Oppenheimer reissued their outperform rating on shares of Transcat (NASDAQ:TRNS - Free Report) in a research report sent to investors on Wednesday, Benzinga reports. They currently have a $130.00 price objective on the scientific and technical instruments company's stock, down from their prior price objective of $155.00.

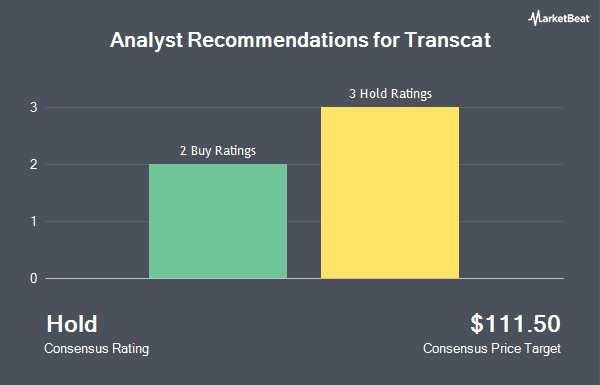

Other analysts have also issued research reports about the company. HC Wainwright reiterated a "buy" rating and set a $156.00 price objective on shares of Transcat in a report on Tuesday. Craig Hallum decreased their price objective on shares of Transcat from $138.00 to $113.00 and set a "buy" rating for the company in a research note on Wednesday. Finally, StockNews.com downgraded Transcat from a "hold" rating to a "sell" rating in a research note on Tuesday. One equities research analyst has rated the stock with a sell rating, two have assigned a hold rating and three have issued a buy rating to the stock. According to data from MarketBeat.com, the stock presently has a consensus rating of "Hold" and an average target price of $127.25.

Get Our Latest Research Report on TRNS

Transcat Trading Down 0.5 %

Shares of Transcat stock traded down $0.45 during trading on Wednesday, hitting $99.00. 267,893 shares of the stock traded hands, compared to its average volume of 52,596. The stock's fifty day simple moving average is $122.86 and its 200 day simple moving average is $122.18. The firm has a market cap of $905.85 million, a P/E ratio of 58.58 and a beta of 0.67. Transcat has a 52-week low of $84.45 and a 52-week high of $147.12.

Transcat (NASDAQ:TRNS - Get Free Report) last issued its quarterly earnings data on Monday, October 28th. The scientific and technical instruments company reported $0.35 EPS for the quarter, missing analysts' consensus estimates of $0.47 by ($0.12). Transcat had a return on equity of 8.48% and a net margin of 5.69%. The business had revenue of $67.83 million during the quarter, compared to the consensus estimate of $70.30 million. During the same period last year, the firm earned $0.41 EPS. The business's quarterly revenue was up 8.0% on a year-over-year basis. As a group, equities analysts expect that Transcat will post 2.06 EPS for the current year.

Institutional Investors Weigh In On Transcat

A number of institutional investors have recently added to or reduced their stakes in TRNS. Diversified Trust Co boosted its position in Transcat by 23.6% during the first quarter. Diversified Trust Co now owns 3,010 shares of the scientific and technical instruments company's stock worth $335,000 after acquiring an additional 575 shares during the last quarter. BNP Paribas Financial Markets increased its stake in Transcat by 24.2% in the first quarter. BNP Paribas Financial Markets now owns 14,024 shares of the scientific and technical instruments company's stock valued at $1,563,000 after purchasing an additional 2,737 shares during the last quarter. Essex Investment Management Co. LLC raised its stake in Transcat by 1.5% during the 1st quarter. Essex Investment Management Co. LLC now owns 37,435 shares of the scientific and technical instruments company's stock worth $4,171,000 after acquiring an additional 569 shares in the last quarter. Swiss National Bank increased its position in shares of Transcat by 1.2% during the first quarter. Swiss National Bank now owns 17,415 shares of the scientific and technical instruments company's stock worth $1,941,000 after purchasing an additional 200 shares in the last quarter. Finally, Russell Investments Group Ltd. increased its position in Transcat by 8.6% during the first quarter. Russell Investments Group Ltd. now owns 26,713 shares of the scientific and technical instruments company's stock worth $2,977,000 after buying an additional 2,121 shares during the period. Institutional investors and hedge funds own 98.34% of the company's stock.

Transcat Company Profile

(

Get Free Report)

Transcat, Inc provides calibration and laboratory instrument services in the United States, Canada, and internationally. It operates through two segments: Service and Distribution. The Service segment offers calibration, repair, inspection, analytical qualification, preventative maintenance, consulting, and other related services.

See Also

Before you consider Transcat, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Transcat wasn't on the list.

While Transcat currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.