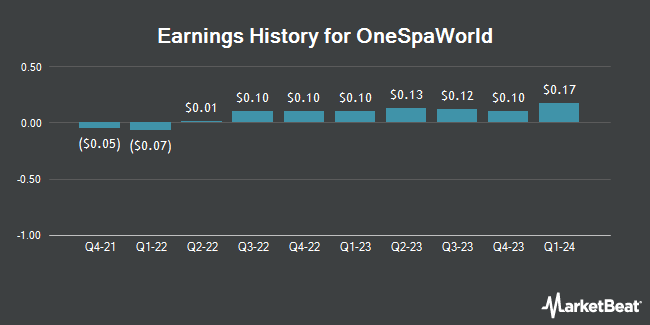

OneSpaWorld (NASDAQ:OSW - Get Free Report) is set to release its earnings data before the market opens on Wednesday, October 30th. Analysts expect OneSpaWorld to post earnings of $0.20 per share for the quarter. OneSpaWorld has set its FY 2024 guidance at EPS and its Q3 2024 guidance at EPS.Individual interested in participating in the company's earnings conference call can do so using this link.

OneSpaWorld (NASDAQ:OSW - Get Free Report) last announced its quarterly earnings results on Wednesday, July 31st. The company reported $0.18 EPS for the quarter, beating analysts' consensus estimates of $0.17 by $0.01. The company had revenue of $224.89 million for the quarter, compared to analysts' expectations of $220.61 million. OneSpaWorld had a net margin of 6.26% and a return on equity of 13.67%. During the same period in the prior year, the company posted $0.13 EPS. On average, analysts expect OneSpaWorld to post $1 EPS for the current fiscal year and $1 EPS for the next fiscal year.

OneSpaWorld Stock Performance

Shares of NASDAQ:OSW traded up $0.27 during trading on Thursday, hitting $17.27. 689,257 shares of the company were exchanged, compared to its average volume of 542,672. OneSpaWorld has a 52-week low of $9.82 and a 52-week high of $17.89. The stock has a 50 day moving average of $16.18 and a 200 day moving average of $15.35. The company has a debt-to-equity ratio of 0.23, a current ratio of 2.03 and a quick ratio of 1.49. The company has a market cap of $1.73 billion, a PE ratio of 63.85 and a beta of 2.14.

OneSpaWorld Announces Dividend

The company also recently declared a quarterly dividend, which was paid on Wednesday, September 4th. Stockholders of record on Wednesday, August 21st were given a dividend of $0.04 per share. The ex-dividend date was Wednesday, August 21st. This represents a $0.16 dividend on an annualized basis and a dividend yield of 0.93%. OneSpaWorld's dividend payout ratio (DPR) is currently 59.26%.

Insider Activity at OneSpaWorld

In related news, Director Andrew R. Heyer sold 6,000 shares of the stock in a transaction dated Monday, August 5th. The shares were sold at an average price of $14.57, for a total value of $87,420.00. Following the completion of the transaction, the director now directly owns 467,145 shares in the company, valued at $6,806,302.65. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. In other OneSpaWorld news, CFO Stephen Lazarus sold 170,339 shares of OneSpaWorld stock in a transaction dated Thursday, September 26th. The shares were sold at an average price of $16.91, for a total value of $2,880,432.49. Following the completion of the transaction, the chief financial officer now directly owns 556,581 shares of the company's stock, valued at approximately $9,411,784.71. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this link. Also, Director Andrew R. Heyer sold 6,000 shares of the business's stock in a transaction that occurred on Monday, August 5th. The stock was sold at an average price of $14.57, for a total transaction of $87,420.00. Following the completion of the transaction, the director now owns 467,145 shares of the company's stock, valued at approximately $6,806,302.65. The trade was a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 184,904 shares of company stock worth $3,111,316 over the last quarter. 5.00% of the stock is owned by corporate insiders.

Analysts Set New Price Targets

Separately, TD Cowen upped their price objective on shares of OneSpaWorld from $16.00 to $19.00 and gave the stock a "buy" rating in a research report on Thursday, August 1st.

Check Out Our Latest Research Report on OSW

OneSpaWorld Company Profile

(

Get Free Report)

OneSpaWorld Holdings Limited operates health and wellness centers onboard cruise ships and at destination resorts worldwide. Its health and wellness centers offer services, such as traditional body, salon, and skin care services and products; self-service fitness facilities, specialized fitness classes, and personal fitness training; pain management, detoxifying programs, and body composition analyses; weight management programs and products; and medi-spa services.

Read More

Before you consider OneSpaWorld, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and OneSpaWorld wasn't on the list.

While OneSpaWorld currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.