Stephens Investment Management Group LLC raised its position in MongoDB, Inc. (NASDAQ:MDB - Free Report) by 22.8% during the 3rd quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm owned 30,664 shares of the company's stock after buying an additional 5,688 shares during the quarter. Stephens Investment Management Group LLC's holdings in MongoDB were worth $8,290,000 at the end of the most recent quarter.

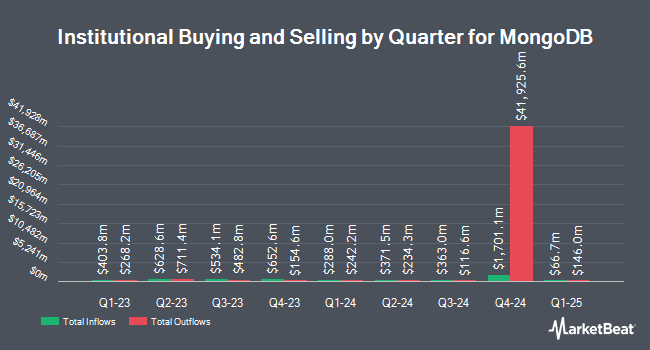

Several other hedge funds have also recently bought and sold shares of MDB. Sanctuary Advisors LLC bought a new stake in shares of MongoDB during the 2nd quarter valued at approximately $1,860,000. Sycomore Asset Management grew its holdings in shares of MongoDB by 86.4% during the 2nd quarter. Sycomore Asset Management now owns 53,568 shares of the company's stock valued at $12,884,000 after purchasing an additional 24,827 shares during the last quarter. Cetera Investment Advisers grew its holdings in MongoDB by 327.6% during the 1st quarter. Cetera Investment Advisers now owns 10,873 shares of the company's stock worth $3,899,000 after acquiring an additional 8,330 shares during the last quarter. Jennison Associates LLC grew its holdings in MongoDB by 14.3% during the 1st quarter. Jennison Associates LLC now owns 4,408,424 shares of the company's stock worth $1,581,037,000 after acquiring an additional 551,567 shares during the last quarter. Finally, SG Americas Securities LLC grew its holdings in MongoDB by 179.7% during the 1st quarter. SG Americas Securities LLC now owns 7,142 shares of the company's stock worth $2,561,000 after acquiring an additional 4,589 shares during the last quarter. 89.29% of the stock is owned by institutional investors.

Insider Buying and Selling at MongoDB

In other MongoDB news, CFO Michael Lawrence Gordon sold 5,000 shares of the company's stock in a transaction dated Monday, October 14th. The shares were sold at an average price of $290.31, for a total transaction of $1,451,550.00. Following the sale, the chief financial officer now directly owns 80,307 shares of the company's stock, valued at $23,313,925.17. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. In related news, Director Dwight A. Merriman sold 3,000 shares of the firm's stock in a transaction that occurred on Wednesday, October 2nd. The shares were sold at an average price of $256.25, for a total value of $768,750.00. Following the sale, the director now directly owns 1,131,006 shares of the company's stock, valued at $289,820,287.50. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available through the SEC website. Also, CFO Michael Lawrence Gordon sold 5,000 shares of the firm's stock in a transaction that occurred on Monday, October 14th. The shares were sold at an average price of $290.31, for a total transaction of $1,451,550.00. Following the completion of the sale, the chief financial officer now directly owns 80,307 shares in the company, valued at $23,313,925.17. This represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 21,281 shares of company stock valued at $5,848,411 over the last three months. 3.60% of the stock is currently owned by insiders.

MongoDB Stock Up 0.5 %

Shares of NASDAQ MDB traded up $1.45 during trading on Friday, hitting $271.85. The stock had a trading volume of 1,035,517 shares, compared to its average volume of 1,254,713. MongoDB, Inc. has a 12 month low of $212.74 and a 12 month high of $509.62. The company has a debt-to-equity ratio of 0.84, a current ratio of 5.03 and a quick ratio of 5.03. The company has a market capitalization of $20.08 billion, a PE ratio of -90.02 and a beta of 1.15. The firm has a fifty day moving average of $274.71 and a two-hundred day moving average of $279.23.

MongoDB (NASDAQ:MDB - Get Free Report) last posted its quarterly earnings results on Thursday, August 29th. The company reported $0.70 earnings per share for the quarter, beating the consensus estimate of $0.49 by $0.21. The company had revenue of $478.11 million during the quarter, compared to analyst estimates of $465.03 million. MongoDB had a negative net margin of 12.08% and a negative return on equity of 15.06%. The firm's revenue for the quarter was up 12.8% on a year-over-year basis. During the same quarter in the prior year, the business earned ($0.63) earnings per share. As a group, equities research analysts forecast that MongoDB, Inc. will post -2.39 EPS for the current fiscal year.

Analyst Ratings Changes

A number of equities research analysts have weighed in on MDB shares. JMP Securities reissued a "market outperform" rating and set a $380.00 target price on shares of MongoDB in a report on Friday, August 30th. Scotiabank boosted their target price on shares of MongoDB from $250.00 to $295.00 and gave the stock a "sector perform" rating in a report on Friday, August 30th. Truist Financial boosted their price target on shares of MongoDB from $300.00 to $320.00 and gave the stock a "buy" rating in a research report on Friday, August 30th. DA Davidson boosted their price target on shares of MongoDB from $330.00 to $340.00 and gave the stock a "buy" rating in a research report on Friday, October 11th. Finally, Mizuho boosted their price target on shares of MongoDB from $250.00 to $275.00 and gave the stock a "neutral" rating in a research report on Friday, August 30th. One equities research analyst has rated the stock with a sell rating, five have given a hold rating, twenty have issued a buy rating and one has given a strong buy rating to the company. According to data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and an average price target of $337.96.

Read Our Latest Stock Report on MDB

About MongoDB

(

Free Report)

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

See Also

Before you consider MongoDB, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MongoDB wasn't on the list.

While MongoDB currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report