Antero Resources (NYSE:AR - Get Free Report) was upgraded by equities research analysts at StockNews.com to a "sell" rating in a report issued on Friday.

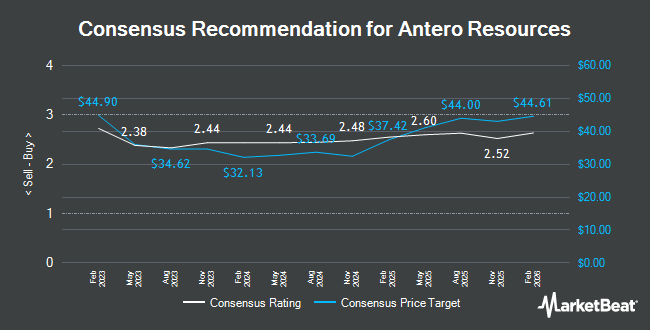

Several other analysts have also commented on AR. Wolfe Research raised Antero Resources from a "peer perform" rating to an "outperform" rating and set a $37.00 price objective for the company in a report on Wednesday, September 11th. Barclays cut their price objective on Antero Resources from $32.00 to $30.00 and set an "equal weight" rating for the company in a report on Thursday, October 3rd. Truist Financial cut their price objective on Antero Resources from $29.00 to $28.00 and set a "hold" rating for the company in a report on Monday, September 30th. UBS Group initiated coverage on Antero Resources in a report on Wednesday, October 16th. They issued a "neutral" rating and a $33.00 price objective for the company. Finally, Scotiabank raised Antero Resources from a "sector perform" rating to a "sector outperform" rating and boosted their price target for the company from $40.00 to $44.00 in a report on Tuesday, August 20th. Two investment analysts have rated the stock with a sell rating, seven have given a hold rating, nine have issued a buy rating and two have given a strong buy rating to the stock. Based on data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and a consensus target price of $32.94.

Get Our Latest Stock Analysis on AR

Antero Resources Stock Down 1.3 %

NYSE:AR traded down $0.34 during trading hours on Friday, reaching $25.54. 5,154,208 shares of the company traded hands, compared to its average volume of 4,113,203. The business's 50-day moving average price is $27.37 and its two-hundred day moving average price is $30.19. The stock has a market capitalization of $7.94 billion, a P/E ratio of 182.43 and a beta of 3.33. Antero Resources has a 1 year low of $20.10 and a 1 year high of $36.28. The company has a current ratio of 0.29, a quick ratio of 0.29 and a debt-to-equity ratio of 0.22.

Antero Resources (NYSE:AR - Get Free Report) last announced its quarterly earnings data on Wednesday, October 30th. The oil and natural gas company reported ($0.16) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.09) by ($0.07). The company had revenue of $1.06 billion for the quarter, compared to analysts' expectations of $1.04 billion. Antero Resources had a net margin of 1.03% and a negative return on equity of 0.59%. Analysts predict that Antero Resources will post -0.17 earnings per share for the current year.

Insider Activity

In related news, insider Yvette K. Schultz sold 50,000 shares of the stock in a transaction that occurred on Monday, August 5th. The stock was sold at an average price of $25.24, for a total value of $1,262,000.00. Following the transaction, the insider now owns 248,363 shares of the company's stock, valued at $6,268,682.12. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Insiders own 6.70% of the company's stock.

Institutional Inflows and Outflows

Several hedge funds and other institutional investors have recently bought and sold shares of AR. Capital Performance Advisors LLP purchased a new stake in Antero Resources during the third quarter worth $45,000. Confluence Investment Management LLC lifted its holdings in shares of Antero Resources by 7.8% during the 3rd quarter. Confluence Investment Management LLC now owns 19,939 shares of the oil and natural gas company's stock valued at $571,000 after purchasing an additional 1,440 shares during the last quarter. Mariner Investment Group LLC purchased a new stake in shares of Antero Resources during the 3rd quarter valued at $430,000. VELA Investment Management LLC lifted its holdings in shares of Antero Resources by 135.6% during the 3rd quarter. VELA Investment Management LLC now owns 73,816 shares of the oil and natural gas company's stock valued at $2,115,000 after purchasing an additional 42,488 shares during the last quarter. Finally, US Bancorp DE lifted its holdings in shares of Antero Resources by 18.2% during the 3rd quarter. US Bancorp DE now owns 134,629 shares of the oil and natural gas company's stock valued at $3,857,000 after purchasing an additional 20,777 shares during the last quarter. Institutional investors own 83.04% of the company's stock.

Antero Resources Company Profile

(

Get Free Report)

Antero Resources Corporation, an independent oil and natural gas company, engages in the development, production, exploration, and acquisition of natural gas, natural gas liquids (NGLs), and oil properties in the United States. It operates in three segments: Exploration and Development; Marketing; and Equity Method Investment in Antero Midstream.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Antero Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Antero Resources wasn't on the list.

While Antero Resources currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.