NU (NYSE:NU - Get Free Report) was downgraded by analysts at Itau BBA Securities from an "outperform" rating to a "market perform" rating in a research note issued to investors on Thursday, Marketbeat Ratings reports.

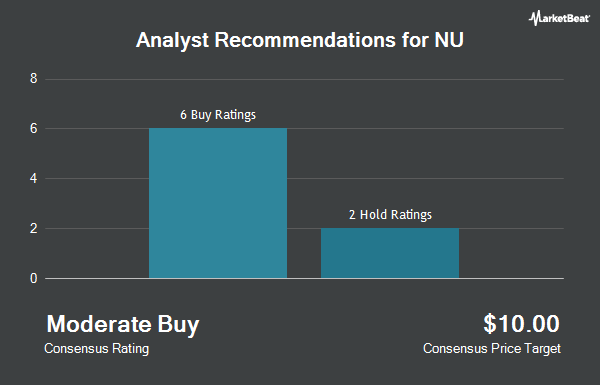

Other equities research analysts have also issued reports about the company. Susquehanna upped their price objective on NU from $16.00 to $18.00 and gave the company a "positive" rating in a research note on Thursday. KeyCorp increased their target price on shares of NU from $15.00 to $17.00 and gave the company an "overweight" rating in a research report on Thursday. JPMorgan Chase & Co. lifted their price target on shares of NU from $14.50 to $15.00 and gave the stock a "neutral" rating in a report on Monday, August 19th. UBS Group downgraded NU from a "buy" rating to a "neutral" rating and set a $13.50 price objective for the company. in a research report on Friday, August 2nd. Finally, Bank of America lifted their price target on shares of NU from $12.80 to $15.00 and gave the stock a "neutral" rating in a research note on Thursday, September 12th. Four research analysts have rated the stock with a hold rating and five have assigned a buy rating to the stock. According to MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and an average target price of $16.21.

View Our Latest Stock Report on NU

NU Stock Down 2.9 %

Shares of NYSE NU traded down $0.45 on Thursday, hitting $15.19. The company had a trading volume of 99,868,930 shares, compared to its average volume of 32,245,865. NU has a 12-month low of $7.74 and a 12-month high of $16.15. The company has a quick ratio of 0.49, a current ratio of 0.49 and a debt-to-equity ratio of 0.25. The firm has a market capitalization of $72.39 billion, a P/E ratio of 46.19, a PEG ratio of 0.72 and a beta of 1.13. The business has a 50 day moving average of $14.45 and a two-hundred day moving average of $13.17.

NU (NYSE:NU - Get Free Report) last announced its quarterly earnings results on Tuesday, August 13th. The company reported $0.12 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.10 by $0.02. The company had revenue of $2.85 billion during the quarter, compared to the consensus estimate of $2.90 billion. NU had a net margin of 15.11% and a return on equity of 27.00%. During the same quarter in the previous year, the company posted $0.05 earnings per share. As a group, equities research analysts forecast that NU will post 0.41 earnings per share for the current fiscal year.

Institutional Trading of NU

Institutional investors and hedge funds have recently made changes to their positions in the business. Allspring Global Investments Holdings LLC raised its holdings in shares of NU by 179.0% during the 1st quarter. Allspring Global Investments Holdings LLC now owns 8,841 shares of the company's stock worth $105,000 after buying an additional 5,672 shares in the last quarter. Hamilton Lane Advisors LLC lifted its stake in shares of NU by 97.8% during the 1st quarter. Hamilton Lane Advisors LLC now owns 500,791 shares of the company's stock valued at $5,974,000 after buying an additional 247,642 shares in the last quarter. Oppenheimer & Co. Inc. purchased a new stake in shares of NU in the 1st quarter valued at about $133,000. US Bancorp DE raised its holdings in NU by 1,241.5% during the 1st quarter. US Bancorp DE now owns 226,036 shares of the company's stock valued at $2,697,000 after buying an additional 209,187 shares during the last quarter. Finally, Avantax Advisory Services Inc. purchased a new position in shares of NU during the 1st quarter worth approximately $130,000. Institutional investors own 80.90% of the company's stock.

NU Company Profile

(

Get Free Report)

Nu Holdings Ltd. provides digital banking platform and digital financial services in Brazil, Mexico, Colombia, and internationally. It offers Nu credit and debit cards; Ultraviolet credit and debit cards; and mobile payment solutions for NuAccount customers to make and receive transfers, pay bills, and make everyday purchases through their mobile phones.

Featured Articles

Before you consider NU, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NU wasn't on the list.

While NU currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.