Neumora Therapeutics (NASDAQ:NMRA - Get Free Report)'s stock had its "outperform" rating reiterated by research analysts at Royal Bank of Canada in a research report issued on Friday,Benzinga reports. They presently have a $29.00 price objective on the stock. Royal Bank of Canada's price objective would suggest a potential upside of 198.97% from the company's previous close.

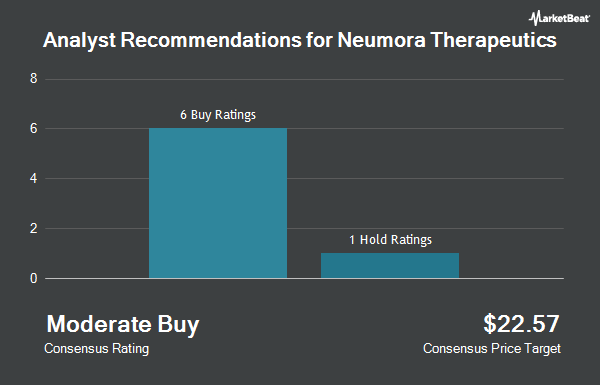

Several other analysts have also weighed in on the stock. JPMorgan Chase & Co. lowered shares of Neumora Therapeutics from an "overweight" rating to a "neutral" rating and lowered their target price for the company from $18.00 to $15.00 in a research note on Tuesday, November 5th. HC Wainwright reiterated a "buy" rating and issued a $30.00 target price on shares of Neumora Therapeutics in a research report on Wednesday, November 13th. Finally, Needham & Company LLC reissued a "buy" rating and issued a $23.00 price target on shares of Neumora Therapeutics in a report on Wednesday, November 13th. Two analysts have rated the stock with a hold rating and five have given a buy rating to the company's stock. According to MarketBeat, the stock presently has an average rating of "Moderate Buy" and an average target price of $21.67.

Read Our Latest Stock Analysis on Neumora Therapeutics

Neumora Therapeutics Price Performance

NMRA stock traded up $0.01 during midday trading on Friday, reaching $9.70. 152,483 shares of the company's stock traded hands, compared to its average volume of 732,039. The business has a 50-day moving average price of $12.96 and a two-hundred day moving average price of $11.44. Neumora Therapeutics has a fifty-two week low of $8.33 and a fifty-two week high of $21.00. The company has a market capitalization of $1.57 billion, a P/E ratio of -5.22 and a beta of 3.92.

Neumora Therapeutics (NASDAQ:NMRA - Get Free Report) last posted its quarterly earnings results on Tuesday, November 12th. The company reported ($0.45) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.39) by ($0.06). During the same quarter in the previous year, the business earned ($1.14) EPS. As a group, research analysts forecast that Neumora Therapeutics will post -1.58 earnings per share for the current fiscal year.

Insider Buying and Selling at Neumora Therapeutics

In related news, CFO Joshua Pinto sold 31,642 shares of the stock in a transaction that occurred on Monday, August 26th. The stock was sold at an average price of $11.78, for a total value of $372,742.76. Following the transaction, the chief financial officer now owns 154,658 shares in the company, valued at approximately $1,821,871.24. This represents a 16.98 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is accessible through this link. Also, Director Matthew K. Fust sold 14,049 shares of the stock in a transaction that occurred on Friday, October 18th. The stock was sold at an average price of $17.03, for a total value of $239,254.47. Following the completion of the transaction, the director now owns 20,100 shares in the company, valued at $342,303. This represents a 41.14 % decrease in their position. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 82,042 shares of company stock valued at $1,059,104. 26.40% of the stock is currently owned by corporate insiders.

Hedge Funds Weigh In On Neumora Therapeutics

A number of hedge funds have recently added to or reduced their stakes in the company. Barclays PLC increased its holdings in Neumora Therapeutics by 352.9% in the third quarter. Barclays PLC now owns 129,210 shares of the company's stock worth $1,708,000 after buying an additional 100,678 shares during the last quarter. Geode Capital Management LLC grew its holdings in Neumora Therapeutics by 54.0% during the third quarter. Geode Capital Management LLC now owns 1,979,847 shares of the company's stock valued at $26,159,000 after purchasing an additional 694,385 shares during the last quarter. Wexford Capital LP grew its holdings in Neumora Therapeutics by 90.1% during the third quarter. Wexford Capital LP now owns 217,879 shares of the company's stock valued at $2,878,000 after purchasing an additional 103,285 shares during the last quarter. State Street Corp grew its holdings in Neumora Therapeutics by 65.3% during the third quarter. State Street Corp now owns 1,790,707 shares of the company's stock valued at $23,655,000 after purchasing an additional 707,409 shares during the last quarter. Finally, Point72 Asset Management L.P. acquired a new position in Neumora Therapeutics during the third quarter valued at approximately $1,097,000. Institutional investors and hedge funds own 47.65% of the company's stock.

About Neumora Therapeutics

(

Get Free Report)

Neumora Therapeutics, Inc, a clinical-stage biopharmaceutical company, engages in developing therapeutic treatments for brain diseases, neuropsychiatric disorders, and neurodegenerative diseases. The company develops navacaprant (NMRA-140), a novel once-daily oral kappa opioid receptor antagonist, which is in phase 3 clinical trials for the treatment of major depressive disorder.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Neumora Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Neumora Therapeutics wasn't on the list.

While Neumora Therapeutics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.