Emerald Advisers LLC purchased a new stake in shares of Clearwater Analytics Holdings, Inc. (NYSE:CWAN - Free Report) in the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor purchased 401,982 shares of the company's stock, valued at approximately $10,150,000. Emerald Advisers LLC owned 0.16% of Clearwater Analytics at the end of the most recent reporting period.

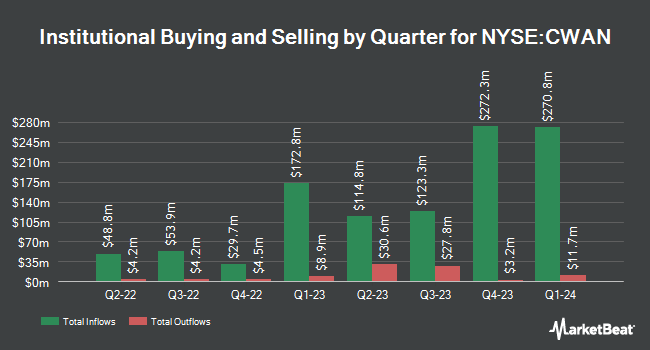

Several other hedge funds and other institutional investors also recently made changes to their positions in the business. Thornburg Investment Management Inc. increased its position in Clearwater Analytics by 31.7% during the first quarter. Thornburg Investment Management Inc. now owns 331,285 shares of the company's stock worth $5,860,000 after acquiring an additional 79,707 shares during the period. California State Teachers Retirement System increased its holdings in shares of Clearwater Analytics by 22.3% during the 1st quarter. California State Teachers Retirement System now owns 131,341 shares of the company's stock worth $2,323,000 after purchasing an additional 23,971 shares during the period. Susquehanna Fundamental Investments LLC acquired a new position in shares of Clearwater Analytics during the first quarter valued at about $825,000. Jane Street Group LLC lifted its stake in shares of Clearwater Analytics by 234.2% in the first quarter. Jane Street Group LLC now owns 265,818 shares of the company's stock valued at $4,702,000 after buying an additional 186,273 shares during the period. Finally, Seven Eight Capital LP acquired a new stake in Clearwater Analytics during the second quarter worth about $1,797,000. 50.10% of the stock is owned by institutional investors and hedge funds.

Clearwater Analytics Price Performance

Shares of NYSE CWAN traded up $0.18 during mid-day trading on Friday, hitting $26.29. 1,032,607 shares of the stock were exchanged, compared to its average volume of 1,043,453. The company has a debt-to-equity ratio of 0.11, a quick ratio of 4.78 and a current ratio of 4.78. Clearwater Analytics Holdings, Inc. has a twelve month low of $15.62 and a twelve month high of $27.65. The company has a market cap of $6.48 billion, a P/E ratio of -1,314.50, a PEG ratio of 9.46 and a beta of 0.61. The stock's fifty day simple moving average is $25.30 and its two-hundred day simple moving average is $21.55.

Clearwater Analytics (NYSE:CWAN - Get Free Report) last issued its quarterly earnings results on Wednesday, July 31st. The company reported $0.10 EPS for the quarter, hitting the consensus estimate of $0.10. Clearwater Analytics had a negative net margin of 1.14% and a positive return on equity of 3.55%. The company had revenue of $106.79 million during the quarter, compared to analysts' expectations of $105.51 million. During the same quarter in the previous year, the company earned ($0.03) EPS. Clearwater Analytics's revenue was up 18.8% on a year-over-year basis. As a group, analysts forecast that Clearwater Analytics Holdings, Inc. will post 0.14 EPS for the current fiscal year.

Wall Street Analysts Forecast Growth

CWAN has been the subject of several recent research reports. Royal Bank of Canada upped their price target on Clearwater Analytics from $25.00 to $28.00 and gave the company an "outperform" rating in a report on Wednesday, September 18th. Citigroup assumed coverage on shares of Clearwater Analytics in a research note on Monday, August 19th. They set a "buy" rating and a $28.00 price target on the stock. Piper Sandler restated a "neutral" rating and issued a $23.00 price objective on shares of Clearwater Analytics in a research note on Monday, September 9th. Wells Fargo & Company lifted their target price on shares of Clearwater Analytics from $22.00 to $23.00 and gave the company an "overweight" rating in a research report on Thursday, August 1st. Finally, Oppenheimer increased their price target on shares of Clearwater Analytics from $25.00 to $31.00 and gave the stock an "outperform" rating in a research report on Monday, October 7th. Three investment analysts have rated the stock with a hold rating and six have assigned a buy rating to the company's stock. According to data from MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and a consensus target price of $25.67.

Read Our Latest Stock Analysis on CWAN

Insiders Place Their Bets

In related news, CFO James S. Cox sold 18,700 shares of the company's stock in a transaction dated Tuesday, October 15th. The stock was sold at an average price of $26.16, for a total value of $489,192.00. Following the completion of the sale, the chief financial officer now owns 224,044 shares in the company, valued at approximately $5,860,991.04. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which can be accessed through this link. In related news, CFO James S. Cox sold 18,700 shares of Clearwater Analytics stock in a transaction that occurred on Tuesday, October 15th. The shares were sold at an average price of $26.16, for a total transaction of $489,192.00. Following the transaction, the chief financial officer now owns 224,044 shares of the company's stock, valued at $5,860,991.04. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this link. Also, CRO Scott Stanley Erickson sold 3,890 shares of the company's stock in a transaction that occurred on Thursday, October 10th. The shares were sold at an average price of $25.38, for a total transaction of $98,728.20. Following the completion of the sale, the executive now directly owns 6,373 shares of the company's stock, valued at $161,746.74. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders sold 10,864,693 shares of company stock valued at $246,818,342. Company insiders own 3.46% of the company's stock.

About Clearwater Analytics

(

Free Report)

Clearwater Analytics Holdings, Inc develops and provides a Software-as-a-Service (SaaS) solution for automated investment data aggregation, reconciliation, accounting, and reporting services to insurers, investment managers, corporations, institutional investors, and government entities in the United States and internationally.

Read More

Before you consider Clearwater Analytics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Clearwater Analytics wasn't on the list.

While Clearwater Analytics currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report