Macquarie restated their outperform rating on shares of Surgery Partners (NASDAQ:SGRY - Free Report) in a report published on Monday morning, Benzinga reports. Macquarie currently has a $35.00 price objective on the stock.

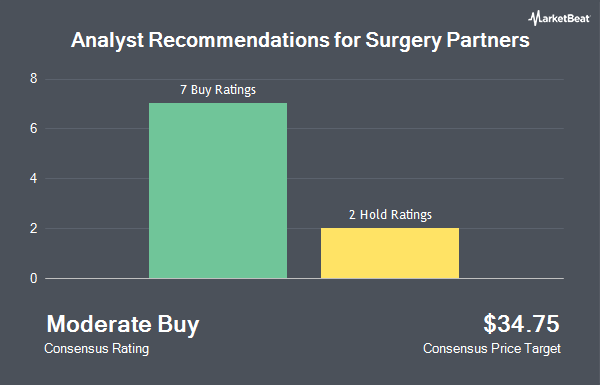

A number of other equities research analysts also recently commented on the company. Cantor Fitzgerald reaffirmed an "overweight" rating and set a $43.00 target price on shares of Surgery Partners in a report on Friday, October 4th. UBS Group assumed coverage on Surgery Partners in a research report on Monday, October 14th. They set a "buy" rating and a $38.00 price target for the company. Royal Bank of Canada reiterated an "outperform" rating and set a $49.00 price target on shares of Surgery Partners in a research report on Wednesday, August 7th. KeyCorp assumed coverage on Surgery Partners in a research report on Friday, October 11th. They set a "sector weight" rating for the company. Finally, StockNews.com cut Surgery Partners from a "hold" rating to a "sell" rating in a research report on Wednesday, August 7th. One equities research analyst has rated the stock with a sell rating, two have given a hold rating and seven have issued a buy rating to the company. Based on data from MarketBeat.com, Surgery Partners currently has a consensus rating of "Moderate Buy" and an average price target of $40.13.

Check Out Our Latest Report on Surgery Partners

Surgery Partners Stock Up 1.6 %

NASDAQ SGRY traded up $0.47 during trading on Monday, hitting $29.22. The company's stock had a trading volume of 428,281 shares, compared to its average volume of 926,305. The company has a debt-to-equity ratio of 0.96, a current ratio of 1.83 and a quick ratio of 1.69. The company has a market cap of $3.71 billion, a PE ratio of -108.26, a P/E/G ratio of 2.24 and a beta of 2.76. The business's 50 day simple moving average is $31.27 and its 200-day simple moving average is $28.22. Surgery Partners has a fifty-two week low of $22.25 and a fifty-two week high of $36.92.

Surgery Partners (NASDAQ:SGRY - Get Free Report) last released its earnings results on Tuesday, August 6th. The company reported $0.21 EPS for the quarter, topping analysts' consensus estimates of $0.20 by $0.01. Surgery Partners had a positive return on equity of 2.96% and a negative net margin of 1.17%. The firm had revenue of $762.10 million during the quarter, compared to the consensus estimate of $735.94 million. During the same quarter in the previous year, the company posted $0.25 earnings per share. The company's revenue was up 14.2% compared to the same quarter last year. On average, equities analysts anticipate that Surgery Partners will post 0.84 EPS for the current fiscal year.

Hedge Funds Weigh In On Surgery Partners

A number of institutional investors and hedge funds have recently added to or reduced their stakes in the stock. Quarry LP lifted its stake in shares of Surgery Partners by 133.1% in the 2nd quarter. Quarry LP now owns 3,082 shares of the company's stock valued at $73,000 after purchasing an additional 1,760 shares during the last quarter. DekaBank Deutsche Girozentrale lifted its stake in shares of Surgery Partners by 102.0% in the 1st quarter. DekaBank Deutsche Girozentrale now owns 2,723 shares of the company's stock valued at $80,000 after purchasing an additional 1,375 shares during the last quarter. EntryPoint Capital LLC lifted its stake in shares of Surgery Partners by 257.1% in the 1st quarter. EntryPoint Capital LLC now owns 6,399 shares of the company's stock valued at $191,000 after purchasing an additional 4,607 shares during the last quarter. Creative Planning acquired a new position in shares of Surgery Partners in the 3rd quarter valued at $258,000. Finally, Capstone Investment Advisors LLC lifted its stake in shares of Surgery Partners by 38.7% in the 1st quarter. Capstone Investment Advisors LLC now owns 9,151 shares of the company's stock valued at $273,000 after purchasing an additional 2,551 shares during the last quarter.

Surgery Partners Company Profile

(

Get Free Report)

Surgery Partners, Inc, together with its subsidiaries, owns and operates a network of surgical facilities and ancillary services in the United States. The company provides ambulatory surgery centers and surgical hospitals that offer non-emergency surgical procedures in various specialties, including orthopedics and pain management, ophthalmology, gastroenterology, and general surgery.

Featured Articles

Before you consider Surgery Partners, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Surgery Partners wasn't on the list.

While Surgery Partners currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.