State of Alaska Department of Revenue boosted its holdings in shares of Dolby Laboratories, Inc. (NYSE:DLB - Free Report) by 143.6% during the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 27,937 shares of the electronics maker's stock after buying an additional 16,470 shares during the period. State of Alaska Department of Revenue's holdings in Dolby Laboratories were worth $2,137,000 as of its most recent SEC filing.

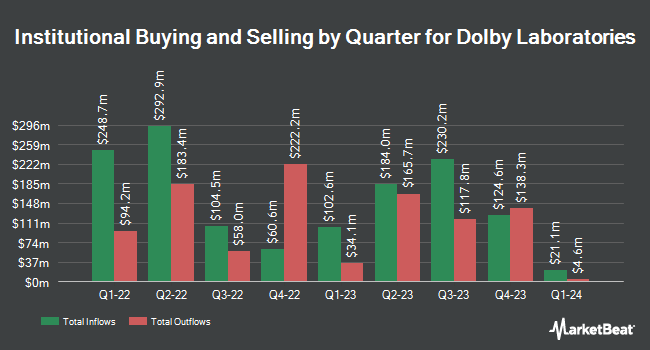

A number of other large investors have also recently made changes to their positions in the business. Vanguard Group Inc. grew its holdings in Dolby Laboratories by 1.7% during the first quarter. Vanguard Group Inc. now owns 6,502,463 shares of the electronics maker's stock worth $544,711,000 after buying an additional 107,713 shares in the last quarter. Ninety One UK Ltd boosted its holdings in Dolby Laboratories by 2.6% during the 2nd quarter. Ninety One UK Ltd now owns 2,344,963 shares of the electronics maker's stock worth $185,791,000 after acquiring an additional 60,114 shares during the last quarter. Disciplined Growth Investors Inc. MN grew its stake in shares of Dolby Laboratories by 0.8% in the 2nd quarter. Disciplined Growth Investors Inc. MN now owns 1,402,623 shares of the electronics maker's stock worth $111,130,000 after acquiring an additional 10,852 shares in the last quarter. Boston Trust Walden Corp raised its holdings in shares of Dolby Laboratories by 185.3% in the third quarter. Boston Trust Walden Corp now owns 1,075,076 shares of the electronics maker's stock valued at $82,276,000 after purchasing an additional 698,283 shares during the last quarter. Finally, Mackenzie Financial Corp lifted its position in shares of Dolby Laboratories by 3.5% during the second quarter. Mackenzie Financial Corp now owns 1,010,230 shares of the electronics maker's stock valued at $80,041,000 after purchasing an additional 33,848 shares in the last quarter. 58.56% of the stock is owned by institutional investors.

Insider Buying and Selling at Dolby Laboratories

In related news, CEO Kevin J. Yeaman sold 28,512 shares of Dolby Laboratories stock in a transaction dated Tuesday, October 15th. The stock was sold at an average price of $74.12, for a total value of $2,113,309.44. Following the completion of the sale, the chief executive officer now owns 83,721 shares of the company's stock, valued at approximately $6,205,400.52. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink. 39.54% of the stock is owned by corporate insiders.

Dolby Laboratories Stock Up 1.0 %

DLB stock traded up $0.75 during midday trading on Friday, hitting $73.65. The company's stock had a trading volume of 198,660 shares, compared to its average volume of 401,029. The stock has a market cap of $7.02 billion, a price-to-earnings ratio of 33.63 and a beta of 0.97. The stock's 50-day moving average price is $72.89 and its 200 day moving average price is $76.49. Dolby Laboratories, Inc. has a 1 year low of $66.35 and a 1 year high of $90.06.

Dolby Laboratories (NYSE:DLB - Get Free Report) last posted its quarterly earnings results on Wednesday, August 7th. The electronics maker reported $0.47 earnings per share for the quarter, beating the consensus estimate of $0.33 by $0.14. The company had revenue of $288.82 million during the quarter, compared to analyst estimates of $286.26 million. Dolby Laboratories had a net margin of 16.87% and a return on equity of 10.66%. As a group, equities analysts forecast that Dolby Laboratories, Inc. will post 2.71 earnings per share for the current fiscal year.

Dolby Laboratories announced that its Board of Directors has initiated a share repurchase program on Wednesday, August 7th that authorizes the company to buyback $350.00 million in outstanding shares. This buyback authorization authorizes the electronics maker to buy up to 5% of its shares through open market purchases. Shares buyback programs are often a sign that the company's board believes its stock is undervalued.

Dolby Laboratories Announces Dividend

The company also recently disclosed a quarterly dividend, which was paid on Tuesday, August 27th. Investors of record on Monday, August 19th were paid a $0.30 dividend. The ex-dividend date of this dividend was Monday, August 19th. This represents a $1.20 annualized dividend and a yield of 1.63%. Dolby Laboratories's payout ratio is 54.79%.

Wall Street Analysts Forecast Growth

Separately, Barrington Research reaffirmed an "outperform" rating and issued a $100.00 price objective on shares of Dolby Laboratories in a research report on Friday, September 20th.

Read Our Latest Stock Analysis on Dolby Laboratories

About Dolby Laboratories

(

Free Report)

Dolby Laboratories, Inc creates audio and imaging technologies that transform entertainment at the cinema, DTV transmissions and devices, mobile devices, OTT video and music services, home entertainment devices, and automobiles. The company develops and licenses its audio technologies, such as AAC & HE-AAC, a digital audio codec solution used for a range of media applications; AVC, a digital video codec with high bandwidth efficiency used in various media devices; Dolby AC-4, a digital audio coding technology that delivers new audio experiences to a range of playback devices; and Dolby Atmos technology for cinema and various media devices.

Featured Articles

Before you consider Dolby Laboratories, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dolby Laboratories wasn't on the list.

While Dolby Laboratories currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.