Creative Planning lifted its holdings in Rambus Inc. (NASDAQ:RMBS - Free Report) by 40.7% during the 3rd quarter, according to its most recent disclosure with the SEC. The institutional investor owned 37,267 shares of the semiconductor company's stock after acquiring an additional 10,772 shares during the period. Creative Planning's holdings in Rambus were worth $1,573,000 as of its most recent filing with the SEC.

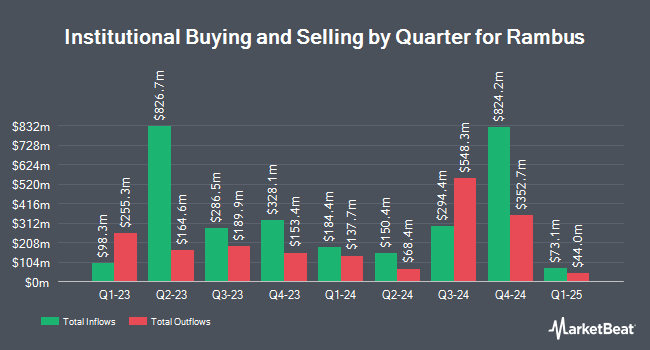

Several other institutional investors and hedge funds have also modified their holdings of RMBS. Allspring Global Investments Holdings LLC grew its stake in shares of Rambus by 129.8% in the first quarter. Allspring Global Investments Holdings LLC now owns 9,069 shares of the semiconductor company's stock valued at $561,000 after acquiring an additional 5,122 shares in the last quarter. State of Michigan Retirement System grew its stake in Rambus by 2.3% during the first quarter. State of Michigan Retirement System now owns 26,400 shares of the semiconductor company's stock worth $1,632,000 after buying an additional 600 shares in the last quarter. Sumitomo Mitsui Trust Holdings Inc. grew its stake in Rambus by 39.6% during the first quarter. Sumitomo Mitsui Trust Holdings Inc. now owns 5,019 shares of the semiconductor company's stock worth $310,000 after buying an additional 1,423 shares in the last quarter. Commonwealth Equity Services LLC grew its stake in Rambus by 119.0% during the first quarter. Commonwealth Equity Services LLC now owns 14,129 shares of the semiconductor company's stock worth $873,000 after buying an additional 7,676 shares in the last quarter. Finally, Van ECK Associates Corp grew its stake in Rambus by 36.5% during the first quarter. Van ECK Associates Corp now owns 43,856 shares of the semiconductor company's stock worth $2,711,000 after buying an additional 11,730 shares in the last quarter. 88.54% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

A number of equities research analysts have issued reports on the stock. Rosenblatt Securities reiterated a "buy" rating and set a $85.00 price objective on shares of Rambus in a research note on Tuesday. Susquehanna reduced their price objective on shares of Rambus from $75.00 to $66.00 and set a "positive" rating on the stock in a research note on Friday, July 26th.

Get Our Latest Report on RMBS

Rambus Stock Down 2.2 %

Shares of RMBS stock traded down $1.11 on Wednesday, reaching $49.89. The company had a trading volume of 1,927,325 shares, compared to its average volume of 1,576,131. The stock has a market capitalization of $5.37 billion, a PE ratio of 24.40 and a beta of 1.19. Rambus Inc. has a one year low of $37.42 and a one year high of $76.38. The business's 50-day moving average is $41.94 and its 200 day moving average is $50.77.

Rambus (NASDAQ:RMBS - Get Free Report) last posted its earnings results on Monday, July 29th. The semiconductor company reported $0.33 EPS for the quarter, missing analysts' consensus estimates of $0.45 by ($0.12). The company had revenue of $132.10 million during the quarter, compared to the consensus estimate of $139.00 million. Rambus had a return on equity of 16.74% and a net margin of 48.31%. The firm's revenue was up 10.3% compared to the same quarter last year. During the same period last year, the company posted $0.36 EPS. On average, sell-side analysts forecast that Rambus Inc. will post 1.41 earnings per share for the current fiscal year.

Rambus Company Profile

(

Free Report)

Rambus Inc provides semiconductor products in the United States, South Korea, Singapore, and internationally. The company offers DDR memory interface chips, including DDR5 and DDR4 memory interface chips to module manufacturers, OEMs, and hyperscalers; silicon IP, such as interface and security IP solutions that move and protect data in advanced data center, government, and automotive applications; and interface IP solutions for high-speed memory and chip-to-chip digital controller IP.

See Also

Before you consider Rambus, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rambus wasn't on the list.

While Rambus currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.