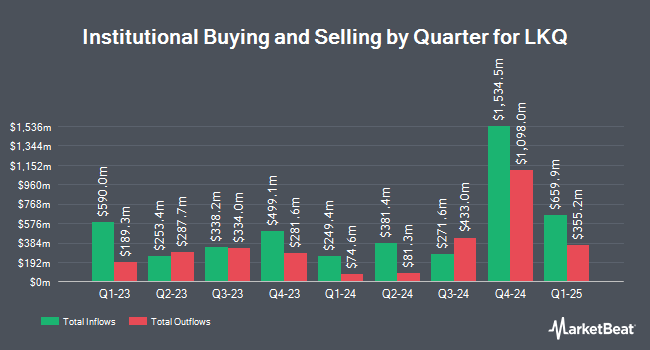

New York State Common Retirement Fund reduced its position in LKQ Co. (NASDAQ:LKQ - Free Report) by 7.1% in the 3rd quarter, according to its most recent filing with the SEC. The firm owned 989,371 shares of the auto parts company's stock after selling 75,464 shares during the period. New York State Common Retirement Fund owned about 0.37% of LKQ worth $39,496,000 at the end of the most recent reporting period.

Several other hedge funds and other institutional investors have also recently bought and sold shares of LKQ. Bleakley Financial Group LLC grew its stake in shares of LKQ by 5.3% during the 1st quarter. Bleakley Financial Group LLC now owns 4,572 shares of the auto parts company's stock valued at $244,000 after buying an additional 229 shares during the period. Motley Fool Asset Management LLC grew its stake in shares of LKQ by 4.6% during the 1st quarter. Motley Fool Asset Management LLC now owns 5,249 shares of the auto parts company's stock valued at $280,000 after buying an additional 233 shares during the period. Banque Cantonale Vaudoise grew its stake in shares of LKQ by 29.8% during the 2nd quarter. Banque Cantonale Vaudoise now owns 1,211 shares of the auto parts company's stock valued at $50,000 after buying an additional 278 shares during the period. Bruce G. Allen Investments LLC grew its stake in shares of LKQ by 33.5% during the 3rd quarter. Bruce G. Allen Investments LLC now owns 1,151 shares of the auto parts company's stock valued at $46,000 after buying an additional 289 shares during the period. Finally, Montag A & Associates Inc. grew its stake in shares of LKQ by 0.6% during the 2nd quarter. Montag A & Associates Inc. now owns 50,495 shares of the auto parts company's stock valued at $2,100,000 after buying an additional 314 shares during the period. 95.63% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

A number of brokerages recently weighed in on LKQ. JPMorgan Chase & Co. upped their price target on shares of LKQ from $54.00 to $55.00 and gave the stock an "overweight" rating in a research report on Thursday, September 12th. Barrington Research reaffirmed an "outperform" rating and set a $60.00 price target on shares of LKQ in a research report on Friday, October 25th. Stifel Nicolaus decreased their price target on shares of LKQ from $53.00 to $47.00 and set a "buy" rating for the company in a research report on Friday, October 25th. StockNews.com raised shares of LKQ from a "hold" rating to a "buy" rating in a research report on Monday, October 28th. Finally, Roth Mkm reaffirmed a "buy" rating and set a $59.00 price target on shares of LKQ in a research report on Thursday, September 12th. Six investment analysts have rated the stock with a buy rating, According to data from MarketBeat, LKQ has a consensus rating of "Buy" and an average price target of $53.80.

Check Out Our Latest Stock Report on LKQ

LKQ Stock Up 0.3 %

LKQ stock traded up $0.11 during trading on Friday, reaching $36.90. The stock had a trading volume of 2,397,065 shares, compared to its average volume of 2,660,639. LKQ Co. has a 1-year low of $35.57 and a 1-year high of $53.68. The company has a current ratio of 1.72, a quick ratio of 0.67 and a debt-to-equity ratio of 0.69. The company has a market capitalization of $9.59 billion, a P/E ratio of 13.77 and a beta of 1.29. The firm has a fifty day moving average price of $39.57 and a 200 day moving average price of $41.49.

LKQ (NASDAQ:LKQ - Get Free Report) last issued its quarterly earnings data on Thursday, October 24th. The auto parts company reported $0.88 EPS for the quarter, topping analysts' consensus estimates of $0.87 by $0.01. LKQ had a net margin of 4.90% and a return on equity of 15.15%. The firm had revenue of $3.58 billion for the quarter, compared to analyst estimates of $3.65 billion. During the same quarter in the previous year, the business posted $0.86 EPS. The firm's revenue was up .4% compared to the same quarter last year. On average, equities analysts anticipate that LKQ Co. will post 3.43 earnings per share for the current year.

LKQ Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Wednesday, November 27th. Stockholders of record on Thursday, November 14th will be paid a $0.30 dividend. The ex-dividend date of this dividend is Thursday, November 14th. This represents a $1.20 dividend on an annualized basis and a dividend yield of 3.25%. LKQ's dividend payout ratio (DPR) is presently 44.78%.

About LKQ

(

Free Report)

LKQ Corporation engages in the distribution of replacement parts, components, and systems used in the repair and maintenance of vehicles and specialty vehicle aftermarket products and accessories. It operates through four segments: Wholesale-North America, Europe, Specialty, and Self Service. The company distributes bumper covers, automotive body panels, and lights, as well as mechanical automotive parts and accessories; salvage products, including mechanical and collision parts comprising engines; transmissions; door assemblies; sheet metal products, such as trunk lids, fenders, and hoods; lights and bumper assemblies; scrap metal and other materials to metals recyclers; and brake pads, discs and sensors, clutches, steering and suspension products, filters, and oil and automotive fluids, as well as electrical products, including spark plugs and batteries.

Featured Stories

Before you consider LKQ, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LKQ wasn't on the list.

While LKQ currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.