Boston Properties (NYSE:BXP - Free Report) had its price objective increased by Compass Point from $75.00 to $80.00 in a report published on Thursday morning, Benzinga reports. They currently have a neutral rating on the real estate investment trust's stock.

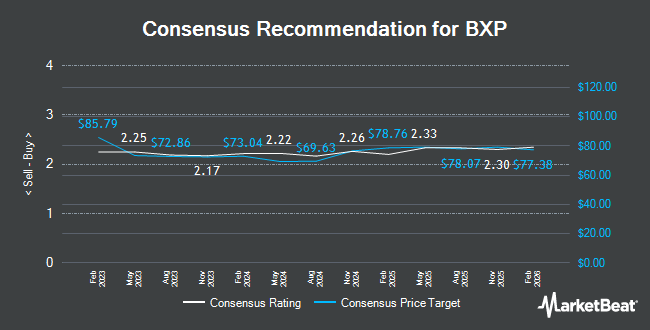

Other research analysts also recently issued reports about the company. StockNews.com raised Boston Properties from a "sell" rating to a "hold" rating in a research report on Thursday, August 8th. Evercore ISI lifted their price target on shares of Boston Properties from $77.00 to $84.00 and gave the stock an "outperform" rating in a research note on Monday, September 16th. Truist Financial lifted their target price on shares of Boston Properties from $67.00 to $77.00 and gave the stock a "hold" rating in a research report on Tuesday, August 27th. Wedbush increased their price target on Boston Properties from $63.00 to $70.00 and gave the company a "neutral" rating in a report on Monday, August 5th. Finally, Scotiabank upped their price objective on Boston Properties from $82.00 to $91.00 and gave the company a "sector outperform" rating in a research report on Friday, October 25th. Seven equities research analysts have rated the stock with a hold rating and six have assigned a buy rating to the stock. According to data from MarketBeat.com, Boston Properties has a consensus rating of "Hold" and a consensus target price of $80.75.

Check Out Our Latest Stock Report on Boston Properties

Boston Properties Trading Down 2.6 %

Shares of Boston Properties stock traded down $2.19 during trading on Thursday, reaching $80.56. 1,889,896 shares of the stock were exchanged, compared to its average volume of 1,270,013. The company has a quick ratio of 4.83, a current ratio of 4.83 and a debt-to-equity ratio of 1.90. The firm has a market cap of $12.65 billion, a price-to-earnings ratio of 66.79, a price-to-earnings-growth ratio of 0.56 and a beta of 1.18. Boston Properties has a 1 year low of $50.64 and a 1 year high of $90.11. The stock's fifty day moving average is $80.47 and its 200 day moving average is $69.40.

Boston Properties (NYSE:BXP - Get Free Report) last posted its earnings results on Tuesday, October 29th. The real estate investment trust reported $0.53 EPS for the quarter, missing the consensus estimate of $1.81 by ($1.28). Boston Properties had a return on equity of 2.05% and a net margin of 5.01%. The company had revenue of $859.23 million during the quarter, compared to analysts' expectations of $829.91 million. During the same period in the prior year, the business posted $1.86 earnings per share. The company's revenue for the quarter was up 4.2% on a year-over-year basis. As a group, equities research analysts expect that Boston Properties will post 7.11 earnings per share for the current fiscal year.

Boston Properties Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Thursday, October 31st. Shareholders of record on Monday, September 30th will be paid a $0.98 dividend. This represents a $3.92 dividend on an annualized basis and a yield of 4.87%. The ex-dividend date is Monday, September 30th. Boston Properties's payout ratio is 321.31%.

Insider Activity

In other Boston Properties news, EVP Raymond A. Ritchey sold 21,835 shares of Boston Properties stock in a transaction on Monday, September 9th. The shares were sold at an average price of $74.25, for a total value of $1,621,248.75. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. In other news, EVP Raymond A. Ritchey sold 21,835 shares of the firm's stock in a transaction that occurred on Monday, September 9th. The stock was sold at an average price of $74.25, for a total value of $1,621,248.75. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, EVP Peter V. Otteni sold 4,785 shares of the stock in a transaction on Friday, August 23rd. The shares were sold at an average price of $73.44, for a total value of $351,410.40. The disclosure for this sale can be found here. Corporate insiders own 1.35% of the company's stock.

Hedge Funds Weigh In On Boston Properties

A number of large investors have recently made changes to their positions in the company. Van ECK Associates Corp grew its position in Boston Properties by 12.0% in the 3rd quarter. Van ECK Associates Corp now owns 69,275 shares of the real estate investment trust's stock valued at $6,024,000 after acquiring an additional 7,447 shares during the last quarter. Sun Life Financial Inc. purchased a new stake in shares of Boston Properties during the third quarter valued at $9,674,000. Whittier Trust Co. of Nevada Inc. grew its holdings in shares of Boston Properties by 2.7% in the third quarter. Whittier Trust Co. of Nevada Inc. now owns 133,871 shares of the real estate investment trust's stock worth $10,771,000 after purchasing an additional 3,502 shares during the last quarter. Whittier Trust Co. increased its stake in Boston Properties by 4.2% in the 3rd quarter. Whittier Trust Co. now owns 296,354 shares of the real estate investment trust's stock worth $23,844,000 after buying an additional 12,018 shares during the period. Finally, Raymond James & Associates lifted its holdings in Boston Properties by 11.9% during the 3rd quarter. Raymond James & Associates now owns 110,587 shares of the real estate investment trust's stock valued at $8,898,000 after buying an additional 11,752 shares in the last quarter. 98.72% of the stock is owned by hedge funds and other institutional investors.

About Boston Properties

(

Get Free Report)

Boston Properties, Inc NYSE: BXP (BXP or the Company) is the largest publicly traded developer, owner, and manager of premier workplaces in the United States, concentrated in six dynamic gateway markets - Boston, Los Angeles, New York, San Francisco, Seattle, and Washington, DC. BXP has delivered places that power progress for our clients and communities for more than 50 years.

Featured Articles

Before you consider Boston Properties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Boston Properties wasn't on the list.

While Boston Properties currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.