Wealth Enhancement Advisory Services LLC grew its position in shares of AXIS Capital Holdings Limited (NYSE:AXS - Free Report) by 71.6% during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 17,265 shares of the insurance provider's stock after buying an additional 7,205 shares during the period. Wealth Enhancement Advisory Services LLC's holdings in AXIS Capital were worth $1,374,000 at the end of the most recent quarter.

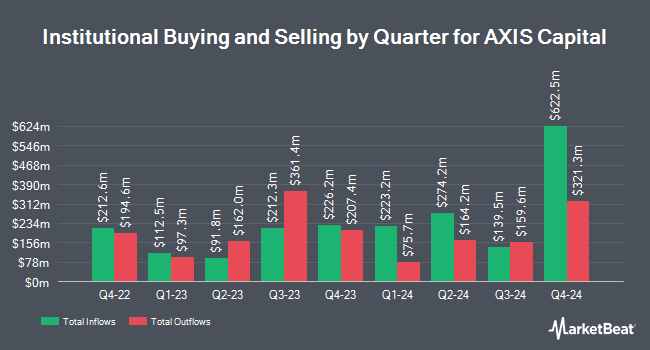

A number of other hedge funds and other institutional investors also recently modified their holdings of the company. Versant Capital Management Inc boosted its stake in shares of AXIS Capital by 55.6% in the second quarter. Versant Capital Management Inc now owns 462 shares of the insurance provider's stock valued at $33,000 after buying an additional 165 shares during the period. GAMMA Investing LLC lifted its position in shares of AXIS Capital by 80.4% during the 2nd quarter. GAMMA Investing LLC now owns 507 shares of the insurance provider's stock valued at $36,000 after acquiring an additional 226 shares during the period. Covestor Ltd grew its holdings in shares of AXIS Capital by 45.9% during the 1st quarter. Covestor Ltd now owns 588 shares of the insurance provider's stock worth $38,000 after purchasing an additional 185 shares in the last quarter. Point72 Asia Singapore Pte. Ltd. increased its position in shares of AXIS Capital by 32.6% in the second quarter. Point72 Asia Singapore Pte. Ltd. now owns 602 shares of the insurance provider's stock worth $43,000 after purchasing an additional 148 shares during the period. Finally, Blue Trust Inc. raised its stake in AXIS Capital by 424.6% in the third quarter. Blue Trust Inc. now owns 1,217 shares of the insurance provider's stock valued at $97,000 after purchasing an additional 985 shares in the last quarter. Institutional investors and hedge funds own 93.44% of the company's stock.

AXIS Capital Price Performance

NYSE AXS traded up $0.68 during trading on Tuesday, hitting $80.06. 570,768 shares of the company's stock were exchanged, compared to its average volume of 578,325. The company has a current ratio of 0.60, a quick ratio of 0.60 and a debt-to-equity ratio of 0.27. The company has a market cap of $6.70 billion, a PE ratio of 11.10, a P/E/G ratio of 0.26 and a beta of 0.90. AXIS Capital Holdings Limited has a fifty-two week low of $53.14 and a fifty-two week high of $83.19. The stock's 50 day moving average price is $79.53 and its two-hundred day moving average price is $73.94.

AXIS Capital (NYSE:AXS - Get Free Report) last released its quarterly earnings data on Wednesday, October 30th. The insurance provider reported $2.71 earnings per share (EPS) for the quarter, beating the consensus estimate of $2.55 by $0.16. AXIS Capital had a return on equity of 19.24% and a net margin of 10.82%. The company had revenue of $1.61 billion during the quarter, compared to the consensus estimate of $1.57 billion. During the same quarter in the prior year, the firm posted $2.34 earnings per share. Research analysts expect that AXIS Capital Holdings Limited will post 10.98 EPS for the current year.

AXIS Capital Dividend Announcement

The company also recently disclosed a quarterly dividend, which was paid on Friday, October 18th. Stockholders of record on Monday, September 30th were paid a $0.44 dividend. This represents a $1.76 annualized dividend and a dividend yield of 2.20%. The ex-dividend date was Monday, September 30th. AXIS Capital's dividend payout ratio is currently 24.41%.

Analyst Ratings Changes

AXS has been the subject of a number of analyst reports. Wells Fargo & Company boosted their price target on AXIS Capital from $74.00 to $78.00 and gave the company an "underweight" rating in a research note on Thursday, October 10th. Roth Mkm boosted their price target on AXIS Capital from $75.00 to $90.00 and gave the company a "buy" rating in a research note on Wednesday, July 31st. Jefferies Financial Group boosted their price target on AXIS Capital from $88.00 to $95.00 and gave the company a "buy" rating in a research note on Wednesday, October 9th. Keefe, Bruyette & Woods boosted their price target on AXIS Capital from $86.00 to $88.00 and gave the company an "outperform" rating in a research note on Wednesday, August 7th. Finally, Bank of America boosted their price target on AXIS Capital from $81.00 to $96.00 and gave the company a "buy" rating in a research note on Thursday, October 10th. One research analyst has rated the stock with a sell rating and seven have given a buy rating to the stock. According to MarketBeat, the company has a consensus rating of "Moderate Buy" and an average target price of $94.71.

Get Our Latest Stock Report on AXIS Capital

AXIS Capital Profile

(

Free Report)

AXIS Capital Holdings Limited, through its subsidiaries, provides various specialty insurance and reinsurance products in Bermuda, the United States, and internationally. It operates through two segments, Insurance and Reinsurance. The Insurance segment offers professional insurance products that cover directors' and officers' liability, errors and omissions, employment practices, fiduciary, crime, professional indemnity, medical malpractice, and other financial insurance related coverages for commercial enterprises, financial institutions, not-for-profit organizations, and other professional service providers; and property insurance products for commercial buildings, residential premises, construction projects, property in transit, onshore renewable energy installations, and physical damage and business interruption following an act of terrorism.

Read More

Before you consider AXIS Capital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AXIS Capital wasn't on the list.

While AXIS Capital currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.