SouthState (NASDAQ:SSB - Get Free Report) had its price objective increased by equities researchers at Piper Sandler from $110.00 to $112.00 in a note issued to investors on Friday, Benzinga reports. The firm presently has an "overweight" rating on the bank's stock. Piper Sandler's price target suggests a potential upside of 16.93% from the company's previous close.

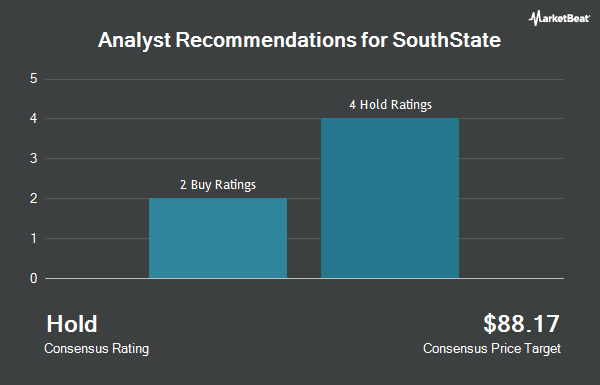

SSB has been the subject of several other reports. Keefe, Bruyette & Woods increased their price objective on shares of SouthState from $95.00 to $110.00 and gave the stock an "outperform" rating in a research report on Monday, July 29th. Hovde Group increased their price objective on shares of SouthState from $97.00 to $112.00 and gave the stock an "outperform" rating in a research report on Monday, July 29th. DA Davidson increased their price objective on shares of SouthState from $102.00 to $112.00 and gave the stock a "buy" rating in a research report on Friday, July 26th. Truist Financial increased their price objective on shares of SouthState from $109.00 to $111.00 and gave the stock a "hold" rating in a research report on Friday, September 20th. Finally, Citigroup started coverage on shares of SouthState in a report on Thursday, October 10th. They issued a "neutral" rating and a $102.00 price target for the company. Four research analysts have rated the stock with a hold rating and five have given a buy rating to the stock. Based on data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and a consensus price target of $104.44.

Get Our Latest Analysis on SSB

SouthState Trading Down 2.3 %

NASDAQ SSB traded down $2.28 on Friday, hitting $95.78. The company's stock had a trading volume of 471,900 shares, compared to its average volume of 479,402. The company has a quick ratio of 0.91, a current ratio of 0.91 and a debt-to-equity ratio of 0.10. SouthState has a 1-year low of $64.81 and a 1-year high of $103.82. The company's 50-day moving average is $96.27 and its 200 day moving average is $86.18. The firm has a market cap of $7.30 billion, a PE ratio of 15.90 and a beta of 0.67.

SouthState (NASDAQ:SSB - Get Free Report) last announced its quarterly earnings results on Wednesday, October 23rd. The bank reported $1.90 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.64 by $0.26. SouthState had a net margin of 20.84% and a return on equity of 9.31%. The firm had revenue of $426.41 million during the quarter, compared to analysts' expectations of $429.47 million. During the same period in the prior year, the company posted $1.62 EPS. The company's revenue was down .4% on a year-over-year basis. As a group, analysts predict that SouthState will post 6.69 earnings per share for the current fiscal year.

Insider Buying and Selling at SouthState

In other SouthState news, insider Daniel E. Bockhorst sold 2,500 shares of the firm's stock in a transaction on Wednesday, September 18th. The shares were sold at an average price of $100.00, for a total value of $250,000.00. Following the transaction, the insider now directly owns 33,328 shares of the company's stock, valued at approximately $3,332,800. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. In related news, CFO William E. V. Matthews sold 5,000 shares of the firm's stock in a transaction dated Friday, September 20th. The shares were sold at an average price of $100.00, for a total transaction of $500,000.00. Following the transaction, the chief financial officer now directly owns 36,964 shares of the company's stock, valued at $3,696,400. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, insider Daniel E. Bockhorst sold 2,500 shares of the firm's stock in a transaction dated Wednesday, September 18th. The shares were sold at an average price of $100.00, for a total transaction of $250,000.00. Following the transaction, the insider now directly owns 33,328 shares in the company, valued at $3,332,800. The trade was a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders own 1.26% of the company's stock.

Institutional Inflows and Outflows

Large investors have recently made changes to their positions in the company. SageView Advisory Group LLC bought a new position in shares of SouthState during the first quarter valued at about $879,000. BNP Paribas Financial Markets increased its holdings in SouthState by 82.5% during the first quarter. BNP Paribas Financial Markets now owns 42,345 shares of the bank's stock worth $3,601,000 after buying an additional 19,138 shares during the last quarter. Janney Montgomery Scott LLC increased its holdings in SouthState by 107.4% during the first quarter. Janney Montgomery Scott LLC now owns 19,006 shares of the bank's stock worth $1,616,000 after buying an additional 9,843 shares during the last quarter. Entropy Technologies LP purchased a new stake in SouthState during the first quarter worth about $562,000. Finally, Wealth Enhancement Advisory Services LLC increased its holdings in SouthState by 234.5% during the second quarter. Wealth Enhancement Advisory Services LLC now owns 26,208 shares of the bank's stock worth $2,003,000 after buying an additional 18,374 shares during the last quarter. 89.76% of the stock is owned by institutional investors.

SouthState Company Profile

(

Get Free Report)

SouthState Corporation operates as the bank holding company for SouthState Bank, National Association that provides a range of banking services and products to individuals and companies. It offers checking accounts, savings deposits, interest-bearing transaction accounts, certificates of deposits, money market accounts, and other time deposits, as well as bond accounting, asset/liability consulting related activities, and other clearing and corporate checking account services.

Featured Stories

Before you consider SouthState, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SouthState wasn't on the list.

While SouthState currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.