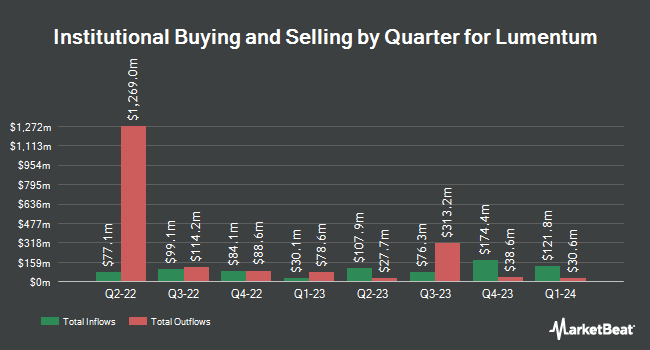

New York State Teachers Retirement System lowered its position in Lumentum Holdings Inc. (NASDAQ:LITE - Free Report) by 11.4% in the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 74,791 shares of the technology company's stock after selling 9,600 shares during the quarter. New York State Teachers Retirement System owned approximately 0.11% of Lumentum worth $4,740,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

A number of other institutional investors and hedge funds have also bought and sold shares of LITE. Janney Montgomery Scott LLC lifted its stake in shares of Lumentum by 1.8% in the 1st quarter. Janney Montgomery Scott LLC now owns 14,587 shares of the technology company's stock valued at $691,000 after acquiring an additional 260 shares during the last quarter. Texas Permanent School Fund Corp grew its stake in shares of Lumentum by 0.9% in the first quarter. Texas Permanent School Fund Corp now owns 58,259 shares of the technology company's stock worth $2,759,000 after purchasing an additional 496 shares during the last quarter. John G Ullman & Associates Inc. increased its holdings in Lumentum by 26.0% during the 1st quarter. John G Ullman & Associates Inc. now owns 73,973 shares of the technology company's stock valued at $3,503,000 after purchasing an additional 15,282 shares during the period. Duality Advisers LP bought a new position in Lumentum during the 1st quarter valued at approximately $1,307,000. Finally, Envestnet Portfolio Solutions Inc. lifted its stake in Lumentum by 11.0% in the first quarter. Envestnet Portfolio Solutions Inc. now owns 9,062 shares of the technology company's stock worth $429,000 after acquiring an additional 901 shares during the period. 94.05% of the stock is currently owned by institutional investors.

Analyst Ratings Changes

A number of research analysts have weighed in on the company. Morgan Stanley upped their target price on Lumentum from $50.00 to $54.00 and gave the stock an "equal weight" rating in a report on Thursday, August 15th. Raymond James raised their price objective on Lumentum from $55.00 to $70.00 and gave the company an "outperform" rating in a research report on Friday, October 4th. Northland Securities upped their price target on Lumentum from $40.00 to $45.00 and gave the stock a "market perform" rating in a research note on Friday, August 16th. Rosenblatt Securities raised their price objective on Lumentum from $65.00 to $69.00 and gave the company a "buy" rating in a research report on Thursday, August 15th. Finally, Susquehanna boosted their target price on Lumentum from $70.00 to $80.00 and gave the stock a "positive" rating in a report on Monday, October 21st. Three analysts have rated the stock with a sell rating, three have issued a hold rating and eight have given a buy rating to the company. According to data from MarketBeat, the stock currently has a consensus rating of "Hold" and a consensus target price of $60.77.

Check Out Our Latest Stock Analysis on Lumentum

Lumentum Trading Up 8.7 %

NASDAQ:LITE traded up $5.79 during mid-day trading on Wednesday, hitting $71.97. 4,194,209 shares of the stock traded hands, compared to its average volume of 1,424,724. The company has a quick ratio of 4.43, a current ratio of 5.90 and a debt-to-equity ratio of 2.61. The stock has a market capitalization of $4.94 billion, a price-to-earnings ratio of -8.78, a PEG ratio of 5.58 and a beta of 0.88. Lumentum Holdings Inc. has a 52 week low of $38.28 and a 52 week high of $72.77. The firm's 50 day moving average is $62.08 and its two-hundred day moving average is $53.34.

Lumentum (NASDAQ:LITE - Get Free Report) last issued its quarterly earnings results on Wednesday, August 14th. The technology company reported $0.06 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.03 by $0.03. Lumentum had a negative return on equity of 4.79% and a negative net margin of 40.21%. The firm had revenue of $308.30 million during the quarter, compared to analyst estimates of $301.36 million. During the same period last year, the company earned $0.12 EPS. Lumentum's quarterly revenue was down 16.9% compared to the same quarter last year. On average, equities research analysts predict that Lumentum Holdings Inc. will post 0.2 earnings per share for the current year.

About Lumentum

(

Free Report)

Lumentum Holdings Inc manufactures and sells optical and photonic products in the Americas, the Asia-Pacific, Europe, the Middle East, and Africa. The company operates through two segments: Optical Communications (OpComms) and Commercial Lasers (Lasers). The OpComms segment offers components, modules, and subsystems that enable the transmission and transport of video, audio, and data over high-capacity fiber optic cables.

Featured Articles

Before you consider Lumentum, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lumentum wasn't on the list.

While Lumentum currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.