Van ECK Associates Corp lifted its position in nVent Electric plc (NYSE:NVT - Free Report) by 40.0% in the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 96,214 shares of the company's stock after purchasing an additional 27,492 shares during the quarter. Van ECK Associates Corp owned about 0.06% of nVent Electric worth $7,026,000 at the end of the most recent reporting period.

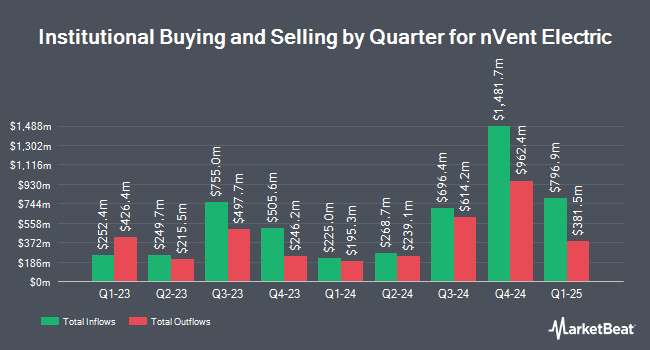

A number of other hedge funds and other institutional investors have also made changes to their positions in NVT. Massachusetts Financial Services Co. MA grew its position in shares of nVent Electric by 16.0% in the 2nd quarter. Massachusetts Financial Services Co. MA now owns 4,884,487 shares of the company's stock valued at $374,201,000 after buying an additional 673,990 shares during the last quarter. Boston Partners grew its holdings in nVent Electric by 3.2% during the first quarter. Boston Partners now owns 3,325,834 shares of the company's stock worth $250,770,000 after acquiring an additional 102,643 shares during the period. Principal Financial Group Inc. increased its holdings in shares of nVent Electric by 2.5% in the 2nd quarter. Principal Financial Group Inc. now owns 1,734,378 shares of the company's stock valued at $132,869,000 after purchasing an additional 42,391 shares in the last quarter. Swedbank AB acquired a new stake in shares of nVent Electric during the 3rd quarter valued at approximately $110,663,000. Finally, Millennium Management LLC raised its holdings in nVent Electric by 159.9% during the second quarter. Millennium Management LLC now owns 1,346,576 shares of the company's stock worth $103,161,000 after purchasing an additional 828,425 shares during the last quarter. Institutional investors and hedge funds own 90.05% of the company's stock.

nVent Electric Stock Down 0.6 %

Shares of NYSE NVT traded down $0.43 during midday trading on Friday, reaching $77.36. 742,289 shares of the company's stock were exchanged, compared to its average volume of 1,579,771. nVent Electric plc has a 52-week low of $49.93 and a 52-week high of $86.57. The company has a debt-to-equity ratio of 0.68, a quick ratio of 1.36 and a current ratio of 1.83. The stock has a market capitalization of $12.75 billion, a PE ratio of 22.81, a price-to-earnings-growth ratio of 1.83 and a beta of 1.26. The business's fifty day moving average price is $69.83 and its two-hundred day moving average price is $73.12.

nVent Electric (NYSE:NVT - Get Free Report) last issued its quarterly earnings results on Tuesday, November 5th. The company reported $0.63 earnings per share for the quarter, missing analysts' consensus estimates of $0.81 by ($0.18). The firm had revenue of $782.00 million during the quarter, compared to the consensus estimate of $937.37 million. nVent Electric had a net margin of 16.95% and a return on equity of 15.66%. nVent Electric's revenue was up 9.4% compared to the same quarter last year. During the same quarter last year, the firm posted $0.84 earnings per share. Analysts forecast that nVent Electric plc will post 2.5 EPS for the current year.

nVent Electric Dividend Announcement

The company also recently announced a quarterly dividend, which was paid on Friday, November 1st. Shareholders of record on Friday, October 18th were paid a dividend of $0.19 per share. This represents a $0.76 dividend on an annualized basis and a yield of 0.98%. The ex-dividend date of this dividend was Friday, October 18th. nVent Electric's payout ratio is 22.29%.

Analyst Upgrades and Downgrades

Several analysts have issued reports on the stock. KeyCorp upped their price target on shares of nVent Electric from $80.00 to $84.00 and gave the company an "overweight" rating in a report on Monday, October 14th. Royal Bank of Canada reduced their price objective on nVent Electric from $82.00 to $80.00 and set an "outperform" rating on the stock in a research report on Monday. Finally, Barclays dropped their price objective on nVent Electric from $87.00 to $86.00 and set an "overweight" rating for the company in a research report on Wednesday, October 2nd. Six investment analysts have rated the stock with a buy rating, According to MarketBeat.com, the company presently has an average rating of "Buy" and an average target price of $85.33.

Read Our Latest Research Report on NVT

Insider Buying and Selling at nVent Electric

In other nVent Electric news, Director Herbert K. Parker purchased 7,566 shares of the firm's stock in a transaction dated Thursday, August 15th. The stock was bought at an average price of $65.71 per share, with a total value of $497,161.86. Following the completion of the purchase, the director now owns 34,524 shares in the company, valued at $2,268,572.04. This trade represents a 0.00 % increase in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this link. In other news, insider Michael B. Faulconer sold 20,004 shares of the company's stock in a transaction on Tuesday, August 13th. The shares were sold at an average price of $63.34, for a total value of $1,267,053.36. Following the transaction, the insider now directly owns 19,766 shares of the company's stock, valued at approximately $1,251,978.44. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, Director Herbert K. Parker bought 7,566 shares of nVent Electric stock in a transaction on Thursday, August 15th. The stock was acquired at an average price of $65.71 per share, with a total value of $497,161.86. Following the completion of the purchase, the director now directly owns 34,524 shares of the company's stock, valued at approximately $2,268,572.04. The trade was a 0.00 % increase in their ownership of the stock. The disclosure for this purchase can be found here. Over the last 90 days, insiders have sold 95,323 shares of company stock worth $6,994,965. 2.50% of the stock is owned by company insiders.

nVent Electric Company Profile

(

Free Report)

nVent Electric plc, together with its subsidiaries, designs, manufactures, markets, installs, and services electrical connection and protection solutions in North America, Europe, the Middle East, Africa, the Asia Pacific, and internationally. The company operates through three segments: Enclosures, Electrical & Fastening Solutions, and Thermal Management.

See Also

Before you consider nVent Electric, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and nVent Electric wasn't on the list.

While nVent Electric currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report