Evercore ISI upgraded shares of Regency Centers (NASDAQ:REG - Free Report) from a hold rating to a strong-buy rating in a research report released on Tuesday morning, Zacks.com reports.

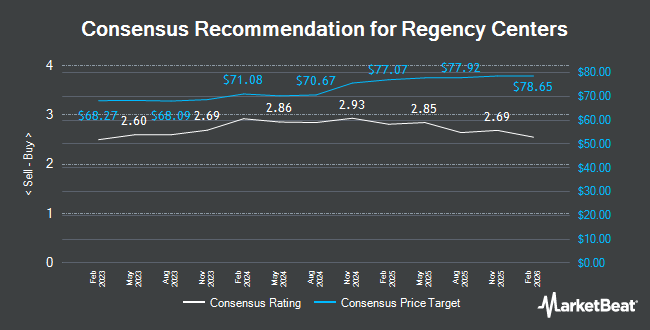

A number of other equities analysts also recently commented on the stock. Truist Financial lifted their target price on shares of Regency Centers from $70.00 to $78.00 and gave the stock a "buy" rating in a research note on Friday, August 16th. Wells Fargo & Company lifted their target price on shares of Regency Centers from $69.00 to $79.00 and gave the stock an "overweight" rating in a research note on Wednesday, August 28th. JPMorgan Chase & Co. lifted their target price on shares of Regency Centers from $71.00 to $77.00 and gave the stock an "overweight" rating in a research note on Thursday, August 8th. KeyCorp began coverage on shares of Regency Centers in a research note on Friday, October 25th. They set an "overweight" rating and a $80.00 target price on the stock. Finally, Scotiabank lifted their target price on shares of Regency Centers from $65.00 to $75.00 and gave the stock a "sector perform" rating in a research note on Monday, August 26th. Two equities research analysts have rated the stock with a hold rating, eight have given a buy rating and two have issued a strong buy rating to the stock. According to MarketBeat.com, Regency Centers currently has a consensus rating of "Buy" and a consensus price target of $76.67.

View Our Latest Analysis on REG

Regency Centers Price Performance

REG traded down $1.26 during midday trading on Tuesday, hitting $71.44. 1,357,115 shares of the company traded hands, compared to its average volume of 1,092,650. The company has a current ratio of 0.93, a quick ratio of 0.93 and a debt-to-equity ratio of 0.65. The company has a market capitalization of $12.97 billion, a price-to-earnings ratio of 33.54, a PEG ratio of 4.42 and a beta of 1.21. Regency Centers has a 52-week low of $56.51 and a 52-week high of $75.26. The business has a 50 day simple moving average of $72.14 and a two-hundred day simple moving average of $66.05.

Regency Centers (NASDAQ:REG - Get Free Report) last posted its quarterly earnings results on Monday, October 28th. The company reported $0.54 earnings per share for the quarter, missing the consensus estimate of $1.04 by ($0.50). The business had revenue of $360.27 million during the quarter, compared to analysts' expectations of $355.17 million. Regency Centers had a return on equity of 5.63% and a net margin of 27.60%. During the same period in the prior year, the business posted $1.02 earnings per share. On average, equities analysts forecast that Regency Centers will post 4.24 earnings per share for the current fiscal year.

Insider Activity

In other news, VP Michael R. Herman sold 1,000 shares of the company's stock in a transaction on Friday, August 16th. The shares were sold at an average price of $69.57, for a total value of $69,570.00. Following the completion of the transaction, the vice president now owns 13,010 shares in the company, valued at approximately $905,105.70. This represents a 0.00 % decrease in their position. The sale was disclosed in a filing with the SEC, which is accessible through this link. In related news, Chairman Martin E. Stein, Jr. sold 25,000 shares of the stock in a transaction on Friday, August 2nd. The shares were sold at an average price of $70.00, for a total transaction of $1,750,000.00. Following the completion of the sale, the chairman now owns 307,199 shares in the company, valued at $21,503,930. This represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Also, VP Michael R. Herman sold 1,000 shares of the stock in a transaction on Friday, August 16th. The stock was sold at an average price of $69.57, for a total transaction of $69,570.00. Following the sale, the vice president now owns 13,010 shares of the company's stock, valued at approximately $905,105.70. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Company insiders own 1.00% of the company's stock.

Institutional Trading of Regency Centers

A number of large investors have recently bought and sold shares of the business. Vanguard Group Inc. lifted its stake in shares of Regency Centers by 3.0% in the 1st quarter. Vanguard Group Inc. now owns 28,889,033 shares of the company's stock worth $1,749,520,000 after acquiring an additional 830,572 shares during the period. Price T Rowe Associates Inc. MD lifted its stake in shares of Regency Centers by 10.7% in the 1st quarter. Price T Rowe Associates Inc. MD now owns 9,048,753 shares of the company's stock worth $547,995,000 after acquiring an additional 873,062 shares during the period. Principal Financial Group Inc. lifted its stake in shares of Regency Centers by 4.2% in the 2nd quarter. Principal Financial Group Inc. now owns 8,922,988 shares of the company's stock worth $555,009,000 after acquiring an additional 357,091 shares during the period. Boston Partners lifted its stake in shares of Regency Centers by 4.1% in the 1st quarter. Boston Partners now owns 4,192,951 shares of the company's stock worth $253,902,000 after acquiring an additional 166,354 shares during the period. Finally, Dimensional Fund Advisors LP lifted its stake in shares of Regency Centers by 4.6% in the 2nd quarter. Dimensional Fund Advisors LP now owns 2,641,921 shares of the company's stock worth $164,327,000 after acquiring an additional 117,368 shares during the period. Institutional investors and hedge funds own 96.07% of the company's stock.

Regency Centers Company Profile

(

Get Free Report)

Regency Centers is a preeminent national owner, operator, and developer of shopping centers located in suburban trade areas with compelling demographics. Our portfolio includes thriving properties merchandised with highly productive grocers, restaurants, service providers, and best-in-class retailers that connect to their neighborhoods, communities, and customers.

Read More

Before you consider Regency Centers, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Regency Centers wasn't on the list.

While Regency Centers currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.