International Assets Investment Management LLC raised its holdings in shares of Hawaiian Electric Industries, Inc. (NYSE:HE - Free Report) by 789.8% during the third quarter, according to its most recent filing with the SEC. The firm owned 106,270 shares of the utilities provider's stock after purchasing an additional 94,327 shares during the period. International Assets Investment Management LLC owned 0.10% of Hawaiian Electric Industries worth $10,978,000 at the end of the most recent reporting period.

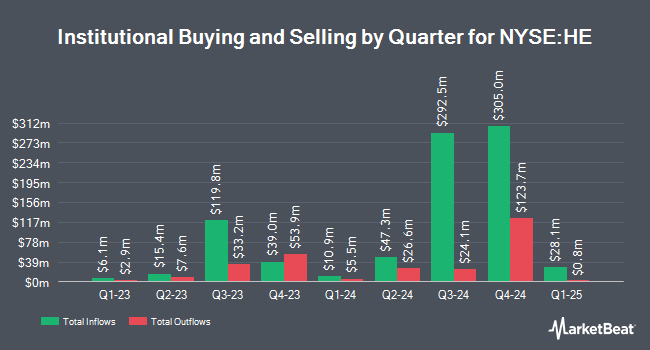

Other large investors have also modified their holdings of the company. Mitsubishi UFJ Trust & Banking Corp lifted its stake in shares of Hawaiian Electric Industries by 31.2% during the 1st quarter. Mitsubishi UFJ Trust & Banking Corp now owns 13,265 shares of the utilities provider's stock worth $147,000 after purchasing an additional 3,156 shares during the last quarter. Fidelis Capital Partners LLC purchased a new stake in shares of Hawaiian Electric Industries during the first quarter valued at about $42,000. State Board of Administration of Florida Retirement System boosted its holdings in shares of Hawaiian Electric Industries by 18.4% in the 1st quarter. State Board of Administration of Florida Retirement System now owns 156,734 shares of the utilities provider's stock valued at $1,766,000 after buying an additional 24,328 shares in the last quarter. Vanguard Group Inc. grew its position in shares of Hawaiian Electric Industries by 1.5% in the 1st quarter. Vanguard Group Inc. now owns 11,059,244 shares of the utilities provider's stock worth $124,638,000 after buying an additional 160,815 shares during the last quarter. Finally, Acadian Asset Management LLC grew its position in shares of Hawaiian Electric Industries by 470.4% in the 1st quarter. Acadian Asset Management LLC now owns 10,780 shares of the utilities provider's stock worth $121,000 after buying an additional 8,890 shares during the last quarter. Institutional investors own 59.91% of the company's stock.

Hawaiian Electric Industries Stock Performance

NYSE HE traded up $0.27 during mid-day trading on Thursday, reaching $10.27. 2,944,283 shares of the stock were exchanged, compared to its average volume of 3,401,257. The company has a market capitalization of $1.13 billion, a P/E ratio of -0.97 and a beta of 0.54. The company has a debt-to-equity ratio of 2.62, a quick ratio of 0.11 and a current ratio of 0.11. The business's 50 day moving average is $10.53 and its 200-day moving average is $11.15. Hawaiian Electric Industries, Inc. has a 1 year low of $7.61 and a 1 year high of $18.19.

Hawaiian Electric Industries (NYSE:HE - Get Free Report) last issued its quarterly earnings results on Friday, August 9th. The utilities provider reported $0.44 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.49 by ($0.05). The business had revenue of $792.30 million for the quarter. Hawaiian Electric Industries had a positive return on equity of 10.69% and a negative net margin of 31.76%. The company's quarterly revenue was down .2% on a year-over-year basis.

Wall Street Analysts Forecast Growth

HE has been the subject of several recent analyst reports. Wells Fargo & Company lowered their price target on Hawaiian Electric Industries from $14.00 to $11.50 and set an "equal weight" rating for the company in a report on Monday, September 30th. Evercore ISI lowered their target price on shares of Hawaiian Electric Industries from $16.00 to $9.00 and set an "in-line" rating for the company in a research note on Tuesday, September 24th. Finally, StockNews.com lowered shares of Hawaiian Electric Industries from a "hold" rating to a "sell" rating in a research note on Friday, October 4th.

Read Our Latest Stock Analysis on Hawaiian Electric Industries

Hawaiian Electric Industries Company Profile

(

Free Report)

Hawaiian Electric Industries, Inc, together with its subsidiaries, engages in the electric utility businesses in the United States. It operates in three segments: Electric Utility, Bank, and Other. The Electric Utility segment engages in the production, purchase, transmission, distribution, and sale of electricity in the islands of Oahu, Hawaii, Maui, Lanai, and Molokai.

Featured Stories

Before you consider Hawaiian Electric Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hawaiian Electric Industries wasn't on the list.

While Hawaiian Electric Industries currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.