Natixis Advisors LLC lifted its stake in Regal Rexnord Co. (NYSE:RRX - Free Report) by 15.3% in the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The firm owned 86,933 shares of the company's stock after acquiring an additional 11,568 shares during the period. Natixis Advisors LLC owned 0.13% of Regal Rexnord worth $14,420,000 as of its most recent filing with the Securities and Exchange Commission.

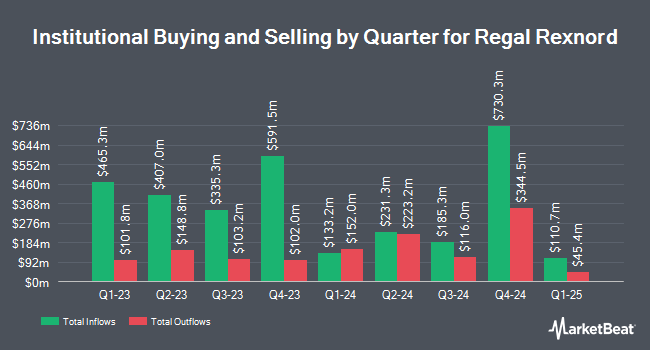

Other institutional investors and hedge funds have also recently added to or reduced their stakes in the company. Capital World Investors raised its holdings in shares of Regal Rexnord by 4.7% during the first quarter. Capital World Investors now owns 6,599,752 shares of the company's stock valued at $1,188,615,000 after acquiring an additional 296,941 shares during the period. Diamond Hill Capital Management Inc. increased its stake in shares of Regal Rexnord by 7.1% during the 2nd quarter. Diamond Hill Capital Management Inc. now owns 3,181,886 shares of the company's stock worth $430,255,000 after purchasing an additional 209,776 shares during the last quarter. Victory Capital Management Inc. boosted its holdings in Regal Rexnord by 42.7% in the second quarter. Victory Capital Management Inc. now owns 1,884,575 shares of the company's stock worth $254,832,000 after purchasing an additional 563,853 shares in the last quarter. Dimensional Fund Advisors LP raised its holdings in Regal Rexnord by 0.6% during the second quarter. Dimensional Fund Advisors LP now owns 1,422,350 shares of the company's stock valued at $192,338,000 after buying an additional 8,159 shares in the last quarter. Finally, The Manufacturers Life Insurance Company increased its holdings in shares of Regal Rexnord by 24.7% during the 2nd quarter. The Manufacturers Life Insurance Company now owns 1,125,445 shares of the company's stock valued at $152,183,000 after acquiring an additional 222,775 shares during the last quarter. 99.72% of the stock is owned by institutional investors.

Regal Rexnord Stock Up 1.5 %

Shares of RRX stock traded up $2.54 on Thursday, hitting $173.74. 246,380 shares of the stock were exchanged, compared to its average volume of 452,958. The business has a 50-day moving average of $169.15 and a 200 day moving average of $157.03. Regal Rexnord Co. has a fifty-two week low of $113.79 and a fifty-two week high of $185.28. The firm has a market capitalization of $11.51 billion, a P/E ratio of 55.24, a price-to-earnings-growth ratio of 1.86 and a beta of 1.04. The company has a current ratio of 2.45, a quick ratio of 1.35 and a debt-to-equity ratio of 0.87.

Regal Rexnord (NYSE:RRX - Get Free Report) last released its earnings results on Monday, November 4th. The company reported $2.49 earnings per share for the quarter, beating analysts' consensus estimates of $2.48 by $0.01. Regal Rexnord had a net margin of 3.41% and a return on equity of 9.48%. The business had revenue of $1.48 billion during the quarter, compared to the consensus estimate of $1.53 billion. During the same quarter last year, the firm earned $2.10 earnings per share. The firm's revenue for the quarter was down 10.4% compared to the same quarter last year. Equities analysts anticipate that Regal Rexnord Co. will post 9.25 EPS for the current year.

Regal Rexnord Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Tuesday, January 14th. Stockholders of record on Tuesday, December 31st will be issued a $0.35 dividend. The ex-dividend date of this dividend is Tuesday, December 31st. This represents a $1.40 dividend on an annualized basis and a dividend yield of 0.81%. Regal Rexnord's payout ratio is 44.16%.

Insider Activity at Regal Rexnord

In other Regal Rexnord news, CEO Louis V. Pinkham sold 8,774 shares of the stock in a transaction dated Thursday, November 7th. The shares were sold at an average price of $180.03, for a total value of $1,579,583.22. Following the transaction, the chief executive officer now directly owns 149,618 shares of the company's stock, valued at $26,935,728.54. This represents a 5.54 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. 0.82% of the stock is currently owned by company insiders.

Analysts Set New Price Targets

A number of research analysts recently issued reports on the stock. The Goldman Sachs Group raised their target price on shares of Regal Rexnord from $176.00 to $195.00 and gave the company a "buy" rating in a research note on Friday, August 2nd. Barclays lifted their target price on Regal Rexnord from $180.00 to $190.00 and gave the stock an "overweight" rating in a research report on Wednesday, October 2nd. StockNews.com upgraded Regal Rexnord from a "hold" rating to a "buy" rating in a research report on Wednesday, October 16th. Citigroup began coverage on Regal Rexnord in a report on Monday, October 14th. They set a "buy" rating and a $200.00 price objective on the stock. Finally, Robert W. Baird cut their target price on Regal Rexnord from $223.00 to $208.00 and set an "outperform" rating for the company in a research note on Wednesday, November 6th. One equities research analyst has rated the stock with a hold rating and nine have assigned a buy rating to the company. According to data from MarketBeat, the company has an average rating of "Moderate Buy" and an average target price of $193.00.

Get Our Latest Report on RRX

Regal Rexnord Profile

(

Free Report)

Regal Rexnord Corporation manufactures and sells industrial powertrain solutions, power transmission components, electric motors and electronic controls, air moving products, and specialty electrical components and systems worldwide. The Industrial Powertrain Solutions segment provides mounted and unmounted bearings, couplings, mechanical power transmission drives and components, gearboxes, gear motors, clutches, brakes, special, and industrial powertrain components and solutions for food and beverage, bulk material handling, eCommerce/warehouse distribution, energy, mining, marine, agricultural machinery, turf and garden, and general industrial markets.

See Also

Before you consider Regal Rexnord, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Regal Rexnord wasn't on the list.

While Regal Rexnord currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.