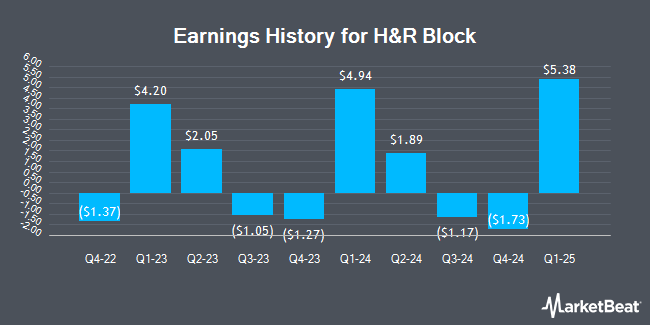

H&R Block (NYSE:HRB - Get Free Report) is scheduled to be issuing its quarterly earnings data after the market closes on Thursday, November 7th. Analysts expect the company to announce earnings of ($1.13) per share for the quarter. H&R Block has set its FY25 guidance at $5.15-5.35 EPS and its FY 2025 guidance at 5.150-5.350 EPS.Investors interested in listening to the company's conference call can do so using this link.

H&R Block (NYSE:HRB - Get Free Report) last issued its earnings results on Thursday, August 15th. The company reported $1.89 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.74 by $0.15. The company had revenue of $1.06 billion for the quarter, compared to analysts' expectations of $1.03 billion. H&R Block had a net margin of 16.49% and a negative return on equity of 220.05%. The firm's quarterly revenue was up 3.0% on a year-over-year basis. During the same quarter last year, the company posted $2.05 earnings per share. On average, analysts expect H&R Block to post $5 EPS for the current fiscal year and $5 EPS for the next fiscal year.

H&R Block Stock Performance

Shares of NYSE HRB traded down $0.97 during midday trading on Thursday, hitting $59.73. 1,417,398 shares of the stock traded hands, compared to its average volume of 1,159,245. The firm has a market capitalization of $8.26 billion, a P/E ratio of 14.20, a PEG ratio of 0.95 and a beta of 0.66. H&R Block has a one year low of $39.20 and a one year high of $68.45. The company has a debt-to-equity ratio of 16.46, a quick ratio of 1.27 and a current ratio of 1.27. The firm has a 50-day moving average of $62.51 and a two-hundred day moving average of $56.30.

H&R Block Increases Dividend

The company also recently declared a quarterly dividend, which was paid on Thursday, October 3rd. Shareholders of record on Thursday, September 5th were issued a dividend of $0.375 per share. The ex-dividend date of this dividend was Thursday, September 5th. This represents a $1.50 annualized dividend and a yield of 2.51%. This is an increase from H&R Block's previous quarterly dividend of $0.32. H&R Block's payout ratio is currently 35.55%.

H&R Block announced that its Board of Directors has initiated a share buyback program on Thursday, August 15th that permits the company to repurchase $1.50 billion in shares. This repurchase authorization permits the company to repurchase up to 16.7% of its shares through open market purchases. Shares repurchase programs are typically an indication that the company's board of directors believes its stock is undervalued.

Insider Activity at H&R Block

In related news, VP Kellie J. Logerwell sold 9,846 shares of the business's stock in a transaction on Monday, August 19th. The shares were sold at an average price of $65.00, for a total value of $639,990.00. Following the sale, the vice president now owns 25,028 shares in the company, valued at approximately $1,626,820. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. In other H&R Block news, CFO Tony G. Bowen sold 79,259 shares of H&R Block stock in a transaction on Monday, August 19th. The shares were sold at an average price of $65.17, for a total transaction of $5,165,309.03. Following the completion of the transaction, the chief financial officer now directly owns 90,095 shares of the company's stock, valued at $5,871,491.15. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, VP Kellie J. Logerwell sold 9,846 shares of the business's stock in a transaction on Monday, August 19th. The shares were sold at an average price of $65.00, for a total transaction of $639,990.00. Following the transaction, the vice president now owns 25,028 shares in the company, valued at $1,626,820. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Over the last three months, insiders sold 115,927 shares of company stock valued at $7,517,056. Insiders own 1.30% of the company's stock.

Analysts Set New Price Targets

A number of equities research analysts have commented on HRB shares. The Goldman Sachs Group raised their price target on H&R Block from $39.00 to $44.00 and gave the company a "sell" rating in a report on Friday, August 16th. StockNews.com lowered shares of H&R Block from a "buy" rating to a "hold" rating in a report on Friday, August 16th. Finally, Barrington Research reaffirmed an "outperform" rating and set a $70.00 target price on shares of H&R Block in a research note on Monday.

Check Out Our Latest Research Report on H&R Block

H&R Block Company Profile

(

Get Free Report)

H&R Block, Inc, through its subsidiaries, provides assisted income tax return preparation and do-it-yourself (DIY) tax return preparation services and products to the general public primarily in the United States, Canada, and Australia. It offers assisted income tax return preparation and related services through a system of retail offices operated directly by the company or its franchisees.

Read More

Before you consider H&R Block, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and H&R Block wasn't on the list.

While H&R Block currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.