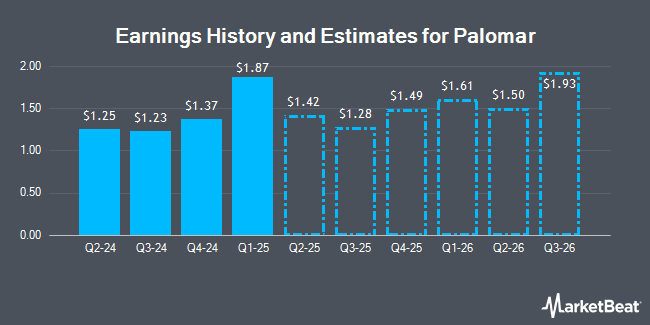

Palomar Holdings, Inc. (NASDAQ:PLMR - Free Report) - Equities researchers at Zacks Research upped their Q3 2026 EPS estimates for Palomar in a report issued on Monday, October 28th. Zacks Research analyst S. Sarkar now anticipates that the company will post earnings per share of $1.37 for the quarter, up from their prior estimate of $1.33. The consensus estimate for Palomar's current full-year earnings is $4.35 per share.

Other equities analysts have also issued research reports about the stock. Keefe, Bruyette & Woods lifted their price target on shares of Palomar from $96.00 to $113.00 and gave the company an "outperform" rating in a report on Tuesday, August 13th. Truist Financial lifted their target price on shares of Palomar from $100.00 to $112.00 and gave the company a "buy" rating in a report on Thursday, August 8th. JPMorgan Chase & Co. lifted their target price on shares of Palomar from $88.00 to $91.00 and gave the company a "neutral" rating in a report on Thursday, July 11th. Piper Sandler lifted their target price on shares of Palomar from $99.00 to $105.00 and gave the company an "overweight" rating in a report on Wednesday, August 7th. Finally, Evercore ISI lifted their target price on shares of Palomar from $90.00 to $99.00 and gave the company an "in-line" rating in a report on Tuesday, August 6th. Three investment analysts have rated the stock with a hold rating and four have given a buy rating to the company's stock. According to MarketBeat.com, Palomar has a consensus rating of "Moderate Buy" and an average target price of $105.50.

View Our Latest Research Report on Palomar

Palomar Trading Down 3.4 %

Shares of PLMR traded down $3.15 during mid-day trading on Thursday, reaching $89.77. The company had a trading volume of 111,869 shares, compared to its average volume of 161,768. The stock has a market cap of $2.24 billion, a price-to-earnings ratio of 25.80 and a beta of 0.33. The firm has a fifty day simple moving average of $95.87 and a 200-day simple moving average of $88.73. Palomar has a fifty-two week low of $49.73 and a fifty-two week high of $103.40.

Palomar (NASDAQ:PLMR - Get Free Report) last announced its quarterly earnings results on Monday, August 5th. The company reported $1.25 earnings per share for the quarter, beating analysts' consensus estimates of $1.09 by $0.16. The company had revenue of $123.08 million for the quarter, compared to analyst estimates of $338.74 million. Palomar had a net margin of 21.63% and a return on equity of 20.83%. Palomar's revenue for the quarter was up 47.0% on a year-over-year basis. During the same quarter last year, the business earned $0.72 EPS.

Insider Buying and Selling

In other news, Director Thomas A. Bradley purchased 1,000 shares of the company's stock in a transaction that occurred on Friday, August 9th. The shares were purchased at an average price of $89.42 per share, with a total value of $89,420.00. Following the purchase, the director now directly owns 4,724 shares of the company's stock, valued at approximately $422,420.08. This represents a 0.00 % increase in their position. The transaction was disclosed in a filing with the SEC, which can be accessed through this link. In other news, Director Thomas A. Bradley purchased 1,000 shares of the company's stock in a transaction that occurred on Friday, August 9th. The shares were purchased at an average price of $89.42 per share, with a total value of $89,420.00. Following the purchase, the director now directly owns 4,724 shares of the company's stock, valued at approximately $422,420.08. This represents a 0.00 % increase in their position. The transaction was disclosed in a filing with the SEC, which can be accessed through this link. Also, CFO T Christopher Uchida sold 1,750 shares of Palomar stock in a transaction on Tuesday, August 6th. The stock was sold at an average price of $94.00, for a total transaction of $164,500.00. Following the sale, the chief financial officer now directly owns 22,344 shares in the company, valued at $2,100,336. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 37,520 shares of company stock valued at $3,626,486 in the last quarter. Company insiders own 4.30% of the company's stock.

Institutional Investors Weigh In On Palomar

Several hedge funds and other institutional investors have recently modified their holdings of PLMR. Vanguard Group Inc. increased its position in shares of Palomar by 3.7% in the 4th quarter. Vanguard Group Inc. now owns 2,363,067 shares of the company's stock worth $131,150,000 after purchasing an additional 85,329 shares during the last quarter. Janney Montgomery Scott LLC bought a new stake in shares of Palomar in the 1st quarter worth about $602,000. Hunter Associates Investment Management LLC increased its position in shares of Palomar by 34.7% in the 1st quarter. Hunter Associates Investment Management LLC now owns 19,146 shares of the company's stock worth $1,620,000 after purchasing an additional 4,937 shares during the last quarter. Texas Permanent School Fund Corp increased its position in shares of Palomar by 1.3% in the 1st quarter. Texas Permanent School Fund Corp now owns 21,644 shares of the company's stock worth $1,814,000 after purchasing an additional 280 shares during the last quarter. Finally, Quantbot Technologies LP boosted its holdings in shares of Palomar by 1,149.0% in the 1st quarter. Quantbot Technologies LP now owns 10,429 shares of the company's stock valued at $874,000 after buying an additional 9,594 shares during the period. Institutional investors own 90.25% of the company's stock.

About Palomar

(

Get Free Report)

Palomar Holdings, Inc, a specialty insurance company, provides property and casualty insurance to residential and businesses in the United States. The company offers personal and commercial specialty property insurance products, including residential and commercial earthquake, fronting, commercial all risk, specialty homeowners, inland marine, Hawaii hurricane, and residential flood, as well as other products, such as assumed reinsurance.

Read More

Before you consider Palomar, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Palomar wasn't on the list.

While Palomar currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.