock.

LivaNova Company Profile

(

Get Free Report)

LivaNova PLC, a medical device company, designs, develops, manufactures, and sells therapeutic solutions worldwide. The company operates through Cardiopulmonary, Neuromodulation, and Advanced Circulatory Support segments. The Cardiopulmonary segment develops, produces, and sells cardiopulmonary products, including oxygenators, heart-lung machines, autotransfusion systems, perfusion tubing systems, cannulae, connect, and other related products.

Featured Articles

Before you consider LivaNova, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LivaNova wasn't on the list.

While LivaNova currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.