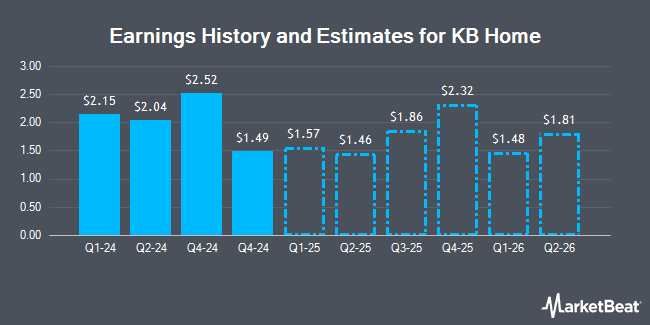

KB Home (NYSE:KBH - Free Report) - Investment analysts at Seaport Res Ptn cut their FY2025 earnings estimates for shares of KB Home in a research report issued on Sunday, November 3rd. Seaport Res Ptn analyst K. Zener now forecasts that the construction company will post earnings per share of $8.41 for the year, down from their previous forecast of $8.78. The consensus estimate for KB Home's current full-year earnings is $8.44 per share.

KB Home (NYSE:KBH - Get Free Report) last released its quarterly earnings results on Tuesday, September 24th. The construction company reported $2.04 EPS for the quarter, missing analysts' consensus estimates of $2.06 by ($0.02). The firm had revenue of $1.75 billion during the quarter, compared to analyst estimates of $1.73 billion. KB Home had a net margin of 9.31% and a return on equity of 15.69%. KB Home's quarterly revenue was up 10.3% on a year-over-year basis. During the same quarter last year, the firm earned $1.80 earnings per share.

KBH has been the topic of a number of other reports. Bank of America boosted their price target on shares of KB Home from $75.00 to $90.00 and gave the company a "neutral" rating in a research report on Thursday, September 19th. Royal Bank of Canada lowered shares of KB Home from a "sector perform" rating to an "underperform" rating and set a $70.00 target price on the stock. in a research report on Thursday, September 5th. The Goldman Sachs Group upped their target price on shares of KB Home from $72.00 to $82.00 and gave the stock a "neutral" rating in a research report on Tuesday, September 3rd. Wells Fargo & Company lowered shares of KB Home from an "equal weight" rating to an "underweight" rating and upped their target price for the stock from $80.00 to $83.00 in a research report on Monday, October 7th. Finally, Barclays boosted their price target on shares of KB Home from $78.00 to $99.00 and gave the stock an "overweight" rating in a research note on Wednesday, September 25th. Four analysts have rated the stock with a sell rating, six have given a hold rating and four have given a buy rating to the company's stock. Based on data from MarketBeat.com, the company presently has a consensus rating of "Hold" and an average target price of $77.50.

Get Our Latest Analysis on KB Home

KB Home Stock Up 2.9 %

NYSE:KBH traded up $2.32 on Tuesday, reaching $82.02. The stock had a trading volume of 732,415 shares, compared to its average volume of 1,232,093. The company has a market capitalization of $6.01 billion, a P/E ratio of 10.22, a price-to-earnings-growth ratio of 0.66 and a beta of 1.81. KB Home has a 1-year low of $50.08 and a 1-year high of $89.70. The stock has a fifty day moving average price of $82.32 and a 200-day moving average price of $76.27.

KB Home Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Wednesday, November 27th. Investors of record on Thursday, November 14th will be issued a dividend of $0.25 per share. This represents a $1.00 annualized dividend and a yield of 1.22%. The ex-dividend date of this dividend is Thursday, November 14th. KB Home's payout ratio is 12.82%.

Insider Buying and Selling

In other news, CFO Jeff Kaminski sold 27,500 shares of KB Home stock in a transaction dated Monday, October 14th. The shares were sold at an average price of $79.40, for a total value of $2,183,500.00. Following the completion of the transaction, the chief financial officer now owns 34,473 shares of the company's stock, valued at $2,737,156.20. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available at this link. 3.52% of the stock is currently owned by corporate insiders.

Institutional Inflows and Outflows

A number of hedge funds and other institutional investors have recently modified their holdings of KBH. Financial Management Professionals Inc. acquired a new stake in shares of KB Home during the 3rd quarter worth about $32,000. Riggs Asset Managment Co. Inc. acquired a new stake in shares of KB Home during the 3rd quarter worth about $43,000. Fidelis Capital Partners LLC acquired a new stake in shares of KB Home during the 1st quarter worth about $60,000. Plato Investment Management Ltd lifted its stake in shares of KB Home by 72.0% during the 1st quarter. Plato Investment Management Ltd now owns 1,080 shares of the construction company's stock worth $77,000 after buying an additional 452 shares during the last quarter. Finally, Tortoise Investment Management LLC lifted its stake in shares of KB Home by 625.3% during the 2nd quarter. Tortoise Investment Management LLC now owns 1,117 shares of the construction company's stock worth $78,000 after buying an additional 963 shares during the last quarter. Institutional investors own 96.09% of the company's stock.

KB Home Company Profile

(

Get Free Report)

KB Home operates as a homebuilding company in the United States. It operates through four segments: West Coast, Southwest, Central, and Southeast. It builds and sells various homes, including attached and detached single-family residential homes, townhomes, and condominiums primarily for first-time, first move-up, second move-up, and active adult homebuyers.

See Also

Before you consider KB Home, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and KB Home wasn't on the list.

While KB Home currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.