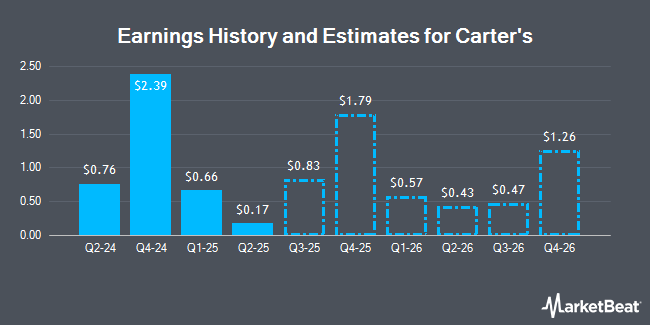

Carter's (NYSE:CRI - Get Free Report) updated its fourth quarter earnings guidance on Friday. The company provided EPS guidance of 1.32-1.72 for the period, compared to the consensus EPS estimate of $1.85. The company issued revenue guidance of $800-840 million, compared to the consensus revenue estimate of $825.80 million. Carter's also updated its FY 2024 guidance to 4.700-5.150 EPS.

Carter's Trading Down 13.4 %

Shares of CRI stock traded down $8.77 during trading hours on Friday, hitting $56.92. 4,842,731 shares of the company were exchanged, compared to its average volume of 938,658. The firm has a market cap of $2.08 billion, a P/E ratio of 9.61, a P/E/G ratio of 3.86 and a beta of 1.23. Carter's has a fifty-two week low of $54.74 and a fifty-two week high of $88.03. The company has a 50 day simple moving average of $66.32 and a two-hundred day simple moving average of $65.99. The company has a debt-to-equity ratio of 0.61, a quick ratio of 0.95 and a current ratio of 2.09.

Carter's (NYSE:CRI - Get Free Report) last issued its quarterly earnings data on Friday, July 26th. The textile maker reported $0.76 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.45 by $0.31. The business had revenue of $564.43 million during the quarter, compared to the consensus estimate of $566.79 million. Carter's had a net margin of 8.29% and a return on equity of 28.65%. Equities analysts anticipate that Carter's will post 4.87 EPS for the current year.

Carter's Dividend Announcement

The firm also recently disclosed a quarterly dividend, which was paid on Friday, September 13th. Shareholders of record on Tuesday, August 27th were issued a dividend of $0.80 per share. This represents a $3.20 annualized dividend and a yield of 5.62%. The ex-dividend date was Tuesday, August 27th. Carter's's dividend payout ratio (DPR) is presently 50.47%.

Wall Street Analyst Weigh In

CRI has been the topic of a number of recent analyst reports. Bank of America lowered their price objective on Carter's from $65.00 to $54.00 and set an "underperform" rating on the stock in a research report on Monday, July 29th. Wells Fargo & Company boosted their price target on shares of Carter's from $60.00 to $72.00 and gave the stock an "equal weight" rating in a research note on Monday, September 9th. Two investment analysts have rated the stock with a sell rating and six have assigned a hold rating to the company's stock. According to data from MarketBeat, Carter's presently has an average rating of "Hold" and a consensus price target of $71.17.

Check Out Our Latest Report on CRI

About Carter's

(

Get Free Report)

Carter's, Inc, together with its subsidiaries, designs, sources, and markets branded childrenswear under the Carter's, OshKosh, Skip Hop, Child of Mine, Just One You, Simple Joys, Little Planet, and other brands in the United States and internationally. It operates through three segments: U.S.

Further Reading

Before you consider Carter's, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Carter's wasn't on the list.

While Carter's currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.