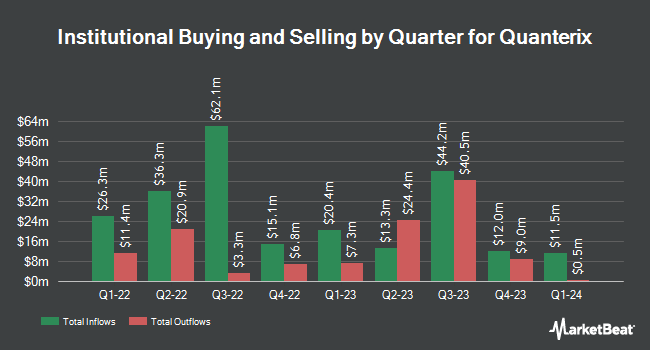

Emerald Advisers LLC boosted its position in shares of Quanterix Co. (NASDAQ:QTRX - Free Report) by 5.6% in the 3rd quarter, according to its most recent filing with the Securities & Exchange Commission. The institutional investor owned 719,217 shares of the company's stock after acquiring an additional 38,230 shares during the period. Emerald Advisers LLC owned about 1.88% of Quanterix worth $9,321,000 as of its most recent SEC filing.

Other large investors also recently modified their holdings of the company. Easterly Investment Partners LLC increased its holdings in Quanterix by 779.9% in the second quarter. Easterly Investment Partners LLC now owns 692,746 shares of the company's stock valued at $9,151,000 after buying an additional 614,012 shares during the last quarter. Lord Abbett & CO. LLC increased its holdings in shares of Quanterix by 22.9% in the 1st quarter. Lord Abbett & CO. LLC now owns 1,757,153 shares of the company's stock valued at $41,398,000 after acquiring an additional 326,876 shares during the last quarter. Farallon Capital Management LLC raised its position in shares of Quanterix by 156.0% during the 1st quarter. Farallon Capital Management LLC now owns 471,000 shares of the company's stock worth $11,097,000 after acquiring an additional 287,000 shares in the last quarter. Assenagon Asset Management S.A. purchased a new stake in Quanterix during the second quarter worth approximately $3,389,000. Finally, Envestnet Asset Management Inc. boosted its holdings in Quanterix by 2,261.8% in the second quarter. Envestnet Asset Management Inc. now owns 209,731 shares of the company's stock valued at $2,771,000 after purchasing an additional 200,851 shares in the last quarter. 86.48% of the stock is owned by hedge funds and other institutional investors.

Insiders Place Their Bets

In related news, Director David R. Walt bought 47,000 shares of the company's stock in a transaction dated Tuesday, August 20th. The shares were acquired at an average price of $13.29 per share, with a total value of $624,630.00. Following the completion of the acquisition, the director now owns 1,487,342 shares in the company, valued at approximately $19,766,775.18. This trade represents a 0.00 % increase in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. 6.90% of the stock is owned by insiders.

Quanterix Price Performance

Shares of QTRX traded up $0.21 during mid-day trading on Friday, reaching $13.43. 383,841 shares of the company's stock were exchanged, compared to its average volume of 336,757. The business's fifty day simple moving average is $12.71 and its 200-day simple moving average is $14.09. The stock has a market capitalization of $515.44 million, a PE ratio of -12.79 and a beta of 1.36. Quanterix Co. has a 52-week low of $10.50 and a 52-week high of $29.70.

Quanterix (NASDAQ:QTRX - Get Free Report) last posted its quarterly earnings data on Thursday, August 8th. The company reported ($0.25) EPS for the quarter, missing analysts' consensus estimates of ($0.23) by ($0.02). Quanterix had a negative net margin of 30.71% and a negative return on equity of 11.52%. The business had revenue of $34.38 million during the quarter, compared to analyst estimates of $34.19 million. During the same quarter in the prior year, the firm posted ($0.16) earnings per share. Equities research analysts predict that Quanterix Co. will post -0.88 earnings per share for the current year.

Wall Street Analyst Weigh In

Several brokerages have recently weighed in on QTRX. Scotiabank reduced their price objective on shares of Quanterix from $32.00 to $28.00 and set a "sector outperform" rating for the company in a research report on Monday, August 12th. The Goldman Sachs Group reduced their price target on shares of Quanterix from $35.00 to $24.00 and set a "buy" rating for the company in a research report on Tuesday, July 9th. Finally, TD Cowen dropped their price objective on Quanterix from $17.00 to $15.00 and set a "hold" rating on the stock in a report on Friday, August 9th.

Check Out Our Latest Stock Analysis on QTRX

Quanterix Profile

(

Free Report)

Quanterix Corporation, a life sciences company, engages in development and marketing of digital immunoassay platforms that advances precision health for life sciences research and diagnostics in North America, Europe, the Middle East, Africa, and the Asia Pacific regions. The company offers HD-X instrument, a protein detection platform; and SR-X instrument that enables researchers to apply Simoa detection in an expanded range of applications.

Featured Stories

Before you consider Quanterix, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Quanterix wasn't on the list.

While Quanterix currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.