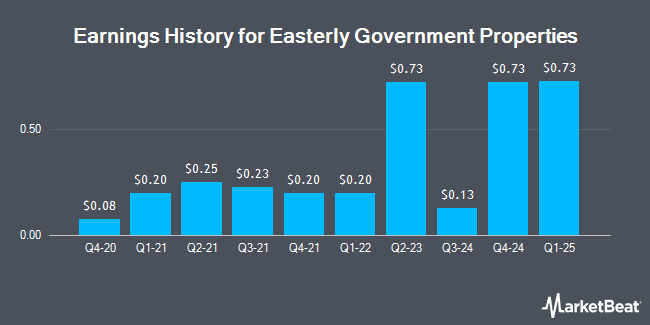

Easterly Government Properties (NYSE:DEA - Get Free Report) is scheduled to be issuing its quarterly earnings data before the market opens on Tuesday, November 5th. Analysts expect the company to announce earnings of $0.29 per share for the quarter. Investors that wish to register for the company's conference call can do so using this link.

Easterly Government Properties Stock Down 0.8 %

DEA stock traded down $0.11 during midday trading on Tuesday, reaching $13.74. The company had a trading volume of 494,108 shares, compared to its average volume of 871,933. The company has a 50 day moving average of $13.56 and a two-hundred day moving average of $12.84. The company has a market capitalization of $1.42 billion, a P/E ratio of 68.85 and a beta of 0.72. Easterly Government Properties has a 1 year low of $10.27 and a 1 year high of $14.52. The company has a current ratio of 3.57, a quick ratio of 3.57 and a debt-to-equity ratio of 1.02.

Analyst Upgrades and Downgrades

Several brokerages recently issued reports on DEA. StockNews.com upgraded Easterly Government Properties from a "sell" rating to a "hold" rating in a report on Thursday, October 10th. Truist Financial raised their price target on Easterly Government Properties from $13.00 to $14.00 and gave the stock a "hold" rating in a research note on Thursday, August 29th. Finally, Jefferies Financial Group raised Easterly Government Properties from a "hold" rating to a "buy" rating and boosted their price target for the company from $13.00 to $15.00 in a research note on Monday, October 14th.

Check Out Our Latest Research Report on Easterly Government Properties

About Easterly Government Properties

(

Get Free Report)

Easterly Government Properties, Inc NYSE: DEA is based in Washington, DC, and focuses primarily on the acquisition, development and management of Class A commercial properties that are leased to the U.S. Government. Easterly's experienced management team brings specialized insight into the strategy and needs of mission-critical U.S.

Featured Stories

Before you consider Easterly Government Properties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Easterly Government Properties wasn't on the list.

While Easterly Government Properties currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.