Masimo (NASDAQ:MASI - Get Free Report)'s stock had its "hold" rating reaffirmed by analysts at Needham & Company LLC in a report issued on Wednesday, Benzinga reports.

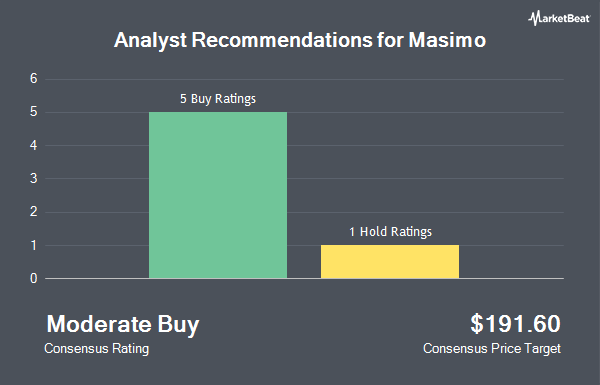

Several other research firms have also recently commented on MASI. Piper Sandler reiterated an "overweight" rating on shares of Masimo in a report on Friday, October 18th. Raymond James upgraded shares of Masimo from a "market perform" rating to an "outperform" rating and set a $170.00 price objective for the company in a research report on Wednesday. Finally, BTIG Research boosted their price objective on Masimo from $166.00 to $170.00 and gave the company a "buy" rating in a research note on Monday, October 14th. Three equities research analysts have rated the stock with a hold rating and five have assigned a buy rating to the company's stock. According to data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and a consensus target price of $152.57.

View Our Latest Research Report on Masimo

Masimo Price Performance

Shares of NASDAQ:MASI traded up $16.07 during trading on Wednesday, reaching $167.63. 2,121,364 shares of the company's stock traded hands, compared to its average volume of 574,318. The firm has a market cap of $8.92 billion, a PE ratio of 114.03 and a beta of 0.97. The company has a 50-day simple moving average of $131.74 and a 200-day simple moving average of $125.64. The company has a quick ratio of 1.15, a current ratio of 2.09 and a debt-to-equity ratio of 0.55. Masimo has a fifty-two week low of $75.36 and a fifty-two week high of $173.90.

Masimo (NASDAQ:MASI - Get Free Report) last posted its quarterly earnings results on Tuesday, November 5th. The medical equipment provider reported $0.98 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.84 by $0.14. Masimo had a return on equity of 14.07% and a net margin of 3.94%. The business had revenue of $504.60 million during the quarter, compared to analyst estimates of $502.87 million. During the same period in the prior year, the business earned $0.63 earnings per share. The business's revenue was up 5.4% compared to the same quarter last year. As a group, analysts predict that Masimo will post 3.88 earnings per share for the current year.

Institutional Investors Weigh In On Masimo

A number of institutional investors have recently made changes to their positions in the company. Thrivent Financial for Lutherans grew its stake in shares of Masimo by 42.1% in the second quarter. Thrivent Financial for Lutherans now owns 1,217,357 shares of the medical equipment provider's stock worth $153,314,000 after purchasing an additional 360,497 shares in the last quarter. Point72 Asset Management L.P. boosted its stake in shares of Masimo by 107.8% during the 2nd quarter. Point72 Asset Management L.P. now owns 677,677 shares of the medical equipment provider's stock valued at $85,347,000 after buying an additional 351,523 shares during the period. Bamco Inc. NY acquired a new position in Masimo in the 1st quarter worth about $50,781,000. Farallon Capital Management LLC raised its stake in shares of Masimo by 13.6% during the 1st quarter. Farallon Capital Management LLC now owns 1,489,563 shares of the medical equipment provider's stock worth $218,742,000 after purchasing an additional 177,914 shares in the last quarter. Finally, Dimensional Fund Advisors LP grew its stake in shares of Masimo by 45.9% in the 2nd quarter. Dimensional Fund Advisors LP now owns 525,594 shares of the medical equipment provider's stock valued at $66,201,000 after buying an additional 165,257 shares in the last quarter. 85.96% of the stock is currently owned by institutional investors.

Masimo Company Profile

(

Get Free Report)

Masimo Corporation develops, manufactures, and markets various patient monitoring technologies, and automation and connectivity solutions worldwide. The company offers masimo signal extraction technology (SET) pulse oximetry with measure-through motion and low perfusion pulse oximetry monitoring to address the primary limitations of conventional pulse oximetry; Masimo rainbow SET platform, including rainbow SET Pulse CO-Oximetry products that allows noninvasive monitoring of carboxyhemoglobin, methemoglobin, hemoglobin concentration, fractional arterial oxygen saturation, oxygen content, pleth variability index, rainbow pleth variability index, respiration rate from the pleth, and oxygen reserve index, as well as acoustic respiration monitoring, SedLine brain function monitoring, NomoLine capnography and gas monitoring, and regional oximetry.

Recommended Stories

Before you consider Masimo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Masimo wasn't on the list.

While Masimo currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.