Boston Trust Walden Corp lowered its position in Donaldson Company, Inc. (NYSE:DCI - Free Report) by 5.3% in the 3rd quarter, according to its most recent 13F filing with the SEC. The firm owned 2,652,557 shares of the industrial products company's stock after selling 148,860 shares during the period. Donaldson comprises approximately 1.4% of Boston Trust Walden Corp's holdings, making the stock its 8th largest position. Boston Trust Walden Corp owned 2.20% of Donaldson worth $195,493,000 at the end of the most recent quarter.

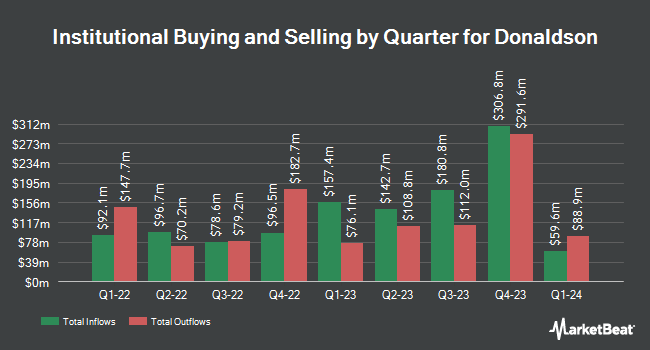

Several other hedge funds also recently bought and sold shares of the company. Wealthspire Advisors LLC boosted its holdings in Donaldson by 2.8% in the 1st quarter. Wealthspire Advisors LLC now owns 5,106 shares of the industrial products company's stock worth $381,000 after buying an additional 140 shares during the period. Vanguard Personalized Indexing Management LLC boosted its holdings in Donaldson by 1.3% in the 2nd quarter. Vanguard Personalized Indexing Management LLC now owns 11,364 shares of the industrial products company's stock worth $813,000 after buying an additional 146 shares during the period. EverSource Wealth Advisors LLC boosted its holdings in Donaldson by 31.6% in the 1st quarter. EverSource Wealth Advisors LLC now owns 766 shares of the industrial products company's stock worth $55,000 after buying an additional 184 shares during the period. Oak Family Advisors LLC lifted its stake in Donaldson by 4.3% in the 2nd quarter. Oak Family Advisors LLC now owns 4,742 shares of the industrial products company's stock worth $339,000 after purchasing an additional 197 shares in the last quarter. Finally, V Square Quantitative Management LLC lifted its stake in Donaldson by 52.0% in the 3rd quarter. V Square Quantitative Management LLC now owns 605 shares of the industrial products company's stock worth $45,000 after purchasing an additional 207 shares in the last quarter. Institutional investors own 82.81% of the company's stock.

Donaldson Price Performance

Shares of NYSE DCI traded up $0.59 during mid-day trading on Friday, hitting $74.88. 529,565 shares of the company's stock traded hands, compared to its average volume of 486,862. The company's 50-day moving average is $72.86 and its two-hundred day moving average is $72.91. The company has a debt-to-equity ratio of 0.32, a current ratio of 1.84 and a quick ratio of 1.23. The company has a market capitalization of $9.02 billion, a P/E ratio of 23.18, a PEG ratio of 1.92 and a beta of 1.04. Donaldson Company, Inc. has a 1 year low of $57.05 and a 1 year high of $78.03.

Donaldson (NYSE:DCI - Get Free Report) last announced its earnings results on Wednesday, August 28th. The industrial products company reported $0.94 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.88 by $0.06. The firm had revenue of $935.40 million for the quarter, compared to analysts' expectations of $941.12 million. Donaldson had a net margin of 11.54% and a return on equity of 29.47%. On average, equities analysts anticipate that Donaldson Company, Inc. will post 3.63 EPS for the current fiscal year.

Insider Activity

In related news, Director James Owens sold 5,210 shares of the stock in a transaction dated Wednesday, September 18th. The shares were sold at an average price of $71.74, for a total value of $373,765.40. Following the sale, the director now directly owns 17,788 shares of the company's stock, valued at $1,276,111.12. This represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through this hyperlink. In related news, Director James Owens sold 5,210 shares of the stock in a transaction dated Wednesday, September 18th. The shares were sold at an average price of $71.74, for a total value of $373,765.40. Following the sale, the director now directly owns 17,788 shares of the company's stock, valued at $1,276,111.12. This represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, insider Amy C. Becker sold 14,500 shares of the stock in a transaction dated Thursday, September 19th. The stock was sold at an average price of $72.89, for a total transaction of $1,056,905.00. Following the completion of the sale, the insider now directly owns 41,368 shares in the company, valued at $3,015,313.52. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last three months, insiders have sold 167,805 shares of company stock worth $12,310,222. 2.58% of the stock is currently owned by corporate insiders.

Wall Street Analysts Forecast Growth

Several analysts have commented on the stock. Stifel Nicolaus decreased their price target on shares of Donaldson from $76.00 to $71.00 and set a "hold" rating on the stock in a research note on Thursday, August 29th. Raymond James assumed coverage on shares of Donaldson in a research note on Friday, June 28th. They issued a "market perform" rating on the stock. Finally, StockNews.com upgraded shares of Donaldson from a "buy" rating to a "strong-buy" rating in a research note on Saturday, September 28th. One investment analyst has rated the stock with a sell rating, two have issued a hold rating, one has assigned a buy rating and one has issued a strong buy rating to the company. Based on data from MarketBeat, the stock presently has an average rating of "Hold" and an average target price of $69.67.

Read Our Latest Stock Analysis on DCI

About Donaldson

(

Free Report)

Donaldson Company, Inc manufactures and sells filtration systems and replacement parts worldwide. The company operates through three segments: Mobile Solutions, Industrial Solutions, and Life Sciences. Its Mobile Solutions segment provides replacement filters for air and liquid filtration applications, such as air filtration systems; liquid filtration systems for fuel, lube, and hydraulic applications; exhaust and emissions systems and sensors; indicators; and monitoring systems.

Featured Stories

Before you consider Donaldson, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Donaldson wasn't on the list.

While Donaldson currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.